- Despite Bitcoin's decline, buying pressure increased noticeably in March.

- The tethered dominance chart showed that some volatility may be on the way.

Bitcoin [BTC] After falling to $607,000 a week ago, it has recovered above the $70,000 level. Despite the rise in prices, some indicators emphasized weakness.

For example, some long-term holders were locking in profits with Bitcoin [BTC]shows a lack of belief.

To understand where BTC and the rest of the market are headed next, AMBCrypto looked at stablecoin metrics from CryptoQuant. This indicates that purchasing power is increasing and may continue to rise.

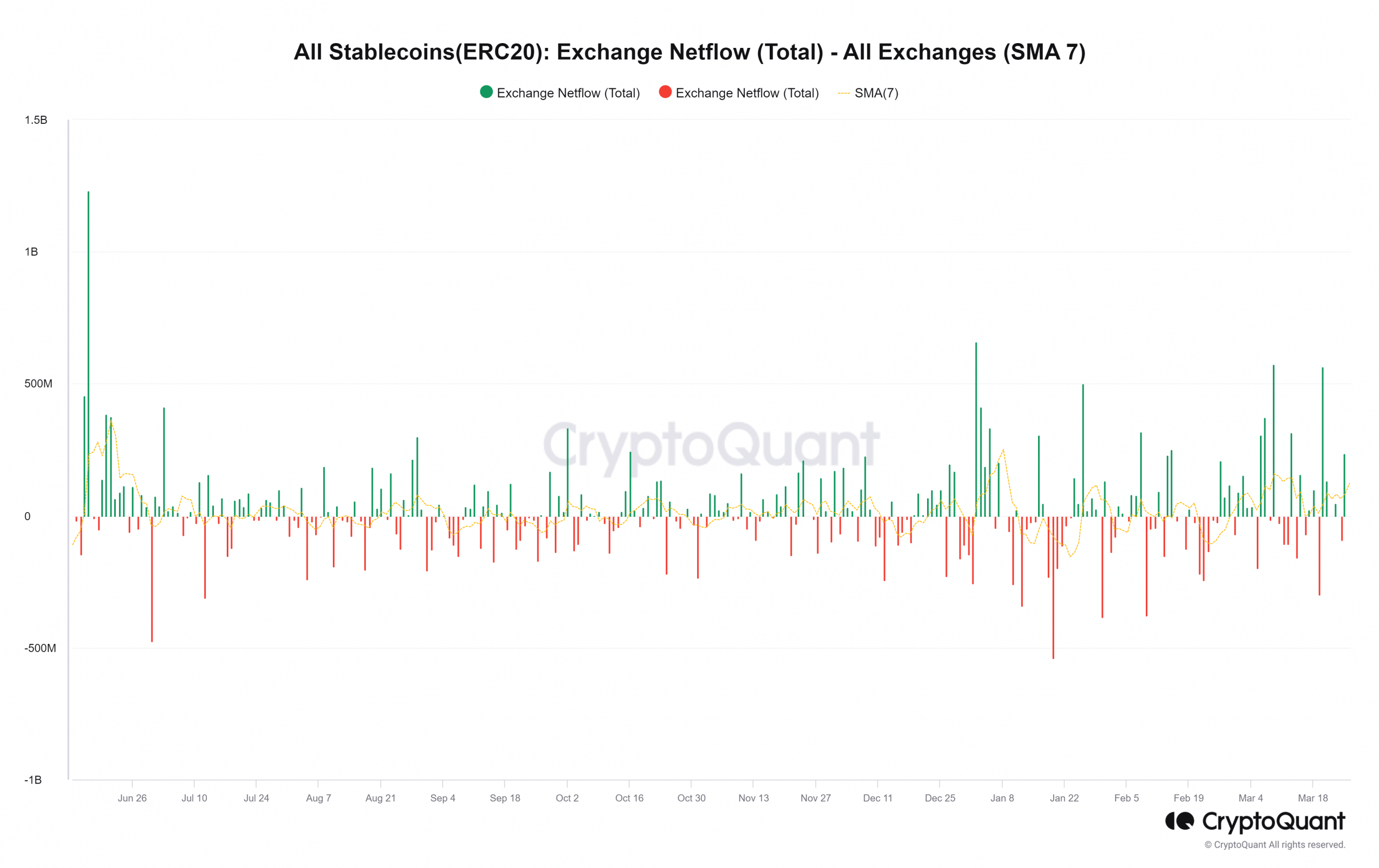

Evaluation of net flow of stablecoins from exchanges

Source: CryptoQuant

Net flows of stablecoins to exchanges showed a positive trend in March. According to a 7-day simple moving average, stablecoin inflows to exchanges have increased over the past 10 days.

