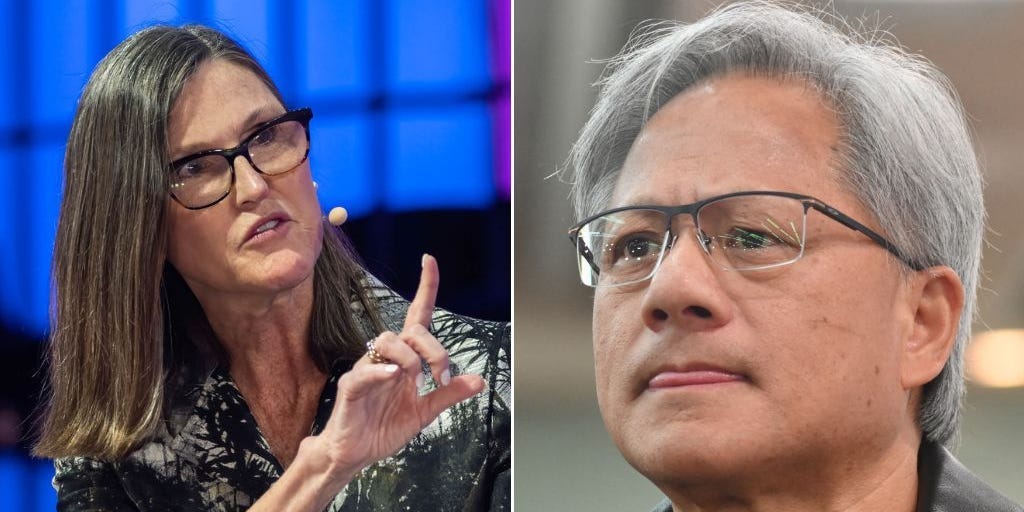

- Cathie Wood says Nvidia has “become a check-box stock.”

- Mr. Wood said he sold the stock because “expectations may get ahead of us.”

- The semiconductor giant's market capitalization exceeded that of Amazon and Alphabet last week.

Cathie Wood of Ark Invest said she believes NVIDIA stock is overvalued and is selling.

“The stock has become a check-box stock,” Wood said on a podcast with The Wall Street Journal's Dion Labuan on Sunday. “That's the height of expectations, which is quite surprising. And we think expectations can lead the way.”

Mr. Wood's investment fund sold $4.5 million worth of Nvidia stock this year. The company is scheduled to report financial results for the final quarter of 2023 on Wednesday.

“In fact, I've been following Nvidia throughout my career since it went public. Nvidia is a very booming stock,” she told Labuan.

An Nvidia representative declined to comment when contacted by BI.

Wood acknowledged that Nvidia “in some ways built the AI era,” but acknowledged there was also “hyperactivity” surrounding the company's stock.

“Everyone is excited to get in at the same time, so you get double orders, triple orders, quadruple orders, and stock corrections,” Wood said. “We think it will happen again.”

The AI boom has greatly boosted the fortunes of semiconductor giants.

Last week, Nvidia's market capitalization reached $1.8 trillion, surpassing Amazon and Alphabet. A 400% surge over the past year means NVIDIA is now as valuable as the entire Chinese stock market.

“If AI is the next industrial revolution, then Nvidia's soaring valuation is definitely going to continue,” Kathleen Brooks of online broker XTB told BI in an interview last week.