As the crypto market shows signs of a burgeoning alternative season, crypto analyst Alex Wacy shared the following strategy: forecast Weissy emphasizes the importance of asset selection and market timing, predicting a selective and explosive growth phase for altcoins.

Virtual currency market outlook and asset selection strategy

Wacy's recent thread highlights expectations for a big alto season. “Only 15% of altcoins will deliver 10-100x in this hypergrowth. Asset selection is more important than ever. One wrong move and you’re out.” His analysis: It highlights the potentially selective nature of market stages and suggests large differences in performance between altcoins.

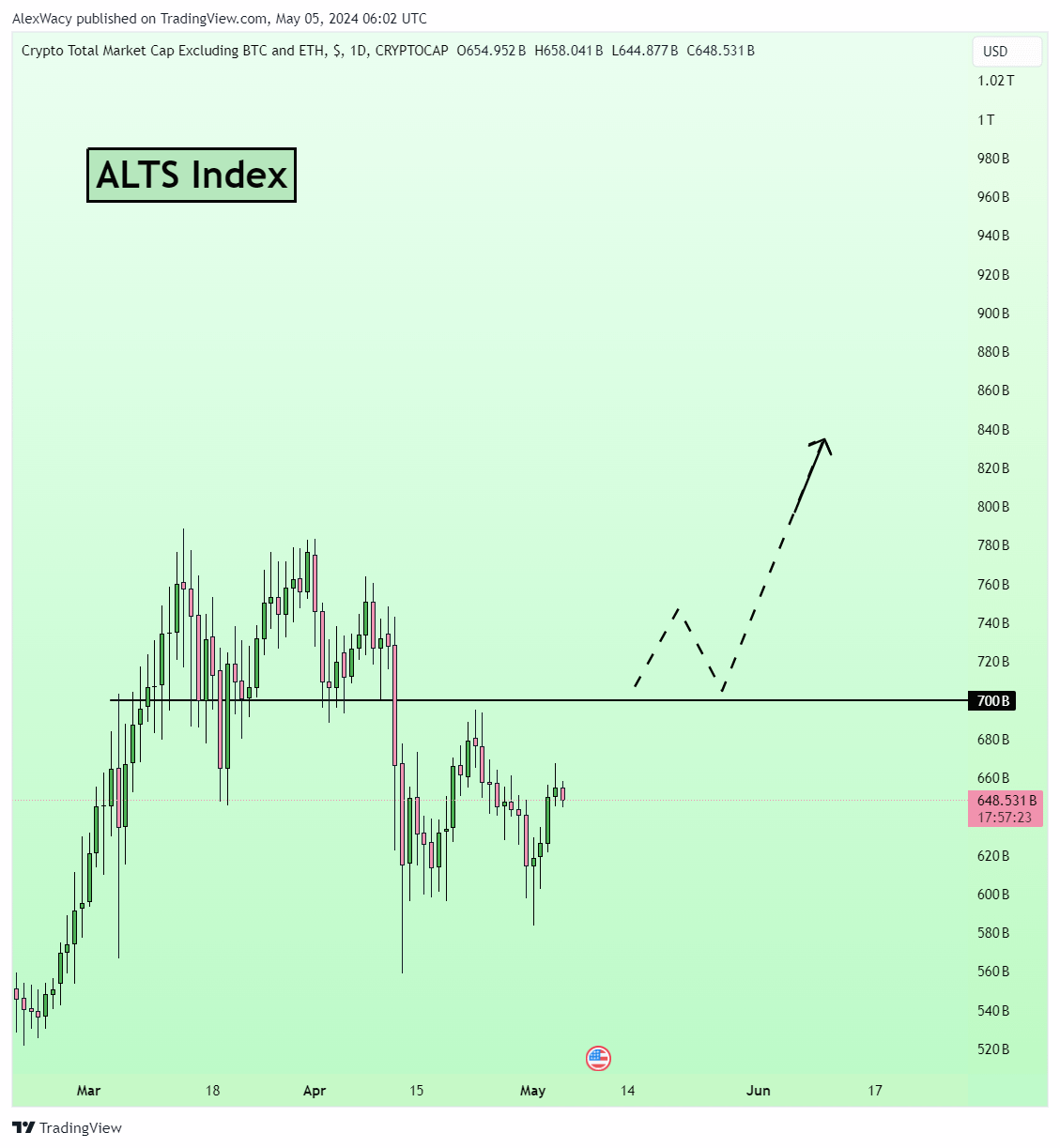

Weissy believes the market is currently undervalued and poised for a significant rally. He suggests that if the altcoin market cap solidifies above $700 billion, it would confirm a bullish trend and signal the start of alt season. This view is rooted in current market behavior, with sentiment remaining largely bearish and presenting a contrarian growth opportunity.

He categorizes current sentiment into three types of capitulation: price, time, and growth, illustrating the different investor behaviors that precede a market recovery. With fear of further declines pervasive, weak hands are likely to be wiped out, setting the stage for a supercycle of fear of missing out (FOMO) and subsequent strong buying activity, Weissy said. .

