2023 was a year of recovery for the cryptocurrency market, with asset prices and market sentiment improving throughout the year after a difficult 2022. But how well have investors actually fared? This blog provides a hypothetical 2023 estimate based on investor interactions with centralized exchanges, including a breakdown of estimated profits by country. Share your currency profit estimates.

Our methodology: How to calculate cryptocurrency profits and estimate profits by country

We use on-chain data to estimate investors' crypto returns based on the movement of crypto assets in and out of our services that can be transferred or transferred to fiat currencies. Specifically, on-chain macros for a selected group of assets that account for approximately 80% of all crypto market capitalization and are traded on major centralized exchanges offering crypto-to-fiat conversion. Start by measuring the flow of your levels. . We then estimate the total collective return earned on each asset by measuring the difference between the U.S. dollar value of all withdrawals on the asset and the value of all deposits on the asset. This methodology is based on the fact that deposits into the service providing off-ramping can be converted into cash, thus realizing gains and losses on the asset. Although this methodology is not perfect, it provides a strong estimate of returns across popular assets traded on centralized exchanges.

Using this methodology to estimate the crypto-asset profits of users of each service we track, we distribute those profits to each country based on each country's share of web traffic to each service's website. This combination of transaction data and web traffic is also the same framework used for annual calculations. Global Cryptocurrency Adoption Index.

Estimated total crypto return in 2023

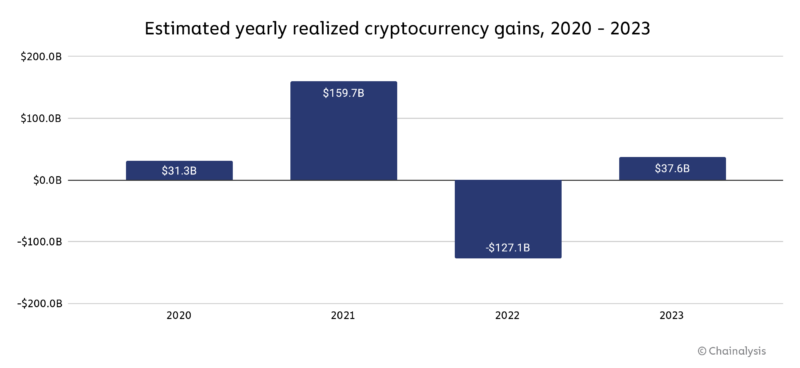

Overall, it is estimated that all crypto investors achieved a total profit of $37.6 billion in 2023.

While this total is much smaller than the $159.7 billion in gains during the 2021 bull market, it represents a significant rebound from 2022, when the market posted an estimated loss of $127.1 billion. Interestingly, the total return forecast for 2023 is lower than for 2021, even though crypto asset prices have grown at similar rates in each of the two years. One possible explanation for this is that investors in 2023 invested in 2023 with the expectation that prices would rise further, given that they did not exceed the all-time high at any point in 2023. It may be that the house was less likely to convert crypto assets into cash. 2021.

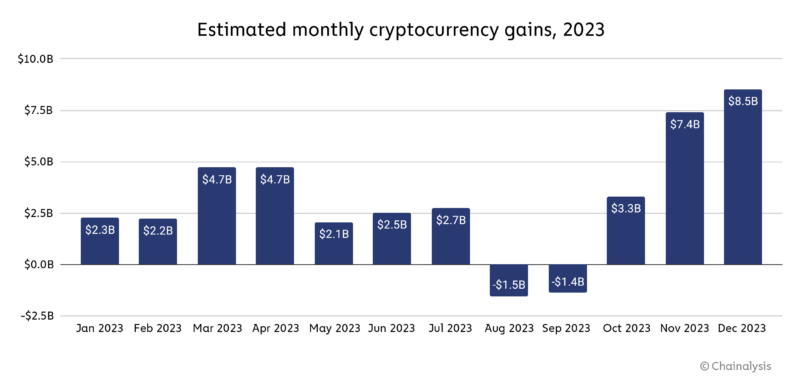

Cryptocurrency gains have been relatively stable throughout the year, but there were two consecutive months of losses in August and September. Profits then rose sharply, making November and December seem smaller than previous months.