This could lead to buying pressure and is an overall bullish sign. Combined with BTC's recent losses, it shows that investors are sending stable stocks to exchanges to buy on the spurts.

They may also serve as collateral for derivatives transactions, which could put upward pressure on prices, but could also increase volatility risk.

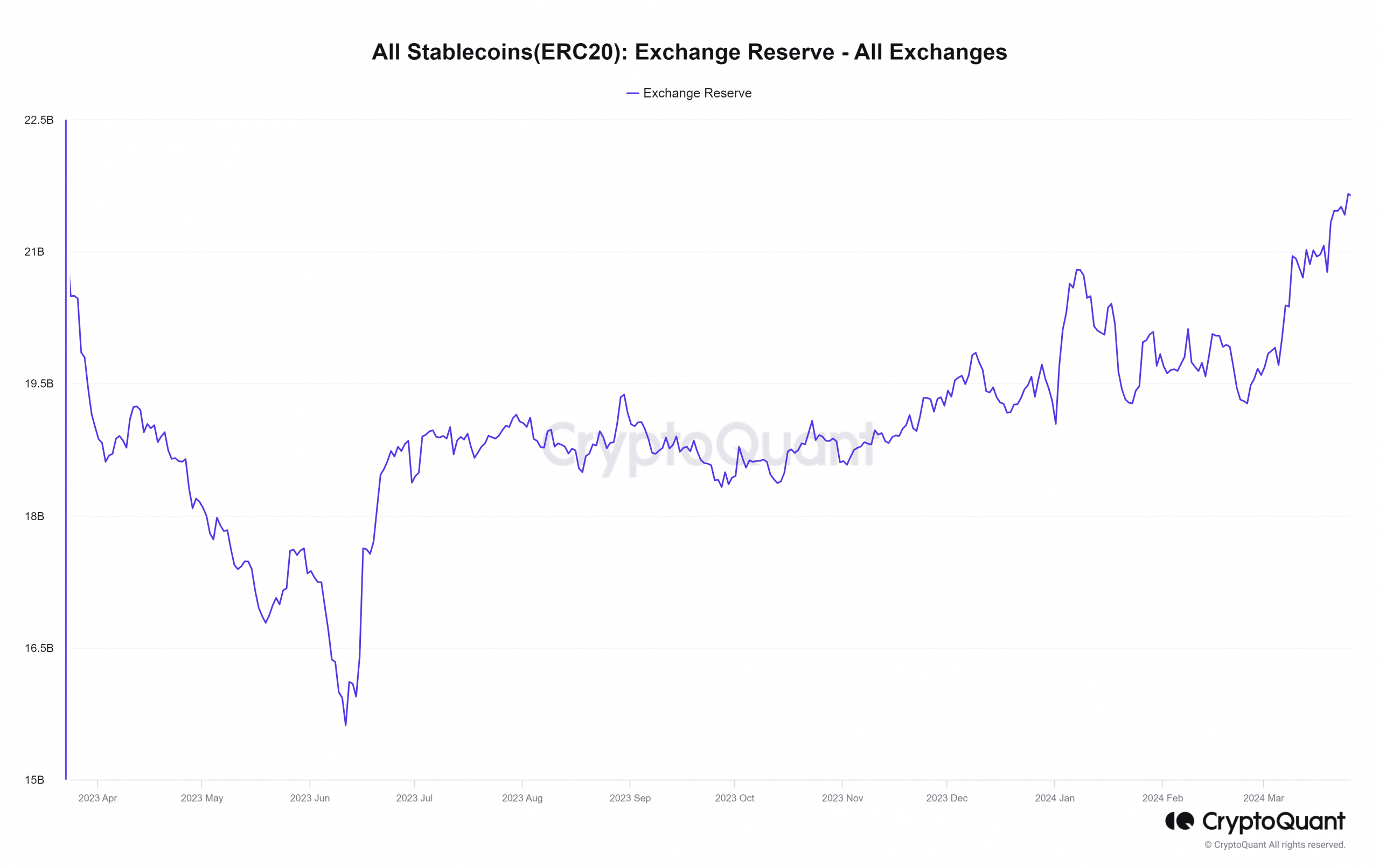

Source: CryptoQuant

Stablecoin exchange reserves have also been trending upward over the past month. Typically, when a cryptocurrency's exchange reserves rise, it indicates potential selling pressure.

For stablecoins like Tether [USDT]and vice versa.

Rising foreign exchange reserves indicate increased buying pressure. Since the role of stablecoins is crucial in terms of providing liquidity, market participants prefer to remain in stablecoins during periods of high volatility.

They can exchange this for assets such as BTC during uptrends or when sentiment is particularly bullish. Therefore, the increase in stablecoin exchange reserves is also a bullish factor.

