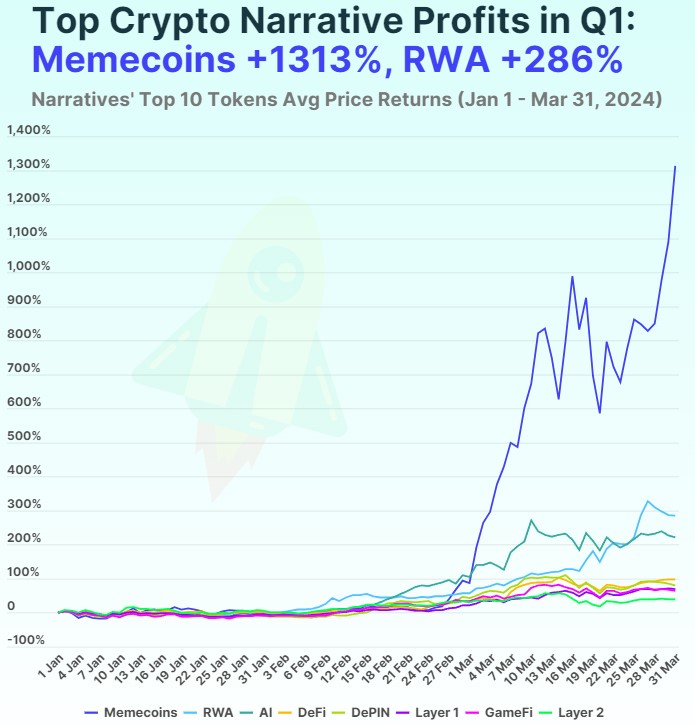

In the first quarter (Q1) of 2024, meme coins emerged as the most profitable coins. Cryptocurrency storyAccording to recent research, the top tokens across the board have delivered a massive average return of 1312.6%. report Conducted by CoinGecko.

This number far exceeds the returns of other stories and highlights the growing popularity and enthusiasm surrounding meme coins in the crypto market.

RWA vs meme coin

Three newly launched tokens were among the top 10 meme coins by market capitalization at the end of the quarter: Brett (BRETT), BOOK OF MEME (BOME), and Cat in a Dogs World (MEW).

BRETT followed closely with a gain of 7727.6%, the highest return since its launch. dog hat (WIF) grew 2721.2% during the quarter. Remarkably, the memecoin story has significantly outpaced that of other cryptocurrencies.

Compared to the second most profitable RWA, Memecoin's profitability was 4.6 times higher and 33.3 times higher than that of the lowest-earning layer 2 in Q1.

RWA story stands for “.real world assets” had a first quarter return of 285.6%. Although it briefly held the title of most profitable story in early February, meme coins and artificial intelligence-based (AI) tokens outperformed RWA in terms of returns. However, RWA managed to regain its position ahead of the AI story by the end of his March.

Notable winners in the RWA category include MANTRA (OM) and TokenFi (TOKEN) with quarter-to-date (QTD) returns of 1074.4% and 419.7%, respectively. XDC Network (XDC) was the only RWA token to fall, dropping 15.6% in the quarter.

artificial intelligence RWA was the only company to achieve a triple-digit return, reaching 222.0% in the first quarter. All large AI tokens rose, with AIOZ Network (AIOZ) leading the way with 480.2%, followed closely by Fetch.ai (FET) with 378.3%.

Even OriginTrail (TRAC), which has the lowest margin in the AI category, returned a respectable 74.9% during the quarter, showing overall interest in AI-related tokens.

Layer 1 tokens follow

The decentralized finance (DeFi) story delivered a moderate return of 98.9% in the first quarter. DeFi returns boosted by Uniswap (UNI) in late February Rate switching proposal. DeFi tokens that performed well include Jupiter (JUP) with a 125.7% gain, Maker (MKR) with 121.2%, and The Graph (GRT) with 111.0% QTD.

In contrast, the Layer 1 (L1) story achieved relatively low profitability with a 70.0% return in Q1 2024. Solana (SOL) gained attention as a popular memecoin chain, but the top-performing large L1 cryptocurrencies were Toncoin (TON) and Bitcoin Cash (BCH), which rose 131.2% and 130.5%, respectively .

Bitcoin (BTC) gained 65.1%; New all-time highEthereum (ETH), on the other hand, posted a more modest 53.9% increase despite expectations surrounding the US Spot Ethereum ETF filing.

Layer 2 (L2) emerged as the least profitable crypto stock in the first quarter, with a relatively low return of 39.5%. Established Ethereum L2 solutions underperform, with Arbitrum (ARB) returning 5.6%; polygon (MATIC) rose 1.2%, while Optimism (OP) ended the quarter with a slight decline of 1.2%. However, Stax (STX) and Mantle (MNT) posted relatively high returns with QTD of 142.5% and 95.8%, respectively.

As of this writing, Dogecoin (DOGE), the largest meme coin by market capitalization, is trading at $0.1745. In the last 24 hours, there has been a price correction of nearly 7%. Over the last month, Dogecoin has shown limited bullish momentum, with a modest increase of just 0.7% during this period.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC's opinion on whether to buy, sell, or hold an investment, and investing naturally involves risk. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.