Estimated virtual currency growth by country in 2023

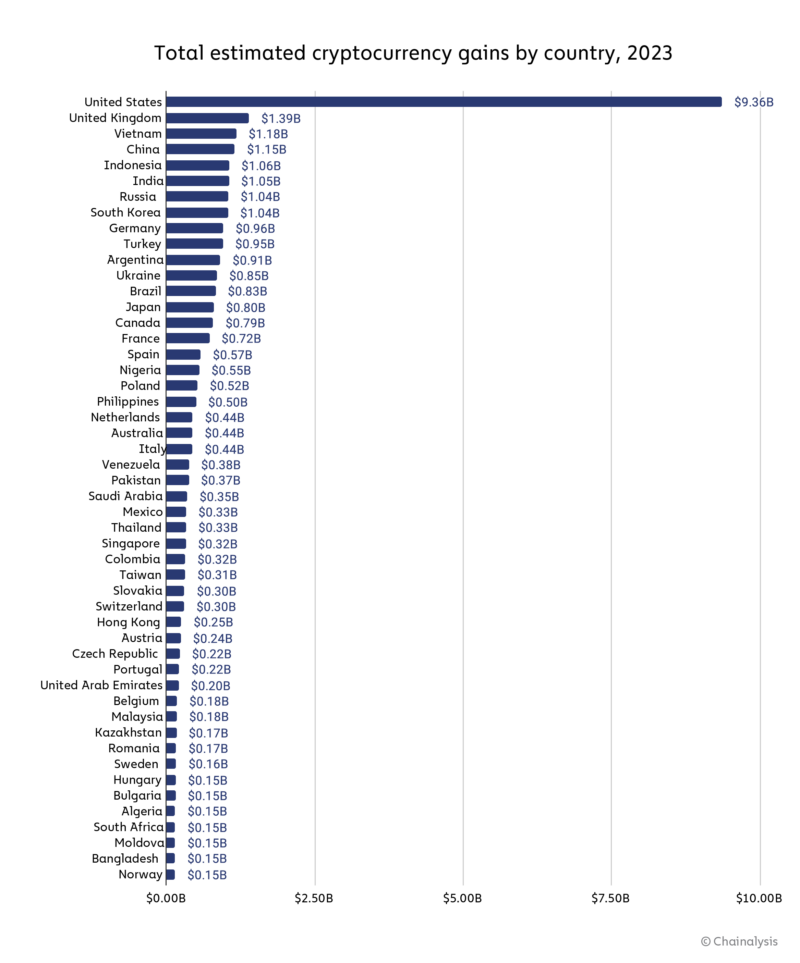

The United States led by a wide margin in crypto profits in 2023, with an estimated amount of $9.36 billion. The UK came in second place with an estimated crypto profit of $1.39 billion.

Interestingly, we also see some things. Upper and lower middle income countries Its inhabitants seem to be making great profits, especially in Asia. For example, Vietnam, China, Indonesia, and India all rank in the top six with estimated profits exceeding her $1 billion. As previously pointed out in our article, 2023 Crypto Geography Report Countries in these income categories, particularly low- and middle-income countries, have seen strong cryptocurrency adoption that has remained notable and resilient during the recent bear market. Our return estimates suggest that many investors in these countries have benefited from the adoption of this asset class.

What will happen in 2024?

So far, the positive trends of 2023 have continued into 2024, with notable crypto assets such as Bitcoin at an all-time high following the approval of Bitcoin ETFs and increased adoption by institutional investors. Achieving value. If these trends continue, we could see an uptick similar to what we saw in 2021. As of March 13th, Bitcoin is up 65.4% in 2024 and Ether is up 70.2%.

This website contains links to third party sites that are not under the control of Chainaracy, Inc. or its affiliates (collectively, “Chainaloss”). Access to such information does not imply any association, approval, approval, or recommendation by Chainaosis of the site or its operators, and Chainaosis is not responsible for the products, services, or other content hosted thereon. I am not responsible.

This material is for informational purposes only and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainarise assumes no liability for any decisions or other acts or omissions made in connection with the recipient's use of this material.

Chainalysis does not guarantee the accuracy, completeness, timeliness, suitability, or validity of the information in this report and is not responsible for any claims attributable to errors, omissions, or other inaccuracies in any such material. We will not be held responsible.