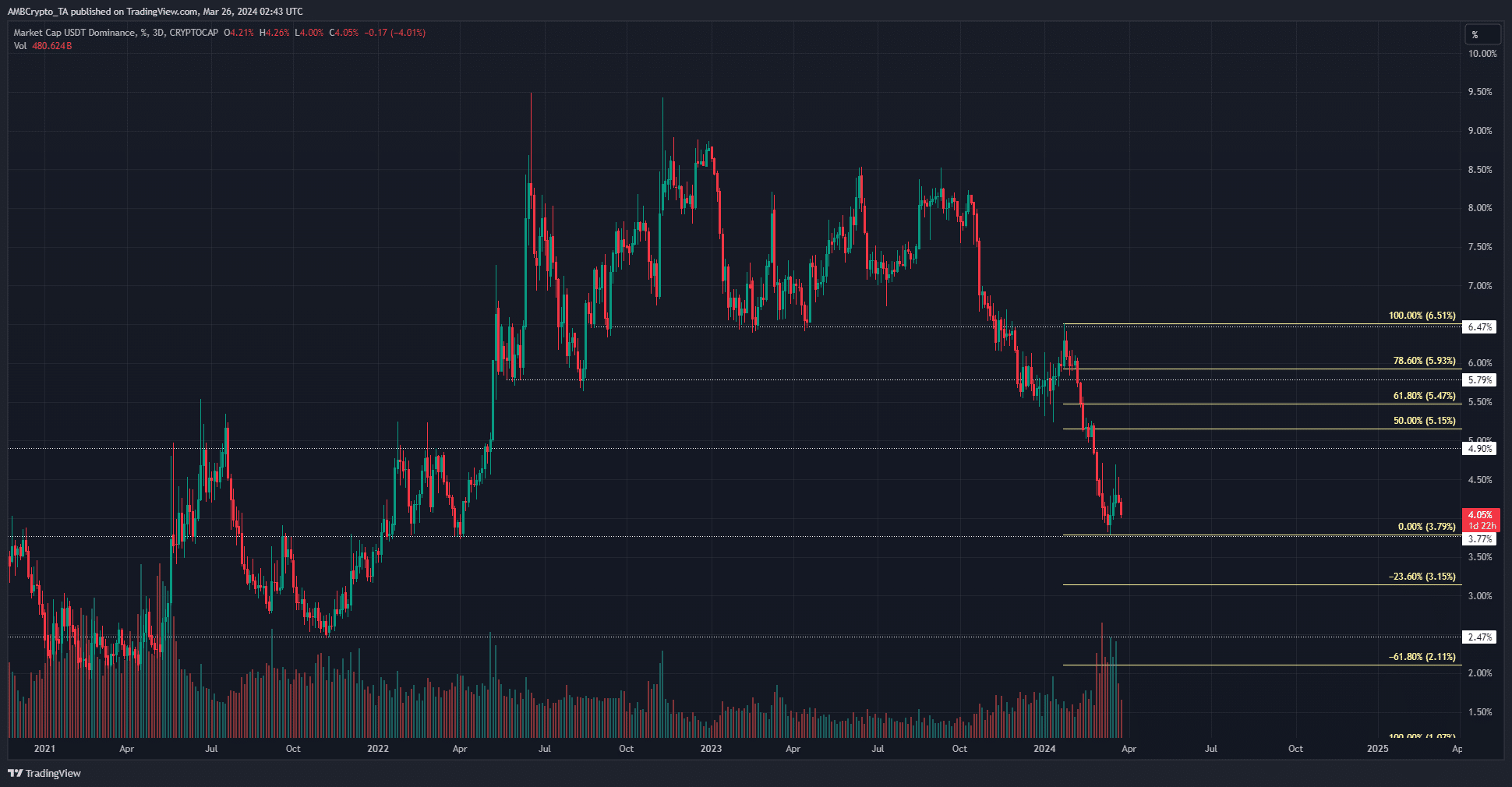

Argument for short-term bearish case

Source: USDT.D on TradingView

Similar to Bitcoin price movements, USDT dominance movements can also provide important insights into market trends. USDT was chosen because it is the largest stablecoin in circulation.

Since mid-October, the USDT.D chart has been on a downward trend. A series of Fibonacci retracement levels were plotted against the recent downward movement of dominance.

This indicates that a retracement may begin in the coming weeks. If USDT regains its dominance, it will reflect bearish pressure in the crypto market as a whole.

Is your portfolio green? Check out our Bitcoin Profit Calculator

The dominance could bounce back if participants sell their tokens for USDT, and technical analysis showed that USDT.D could reach 5.15% or 5.47% in April.

Investors will want to have dry powder on hand in case prices crash. The higher time frame trend for BTC is very bullish and any short-term discount would be very welcome.