(Kitco News) – Cryptocurrency market price action on Thursday showed reduced volatility as Bitcoin (BTC) mostly consolidated above $70,000 and altcoins traded mixed. The slowdown in market activity comes as traders continue to digest yesterday's stronger-than-expected CPI report and what it means for interest rates and risk assets going forward.

Stocks rebounded led by the tech sector after Wednesday's CPI drop, lifting the Nasdaq. Lower-than-expected producer prices were credited with allaying investor concerns and leading to a green day for major indexes.

As of the closing bell, the S&P and Nasdaq finished up 0.74%, 0.08%, and 1.68%, respectively, while the Dow was flat.

According to data provided by TradingView, Bitcoin traded in a range of $69,560 to $71,310 on Thursday, with neither bulls nor bears gaining ground.

BTC/USD Charts by TradingView

At the time of writing, Bitcoin is trading at $70,700, up 1.05% on the 24-hour chart.

ETF flows will stabilize

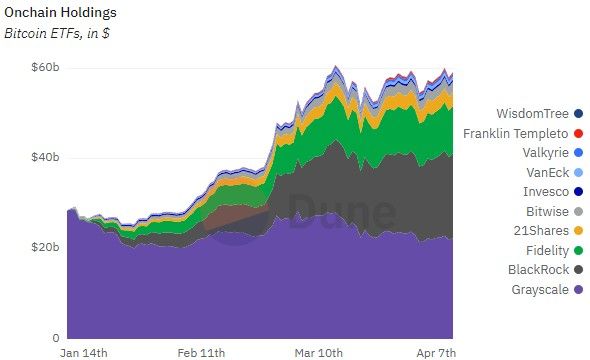

Bitcoin's sideways price trend over the past few weeks comes after the Spot BTC exchange-traded fund (ETF) set records for inflows and trading volumes in its first two months of trading, with inflows into the fund stabilizing. It is consistent with becoming

The Nine has recently recorded several days of net outflows, but overall its total assets under management continue to grow. According to data provided by Dune Analytics, the ETF has had net inflows of $12.5 billion since its inception and currently holds his 839,000 Bitcoins worth approximately $58.9 billion.

As shown in the chart above, capital inflows appear to be consolidating as well as the asset chart after a significant rally, and some analysts say some bullish developments could bring it back up again soon. There is a possibility that it will start.

This includes the pending launch of multiple spot BTC ETFs in Hong Kong, with some products being listed by Chinese investment firms, and Morgan Stanley and UBS announcing that they will have clients by the end of April. It is rumored that they are working on making ETFs accessible.

According to VanEck CEO Jan van Eck, the retail sector is primarily responsible for inflows into Spot Bitcoin ETFs in the US, with significant investment from traditional finance (TradFi) companies expected to continue.

“I was surprised [by the initial success of the ETFs], but I think it's still not a traditional investor. I still think 90% of the flow is retail,” Van Eck told Cointelegraph at Paris Blockchain Week. “Bitcoin whales and other institutions have been moving assets, but they were already exposed to Bitcoin.”

He said that so far no U.S. bank has formally approved or allowed financial advisors to recommend Bitcoin, and that some large institutional investors from banks and traditional companies will He added that although there is potential for entry, the Bitcoin ETF situation is still in its infancy.

“There's going to be a lot of maturation going on,” he said. “We have a long way to go because a lot of the technology will be developed on-chain.”

Why Bitcoin ETFs can help increase adoption rates, as investors have long been able to buy Bitcoin directly, says Van Eck Investors are looking to fund managers to manage their entire portfolios therefore, convenience is the main factor.

“Convenience, safety and affordability,” he said. “Many centralized exchange platforms like Coinbase had 2% spreads. ETF spreads are in the single digits, and commissions are free or low. It's easier to just buy tickets than anything else. .”

Van Eck also highlighted the evolving nature of crypto supporters and the move away from Bitcoin extremism needed to achieve mass adoption.

“I started paying attention to Bitcoin. It's not that I'm a big fan of it or anything, but I think sometimes you just want to store value in your portfolio,” he explained. “What I care about is people's investment savings.”

He concluded that the approval of a spot BTC ETF in the US is not as big of a deal as many think, as Bitcoin is still a global currency in the early stages of adoption.

“What I would like to point out is that this is not the most shocking incident,” he said. “The Bitcoin market is much more global and deep than just being influenced by ETFs.” He pointed out that this shows that the market's influence is increasing.

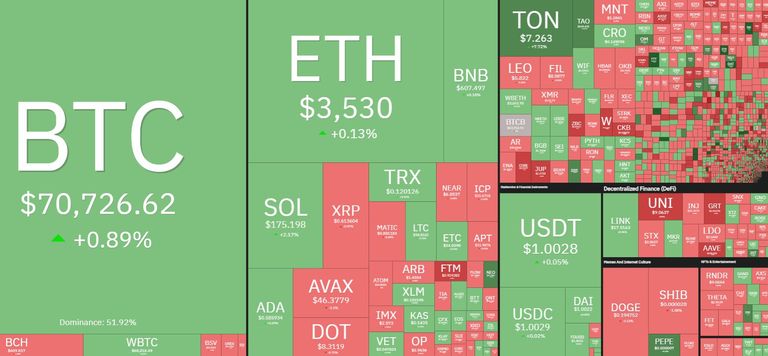

Altcoin trading is mixed as traders shuffle positions

On Thursday, the top 200 altcoins were expected to have a volatile week ahead of the April 19-20 halving, with traders taking advantage of a lull in trading activity to balance their portfolios. As a result, there was a 50/50 split between winners and losers.

Daily cryptocurrency market performance. Source: Coin360

Bittensor (TAO) led the gainers with a 15.3% gain since the token was listed on Binance, followed by MANTRA (OM) with a 12.5% gain and Neo (NEO) with a 10.3% gain. Nervos Network (CKB) led the losers with a 13.7% decline, Saga (SAGA) fell 13.6% and Uniswap (UNI) fell 11.5% after receiving a wells notice from the SEC.

Currently, the total market capitalization of virtual currencies is $2.62 trillion, with Bitcoin controlling 53%.

Disclaimer: The views expressed in this article are those of the author and may not reflect the views of Kitco Metals Inc. The author has made every effort to ensure the accuracy of the information provided. However, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation for the exchange of products, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept liability for losses and/or damages arising from the use of this publication.