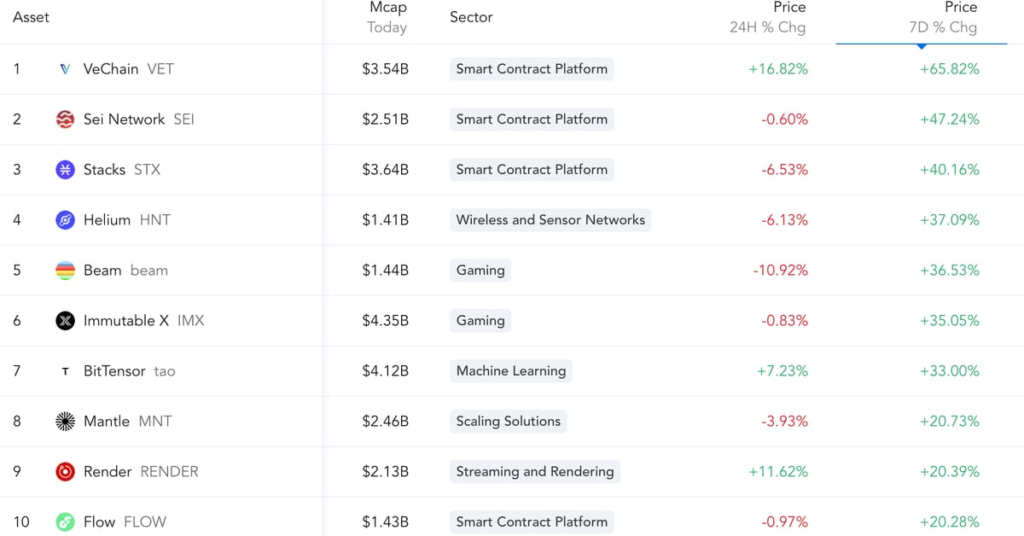

Bitcoin (BTC) has had a strong week, rising 11% over the past seven days, but altcoins have soared even more, with some rising over 50%. The one that rose the most was VeChain’s VET, which rose by about 65%. VeChain is a blockchain aimed at improving enterprise supply chain management and business processes. It's unclear what triggered VET's surge other than following the Bitcoin pump, but the company announced earlier this week that “account abstraction” went live, improving interoperability and unlocking programmable smart contract wallets. announced that it had been done. According to Kenny Hearn, chief investment officer at SwissOne Capital, the chain ranks second in the on-chain oracle market, just behind Chainlink (LINK). “VeChain’s meeting with multiple X2Earn projects last week must have further fueled the bullish sentiment driving this move,” he said. Sei Network (SEI) rose almost 50%, while ether, the second-largest cryptocurrency by market capitalization, rose 15%.

As Bitcoin's price soars to just below $53,000, MicroStrategy (MSTR), the cryptocurrency's largest corporate owner, has more than $10 billion in assets and amassed more than $4 billion in profits. At the end of January, the company held 190,000 Bitcoins purchased for a total of $5.93 billion, or $31,224 per coin, according to the company's latest investor presentation. MicroStrategy started acquiring Bitcoin in the second quarter of 2020 and has been purchasing tokens every quarter since then. Last December, the company had a profit of nearly $2 billion, but that figure has doubled thanks to Bitcoin's more than 20% rally since the start of 2024.

Coinbase (COIN) stock price soared as the U.S.-listed cryptocurrency exchange beat analysts' expectations for fourth-quarter earnings and sales, benefiting from soaring crypto prices. The company reported earnings of $1.04 per share, beating analysts' average estimate of $0.02 per share, according to FactSet data. Sales of $953.8 million exceeded analysts' expectations of $826.1 million. The cryptocurrency exchange's stock rose about 13% in Thursday market trading after rising about 3% during regular trading. COIN stock has fallen about 4% this year, even as Bitcoin (BTC) prices have risen about 23%.