Bitcoin (BTC)'s overnight fall from a new record high has cleared the market of excessive leverage and normalized funding rates in the crypto perpetual futures market.

The top cryptocurrency by market capitalization fell 10% to $59,700 after hitting a lifetime high above $69,000. This correction forced the termination of his $1 billion worth of leveraged perpetual futures bets across digital asset markets.

The broader market index, the CoinDesk 20 Index (CD20), rose to a high of $2,627 on Tuesday, but has since fallen to $2,496.

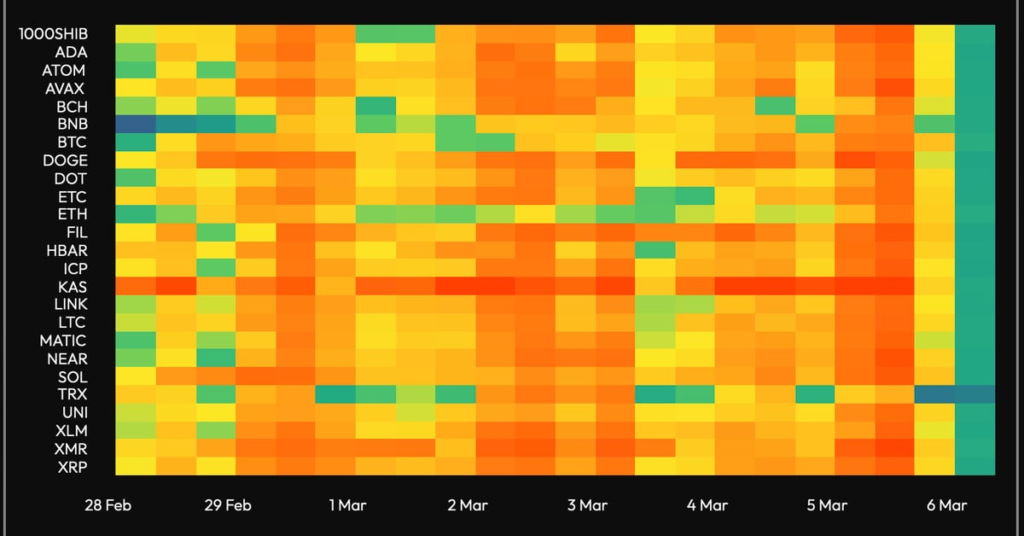

Since then, the annualized funding rate or cost of holding a leveraged bet on perpetual futures associated with the top 25 cryptocurrencies has reset to less than 20%, down from the triple digit numbers observed a few days ago. It has decreased significantly.

In other words, the overheated perpetual futures market has cooled, opening the door to longer-term record highs. Bitcoin's strong bullish momentum pushed funding rates above 100% earlier this week as investors jumped in with both feet, using leveraged products to maximize profits.

Exchanges use a funding rate mechanism to match the perpetual price with the spot price. A positive funding rate indicates that perpetual bonds are trading at a premium to the spot price, indicating increased demand for bullish bets. As such, high funding rates like those seen earlier this week are said to reflect the over-optimism often seen at mid-market peaks.

According to Velo Data charts, the funding rates of the top 25 cryptocurrencies have ranged from slightly positive to as high as over 150% over the past week.

The most recent measurements for most coins are less than 20%.

According to John Glover, chief investment officer at Reddon, the market could continue to deleverage in the coming weeks, and Bitcoin prices could return to $40,000.

“The euphoria surrounding the recent rise in Bitcoin prices is very reminiscent of the last time we were trading at $65,000. will point to the fact that the decline that has occurred since April 2021 (since April 2021) is due to bad players in the market, but I would argue that although it may have been caused by bad players, , the sell-off was due to people becoming overleveraged with unrealistic expectations for a straight-line rise to $100,000,” Glover said in an email.

“I believe we are back on the same page and will be back in the mid-to-low $40,000 area in the coming weeks. Things always look bullish at peak times,” Glover added. Ta.