Top 6 Altcoins with Most Potential

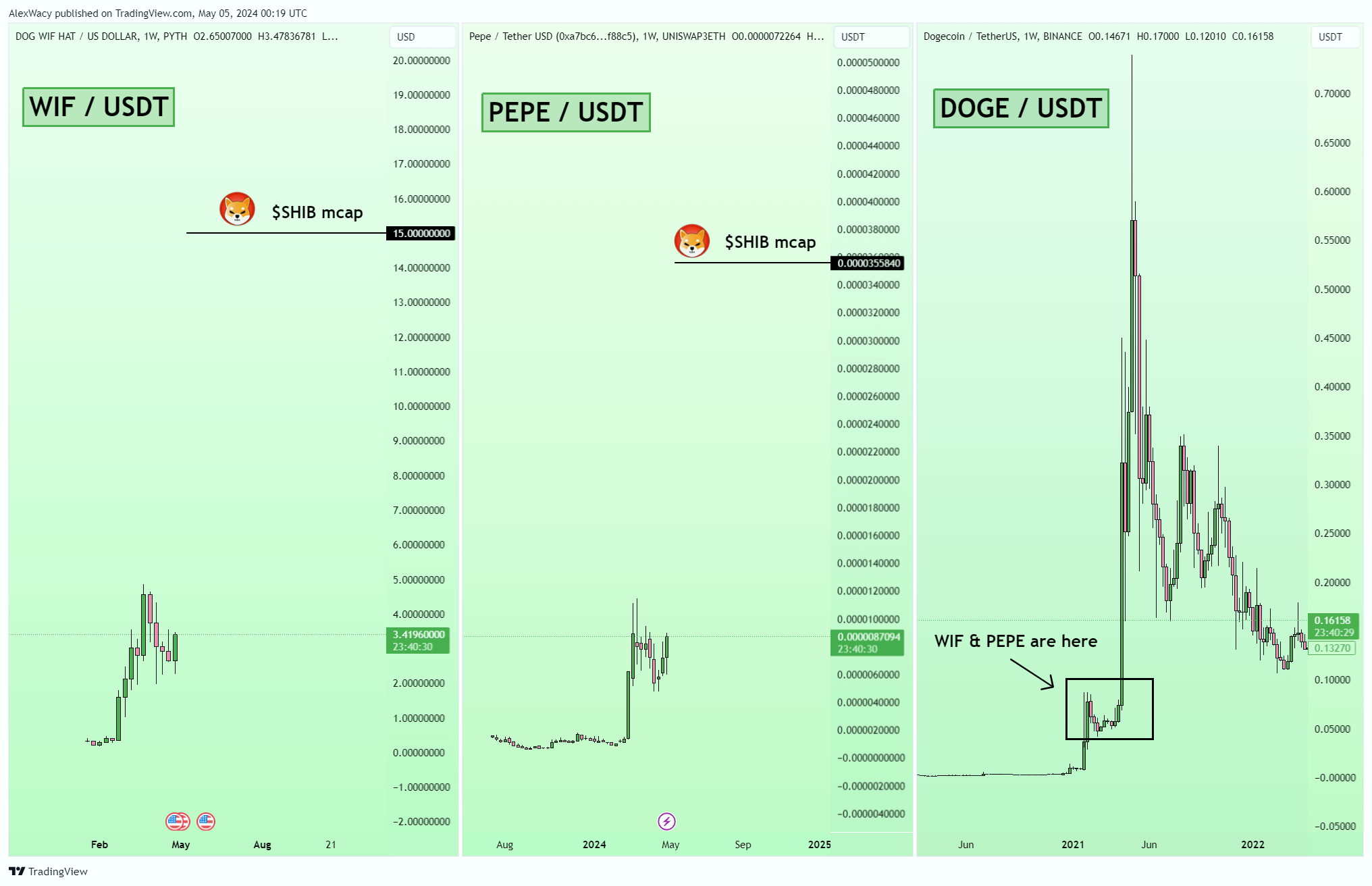

#1 and #2: WIF and PEPE These meme coins are highlighted by Weissy as potential early moves in the expected alt season. “Look at WIF and PEPE. Structurally, they are similar to his DOGE during its meteoric rise. These coins have developed community and meme appeal, and compared to his SHIB in previous cycles. 's market capitalization,'' argues Weissy. He noted that PEPE appears particularly poised for a breakout, while WIF is currently weak, but market sentiment could change quickly.

#3 ONDO Finance (ONDO): This Real World Asset (RWA) focused coin features strong buying support during price declines. Weissy believes ONDO is an undervalued asset with significant upside potential. “ONDO has a resilient buy floor. Even a slight pullback to around $0.64 could be a favorable entry point ahead of a significant upward trajectory,” he advises. His first target is his $1.62 price range.

#4 Arweave (AR): Arweave, known for its decentralized data storage solutions, has been praised by Wacy for its strong market structure and resilience during downturns. Additionally, Arweave is building his AO, a decentralized computer network that can be run from anywhere. “Arweave is more than just storage. It is a foundational technology for a decentralized future. A consolidation above $49 will likely be the catalyst for an explosive growth phase,” he predicted. do.

#5 Echelon (Prime): Wacy will discuss PRIME's multifaceted ecosystem, which includes trading card games and AI-powered games. Both are attracting attention. “Echelon sits at the intersection of gaming and blockchain technology, attracting a wide audience with its innovative gameplay and decentralized features,” he said. From a technical analysis perspective, PRIME price is near a favorable buy zone of $14.97 to $17.5. “We hope that altcoins are already in the alt season and we expect to see a V-shaped reversal,” said Weissy.

