On April 30, 2024, Chief Business and Transformation Officer Jeffrey Melucci sold 13,714 shares of Kimberly-Clark Corporation (NYSE:KMB) stock, as reported in an SEC filing. The transaction took place at a price of $135.53 per share, for a total transaction value of approximately $1,859,188.42.

Kimberly-Clark Corp (NYSE:KMB) is a global leader in personal care products, manufacturing and marketing a wide range of products primarily for household use. Its portfolio includes well-known brands such as Huggies, Kleenex, and Scott, and serves customers around the world.

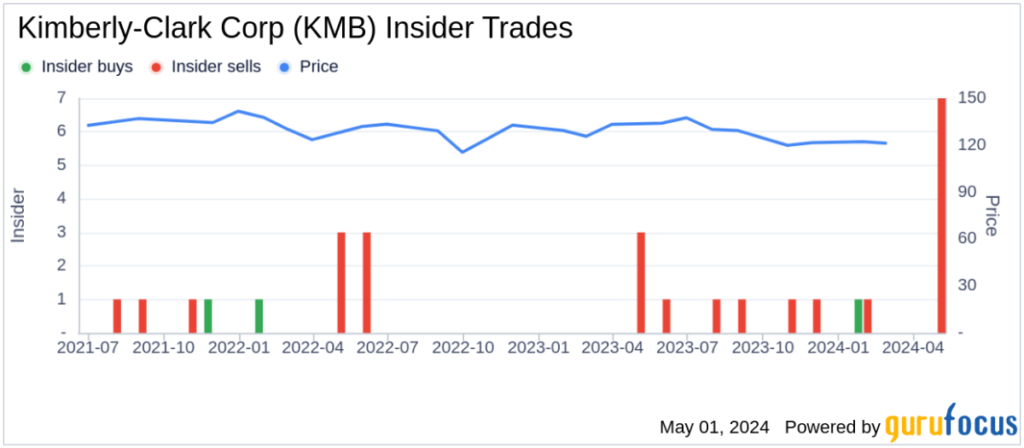

Over the past year, Jeffrey Melucci sold a total of 27,527 shares of the company's stock, but did not buy them. This recent sale is part of a broader trend within the company, with 13 insider sales and only 1 insider purchase over the same period.

As of the latest trading, Kimberly-Clark Corporation (NYSE:KMB) has a market cap of $45.97 billion. The company's price-to-earnings ratio is 25.10x, which is higher than both the industry median of 18.645x and the company's historical median.

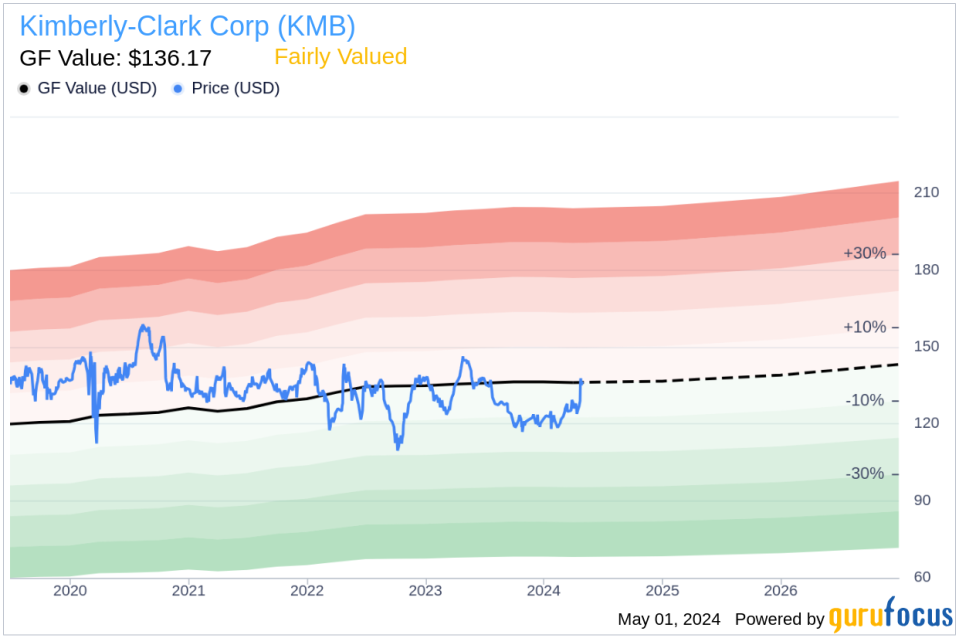

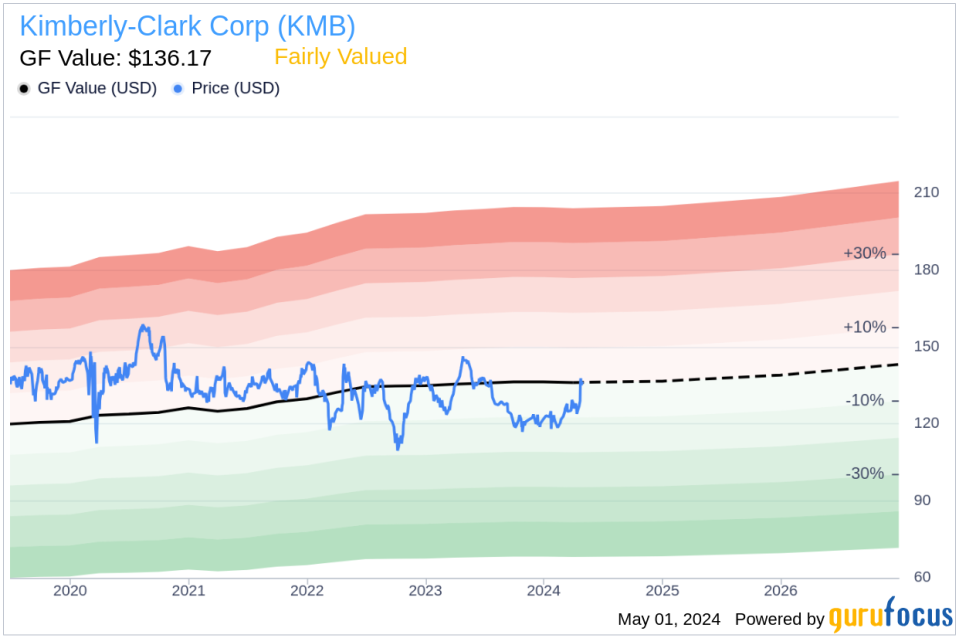

Kimberly-Clark Corp's GF Value is calculated to be $136.17, with a Price to GF Value ratio of 1, suggesting the stock is fairly valued. This valuation is supported by historical trading multiples and adjustment factors based on past performance. and future performance forecasts.

This insider selling may be of interest to investors who track insider behavior as an indicator of company confidence and market movement. For more detailed insights and further updates, investors are encouraged to follow the links provided and monitor Kimberly-Clark's filings and market performance.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.