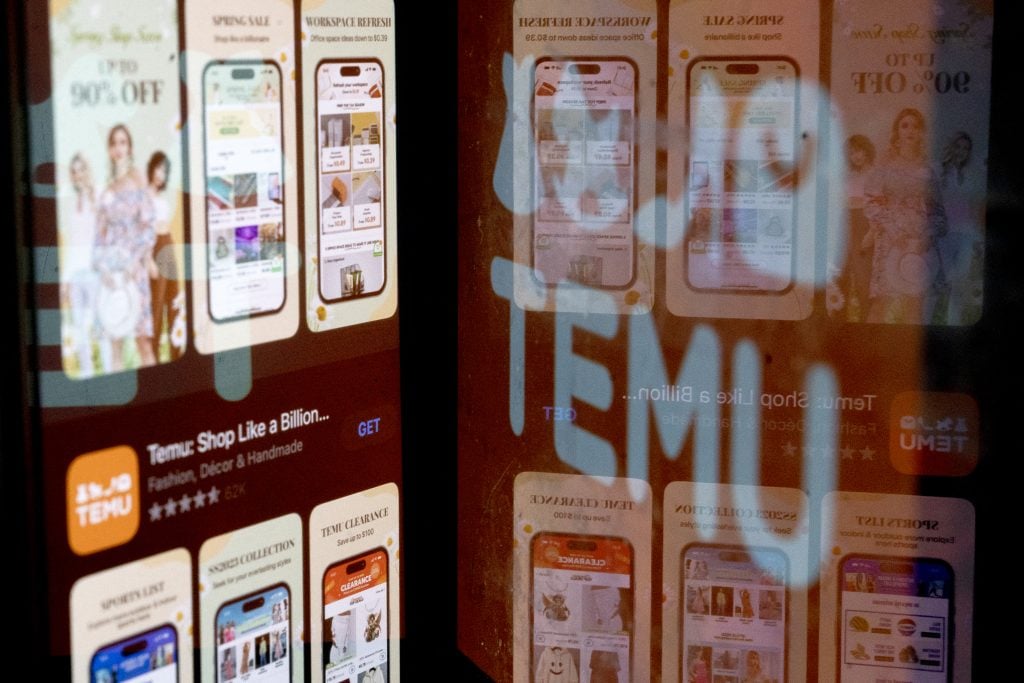

E-commerce marketplace Temu was launched in South Africa in January as Chinese giant PDD Holdings begins its expansion into Africa.

PDD Holdings was founded in Shanghai in 2015 and launched the Pinduoduo platform in the same year. Pinduoduo is a third-party marketplace that connects buyers and sellers and is known for offering deep discounts on consumer products. The company makes money by taking a percentage of each transaction and charging sellers advertising fees.

With revenue of 130 billion yuan ($18 billion) in 2022, Pinduoduo is particularly profitable thanks to its extremely lean business model. First, the company has far fewer employees than similar companies. PDD will have fewer than 13,000 employees in early 2023, compared to Amazon's 1.5 million employees, helping reduce costs.

One reason for this small number of employees is that, unlike its competitors, PDD also outsources fulfillment and distribution functions to third parties. Although this is unusual for a company of PDD's size, this model has enabled PDD to achieve the highest profit margins among Chinese e-commerce platforms.

The company has faced some criticism in China over the years, with some claiming that PDD sells low-quality goods and even counterfeit goods, which halts the company's rapid growth. was of little use. In the first quarter of 2023, Pinduoduo had 623 million monthly active users in China alone.

PDD was initially in the red, but began posting profits in the third quarter of 2020. These profits have increased rapidly since then, with PDD recording a net profit of $8.455 billion in 2023. This number increased by almost 85% compared to the previous year. PDD, which was listed on the Nasdaq in 2018, currently has a market capitalization of over $150 billion.

The Chinese company is now very profitable, and PDD is trying to take the Pinduoduo model to the world with its Temu marketplace. Through the Temu Marketplace, consumers around the world will have access to consumer products manufactured and shipped in China. Temu currently operates in over 50 countries and entered the African market for the first time with its recent launch in South Africa.

Cape Town investment banker Mkuzo Mwachande told African Business that PDD's expansion into Africa is driven by a desire to develop access to the fast-growing market.