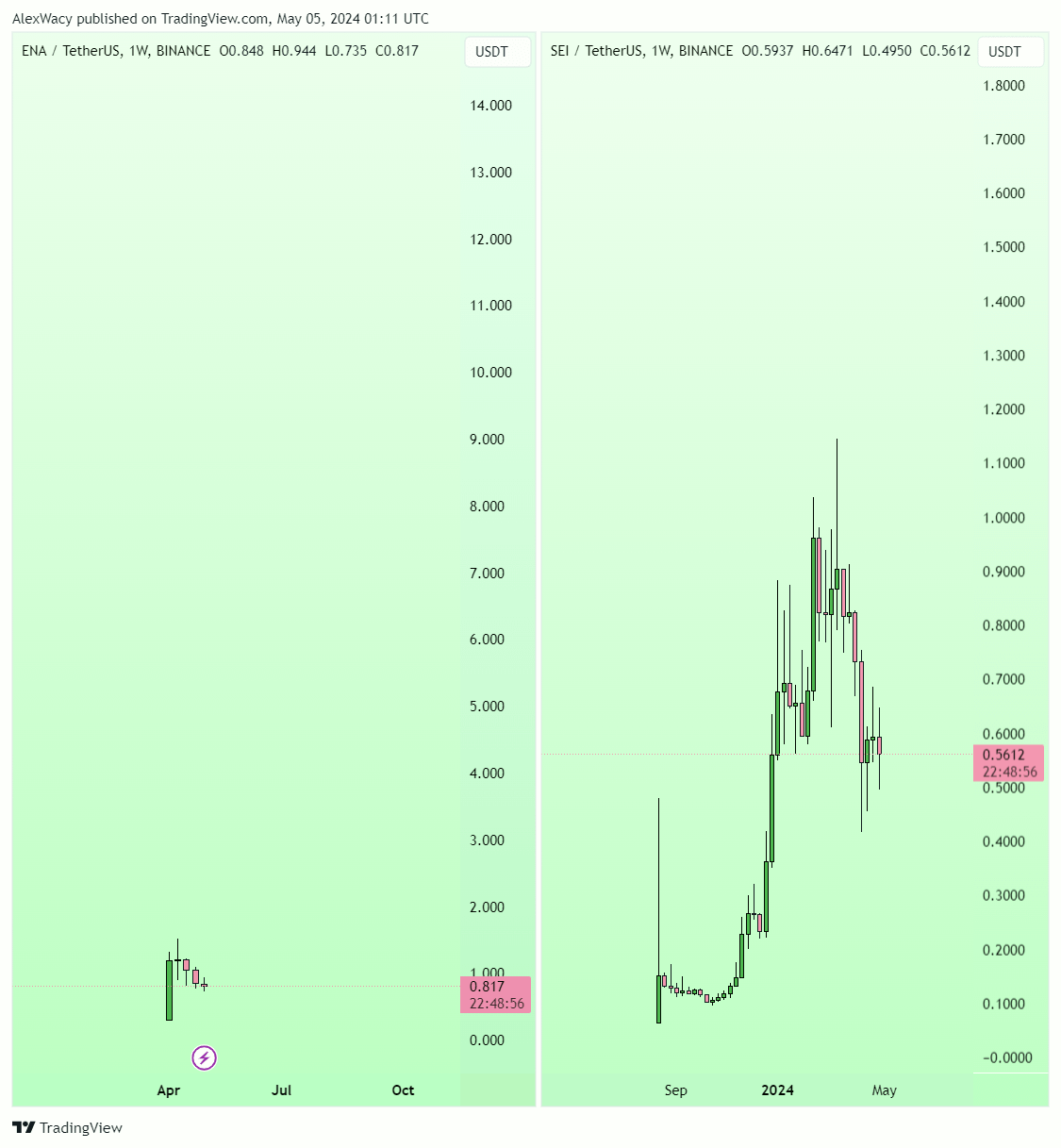

#6 Ethena (ENA): This synthetic dollar protocol offers an alternative to traditional banking and is poised for growth. “The Ethena pattern on the weekly chart typically precedes large price movements.The next major unlock event is scheduled for April 2025, and its consolidation could be substantial. ,” explains Weissy. He likens the current price trend of ENA to that of SEI.

Strategic profit taking

Mr. Weissy also predicts that the altcoin market index TOTAL3 could rise from $2 trillion to $2.3 trillion during the alt season, and also provides strategic advice on profit taking. He has indicated he would consider taking partial profits once the market reaches about $1.6 trillion. His rationale is based on historical patterns in which many investors have fallen prey to greed and ended up losing large sums of money.

The analyst also advises preparing a profit-taking strategy in advance and suggests setting aside 10-15% of the position for potential further growth beyond initial goals. He warns that the spike at the end of a growth period often causes excessive greed, and it is important to recognize such signals in order to exit in a timely manner before a bear market situation sets in. suggests that it is possible.

At the time of writing, WIF was trading at $3.58.

Featured image from iStock, chart from TradingView.com