-

Bitcoin has broken through the $70,000 level after a 10-day cooling off period.

-

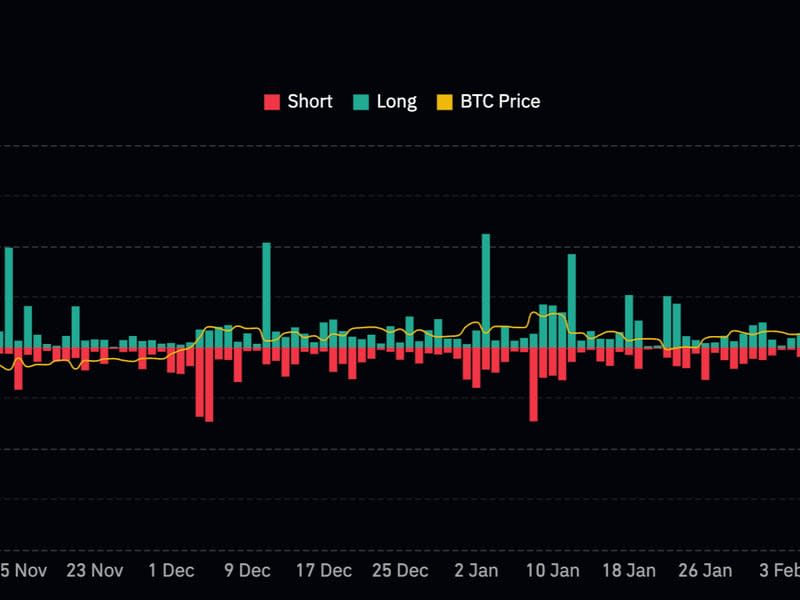

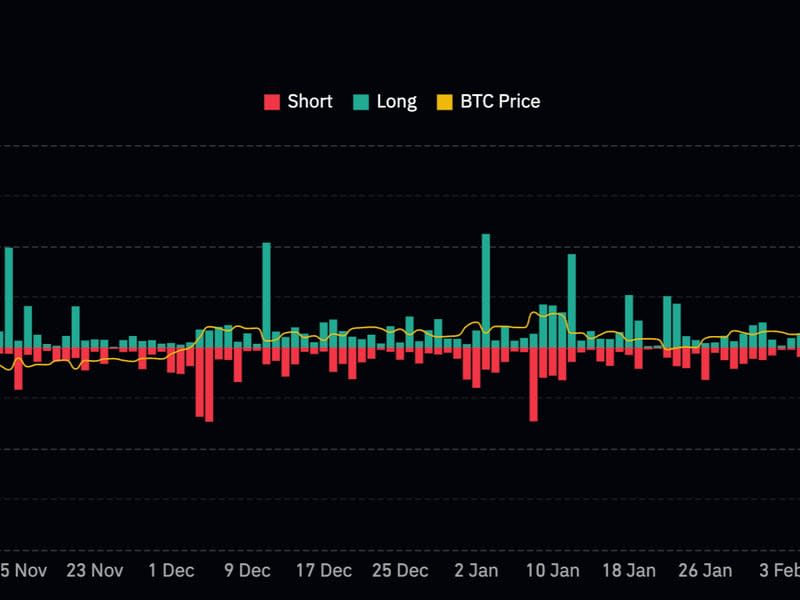

Although this rally did not trigger large-scale short selling, it suggests that not many market participants used leverage to bet on a decline in prices.