“The Chinese market, where PDD primarily operates, is becoming increasingly competitive and saturated,” he says. “Concerns about China's aging population and shrinking workforce may prompt PDD to diversify its revenue sources and tap into new markets with growth potential.Africa has a large and young population. This represents an attractive opportunity for PDD to expand its user base and increase sales.”

“Other big Chinese companies like Alibaba and AliExpress have already been in the African market for quite some time,” added Port Louis-based China-Africa analyst Christian Gerow Nyima Byamungu. . They all recognize that Africa is becoming a big market and many consumers want to take advantage of what Chinese e-commerce companies have to offer. ”

The charm of cheap products

Byamungu also points out that Chinese platforms have an advantage in Africa compared to European and American rivals because they can offer low-cost products.

“Africa is a market full of huge opportunities. There are huge numbers of people eager to buy from Chinese platforms,” he told African Business. “Most African consumers, because of their purchasing power, cannot buy clothing and other products from Europe because the costs are much higher.”

“Purchasing from China has become cheaper and Africans are realizing that the quality of goods coming in is much better than before. For all these reasons, Africa has become a hotspot for Chinese e-commerce ventures to enter. This is a rapidly growing market.”

Temu's launch in South Africa appears to be going well, with logistics in place to deliver orders within 10 days, but faces major challenges if it wants to expand into other parts of South Africa Byamungu says he will.

“The biggest challenge they face is entering a market where there is no strong logistics company that can cover the business-to-consumer element, the 'last mile' of direct-to-consumer delivery,” he said. explain. “These logistics-related issues will cause significant difficulties in the execution of business models.”

“For example, the Democratic Republic of the Congo is a huge market. There are many consumers and businesses who want to buy from Chinese stores. But the logistics system in the DRC is so poor that it takes a long time for the goods to arrive. It can take three to four months,” says Byamungu.

“B2C, last-mile delivery services are key to the success of our business model in Africa. The lack of this could be a factor preventing Tem from expanding elsewhere on the continent.”

local fear

The launch of Tem in South Africa has not been without controversy, with some local producers worried that the Chinese e-commerce giant will squeeze local companies with its ultra-low prices.

The Southern African Clothing and Textile Workers' Union also argued that tax loopholes could give Tem an unfair advantage. South Africa allows entry of low-value goods without customs declaration or duty, allowing PDD to bring products into South Africa without incurring additional charges.

Mwachande believes Temu's launch in South Africa “raises questions about market competition and sustainable business practices.” However, he also points out that African consumers are likely to be attracted to Tem because it is available at very low prices, so “local businesses will lose out.”

“Especially given the current situation in Africa (high unemployment, limited access to financial services, high poverty rates, high levels of income inequality), a rational decision for African consumers is that even if quality is “You're going to choose a cheaper product,” he says.

“Many local companies in Africa do not have strong brand recognition. Considering all this, local companies are likely to lose out from the launch of Temu in South Africa.”

But Byamungu suggests these concerns are largely unfounded. “To be honest, in most African countries, there aren't that many local producers making products. It's not like Chinese companies are undercutting a strong local market,” he says. “While I understand the frustration, it is not justified given the lack of local manufacturers in many African economies.”

Byamungu believes that the entry of Temu and others into the African market could actually encourage further growth for local companies. He argues that “having access to these e-commerce platforms is a huge advantage for African countries. These platforms are generating new business for local people.”

“A lot of locals in African markets are buying a lot of cheap goods from platforms like Alibaba and potentially Tem,” he says. “They can then resell those goods or use them to make new products, such as clothes, for a good profit.Temu can be used as a tool to generate business and create wealth. You can become.”

There were several attempts by local players to push back against South Africa's Temu. Earlier this year, domestic online fashion retailer Zando launched its international e-commerce arm, Zando Global, in hopes of thwarting the expansion of Tem and Shein, another Chinese e-commerce platform, into South Africa. Raised.

“Zando Global steps in as a local hero, offering a reliable alternative to those seeking international products without the fear of ordering from overseas,” the company said at the launch.

However, Temu's supply chain in South Africa appears to be strong, and given the company's ability to offer extremely low-cost products to consumers, it will be difficult for African platforms to compete.

“If we continue to improve product quality and delivery times, Temu and other Chinese e-commerce platforms will continue to drive sales to African retailers, small businesses and consumers,” Byamungu said. say.