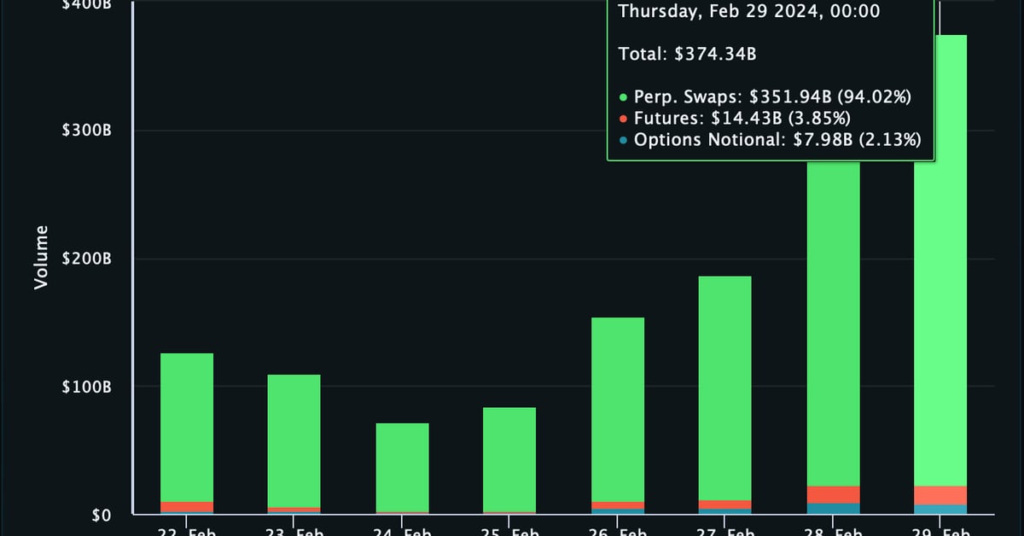

of Bitcoin bulls are back, as well as price fluctuations. BTC is trading 6.8% higher at the time of writing at $62,992, having hit a high of nearly $64,000 on Wednesday. Prices have increased 21% this week alone. The broader market index, the CoinDesk 20 Index, rose 7.5% to trade at $2,326. Cryptocurrencies’ 30-day realized volatility, or the standard deviation of the daily price change over the past 30 days, jumped from 30% to 46% annualized in one week. Activities in the virtual currency derivatives market are increasing. According to Swiss-based data tracking platform Laevitas, $374 billion worth of crypto futures, perpetual futures and options contracts were traded in the past 24 hours. This is the highest single-day statistic since November 2021. Resurgent demand for leveraged products that boost profits and losses suggests increased risk appetite and the potential for price fluctuations due to sudden liquidations.

bitcoin miner sells more As the market rises, coins decrease and inventory decreases. The estimated number of BTC held in wallets associated with miners has decreased by 8,426 BTC ($530 million) since the beginning of the year to 1,812,482 BTC, according to data tracked by Glassnode. The decline started in late October when miners held over 1.83 million BTC. Analysts at FRNT Financial said the impending halving of miners' pay and China's continuing dry season helped boost sales.

morgan stanley I have decided The question is whether the company will offer spot Bitcoin ETFs to customers of its major brokerage platforms, two people familiar with the matter said. On January 10th, the US Securities and Exchange Commission gave the green light to 11 spot Bitcoin ETFs. Since then, billions of dollars have been poured into these products, which closely track the price of Bitcoin and allow investors to gain exposure to the cryptocurrency without owning Bitcoin. It is being But if major registered investment advisor (RIA) networks and broker-dealer platforms such as Merrill Lynch, Morgan Stanley, and Wells Fargo offer ETFs, the floodgates of liquidity will open. Morgan Stanley, a leader in the alternative investments and private markets space, has over $150 billion in assets under management and became the first major U.S. bank to offer access to Bitcoin funds to wealthy clients in 2021. became.