At a relatively uneventful City Council meeting on Tuesday, council members voted in favor of approving the proposed business license modernization and related business license tax rate changes.

In the room were Deputy City Treasurer Stephanie Manglalas, Treasurer Oscar Santiago, Business License Administrator Haley Favre-Smith, HdL Operations Director Eric Myers, and Baker Tilly Managing Director Andy Belknap. Mr. was present.

“Revenues collected from the Business License Program are essential to the health of the General Fund and are an important source of funding to advance City Council’s strategic priorities and maintain essential services,” Manglalas said.

Manglala said the Treasury Department collects business license taxes from about 23,000 businesses, 13,000 of which are physically located in the city, and the City of Santa Monica collected existing license taxes more than 30 years ago in 1990. adopted the tax law.

“As you can see…there has been a significant shift away from brick-and-mortar businesses since the 1990s…the pandemic has also had a lasting impact on operations and how some high-income taxpayers will operate in the future. “Modernizing the tax code will reflect the economic changes that have occurred and will continue to occur in the world,” Manglaras said.

There appears to have been little resistance from the council to this change, in fact, this same presentation was made just over a week ago before the Downtown Santa Monica Corporation Board of Directors, leading to a significant amount of discussion and further discussion. Explanation approved 9. -3, board members Laura Vlastil, Luke Kane and Julia Rudd abstained.

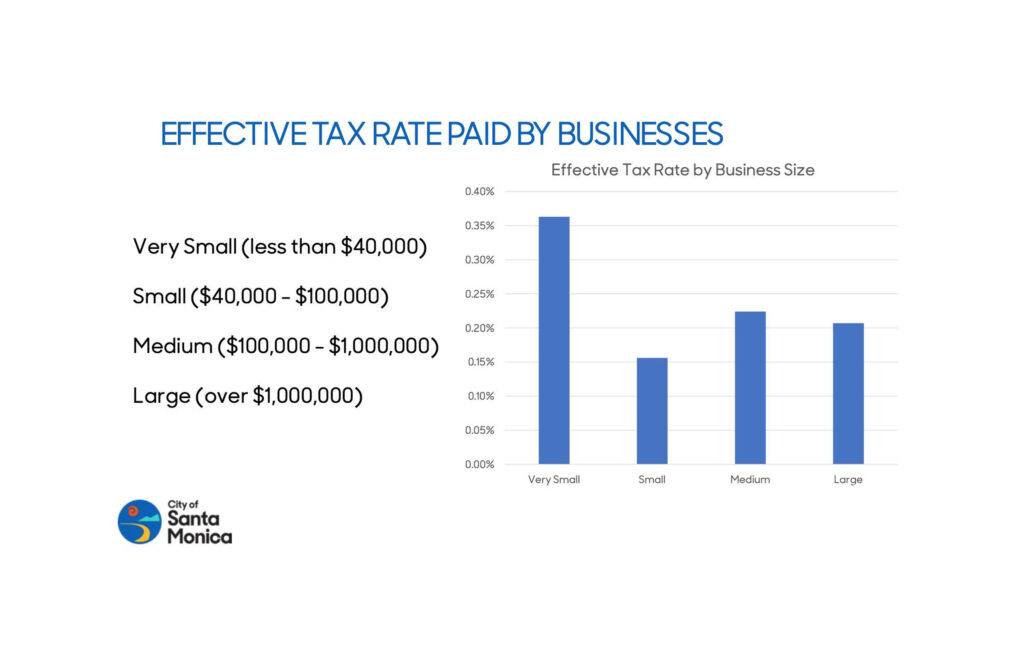

Deputy Mayor Lana Negrete (who herself is a small business owner and is therefore in a position to offer valuable perspective) raises a very pertinent issue, perhaps redefining “small business” and creating new suggested that it might be wise to add the concept. A category called “micro business” has been added to more clearly distinguish business efforts in small businesses.

“I know we refer to small businesses as businesses under 5 million, but if you're applying for a loan and you're a small business, it's actually a small business. If you're under 100,000, then the reality is: [you might be] We make cookies and bracelets and sell them at farmers markets,” Negrete said.

He said it was important to continue to focus equally on these small businesses, and further clarity on the size and composition of each would certainly help owners secure bank financing and potential investment. Deaf added.

There were also questions about the classification of “corporate management headquarters” and how this affects, or could be affected by, existing incentives to bring employees back to the office post-pandemic. However, the answers provided were mostly theoretical.

“The way this tax proposal is framed really prioritizes equity and focuses on supporting small businesses,” City Manager David White responded, adding, “So what direction can we take from this meeting? Regardless, if you're going to shift or adjust your headquarters, you need to take a step back and see how much leeway you have in terms of providing these incentives and brakes…because, as you can see, Because the forecast is that it could generate 2 million to 4 million. [dollars] However, the numbers vary widely. Therefore, we cannot guarantee that you will earn that much. That's our current prediction. ”

Councilman Oscar de la Torre asked about the history of that particular cap, since the auto industry is a major source of revenue for the city of Santa Monica.

Manglala explained that when she went looking for all the records from the '80s, she found that the limits start at about $2,500. It was raised in 1983 and again in 1990, but there was discussion about abolishing it. But the same conversation happened, and in 1990 the cap was raised from $5,000 to $20,000, and in 1992 the cap was raised to $25,000, where it remains today.

A motion was ultimately tabled by Councilor Caroline Trosis. “While maintaining the proposed changes related to the phase-in approach, additional incentives where possible, and clarification of the definition of small business, and the very fair approach that you have taken, I would like to vote in November 2024. I would be grateful if you could prepare a draft modernization measure to be submitted to the

The motion passed unanimously 7-0, with Negrete seconding it.

scott.snowden@smdp.com