-

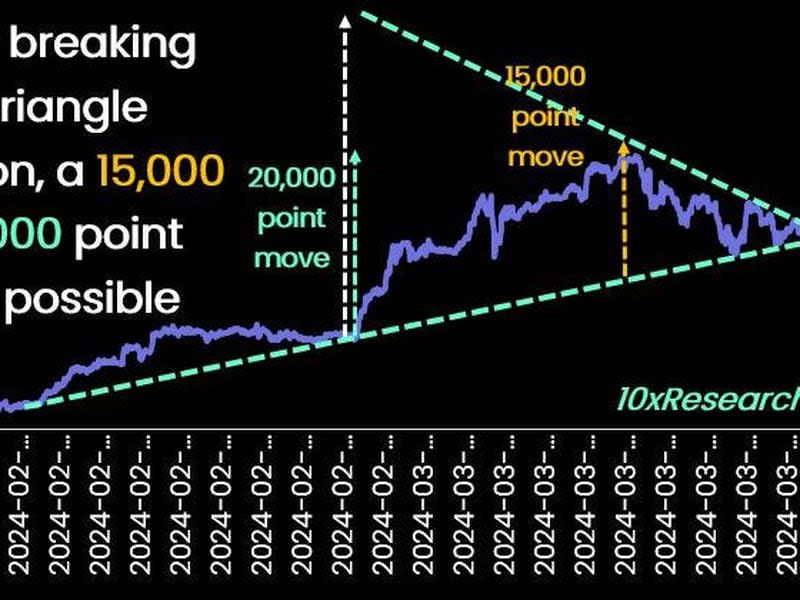

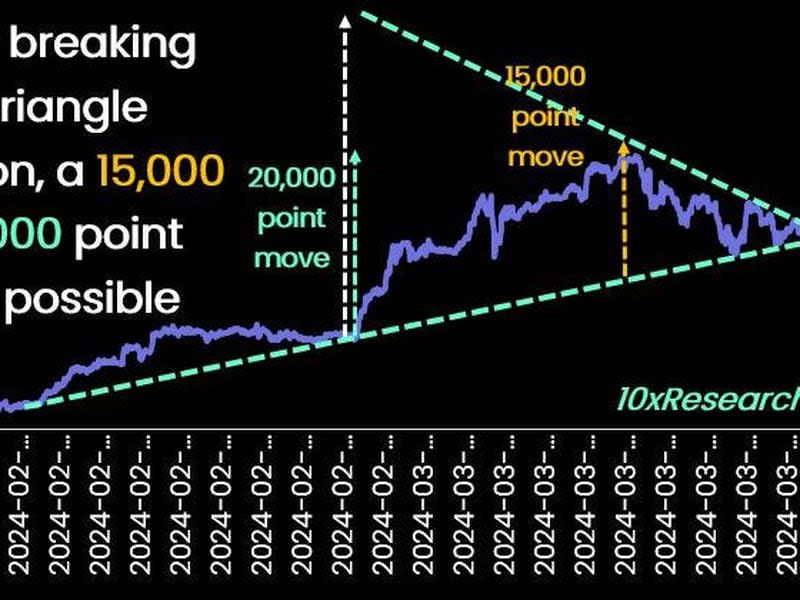

According to 10x Research, Bitcoin could reach $83,000 after breaking out of its consolidation pattern.

Cryptocurrencies started the week with strong gains, rebounding from recent losses as Bitcoin {{BTC}} once again traded above its 2021 highs.

Bitcoin {{BTC}} soared above $70,000 during Monday's U.S. trading hours, surpassing that level for the first time in 10 days and rising more than 7% in the past 24 hours. During the same period, Ethereum's Ether {{ETH}} rose by 6%, while tokens from major layer 1 blockchains Solana {{SOL}} and Avalanche {{AVAX}} rose by more than 10%. Did.

The rally spread across virtually all digital assets, with every component of the broader market CoinDesk 20 Index (CD20) turning green, with the gauge up 6.1% on the day.

The sudden resurgence led to the liquidation of $195 million in leveraged derivatives positions across all crypto assets, according to data from CoinGlass, of which about $129 million was short positions seeking to profit from falling prices. Met. Bitcoin short interest amounted to $53 million, lower than the recent daily average.

Despite the price spike, the relatively modest amount of short-term liquidations suggests that not many market participants used leverage to bet on continued weakness.

Bitcoin aims above $83,000 after breaking out of consolidation pattern

Monday's surge, coupled with modest inflows into a new U.S.-listed spot Bitcoin ETF and increased selling in Grayscale's GBTC fund, pushed BTC from a record price of over $73,000 last week to $61,000. This suggests that the recent correction in the crypto market may be coming to an end.

Analytics firm 10x Research said in a report on Monday that Bitcoin could break out of its consolidation pattern and reach new all-time highs. Based on the formation of a symmetrical triangle, a chart pattern in technical analysis, this breakout could foretell Bitcoin's next move from around $63,000 to $15,000 to $20,000, the report said. states. If that happens, BTC will rise to $83,000.

Another important level that BTC cleared today was its 2021 peak of $68,000. This is because when the highs of previous market cycles are “retested and broken again, BTC has tended to make significant gains,” said Markus Thielen, founder of 10x.

The report states that this uptrend is supported by several central banks leaning towards a dovish stance, which should benefit Bitcoin.

“The Fed has signaled that it is willing to accept higher inflation for an extended period of time and is keen to ease the pace of quantitative tightening,” Thielen said. “The Bank of Japan and the Swiss National Bank were also surprised on the dovish side.”

The report highlights that Bitcoin tends to perform well in US election years, and 2024 is one of them, with historical gains of 100% to 200%, also expected later this year. This is the basis for the price increase.

“Our upside targets of $83,000 and $102,000 could be achieved over time,” Thielen said.

Updated (15:45 UTC, March 25, 2024): Notes cost over $70,000.