Share this article

![]()

![]()

Bitcoin (BTC) prices are showing volatility ahead of tomorrow's US Consumer Price Index (CPI) report. Bitcoin soared above $72,000 earlier this week before falling below $68,500 on Tuesday, according to data from CoinGecko. BTC is trading around $68,800 at the time of writing, down 4% in the past 24 hours.

The CPI report, released on Wednesday, is expected to have a major impact on the Fed's policy, especially on interest rates. Last month, CPI inflation was reported at 3.2% and core CPI at 3.8%. Forecasting future data estimates CPI to be 3.5% and core CPI to be 3.7%.

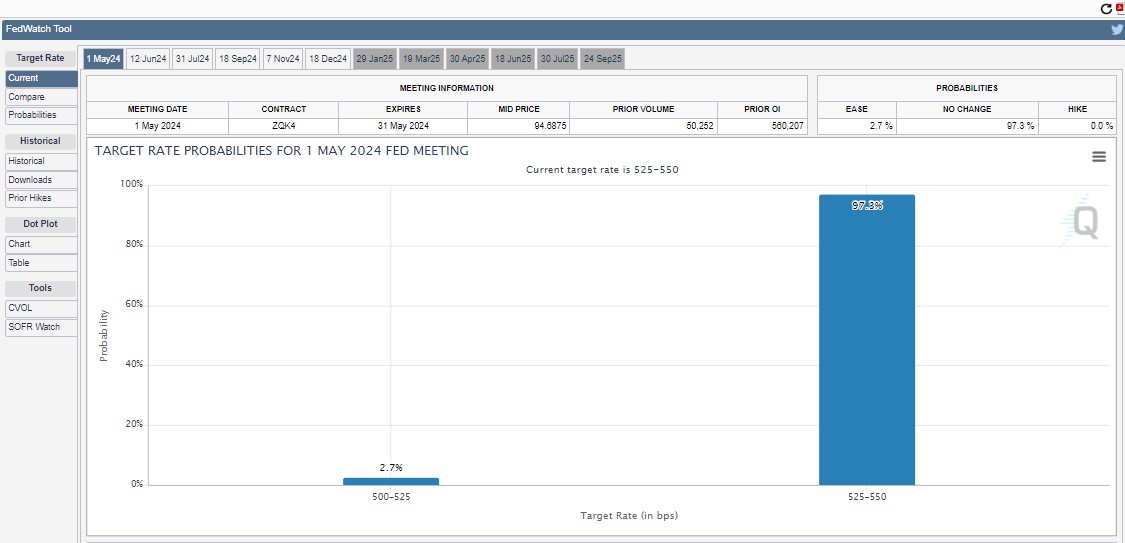

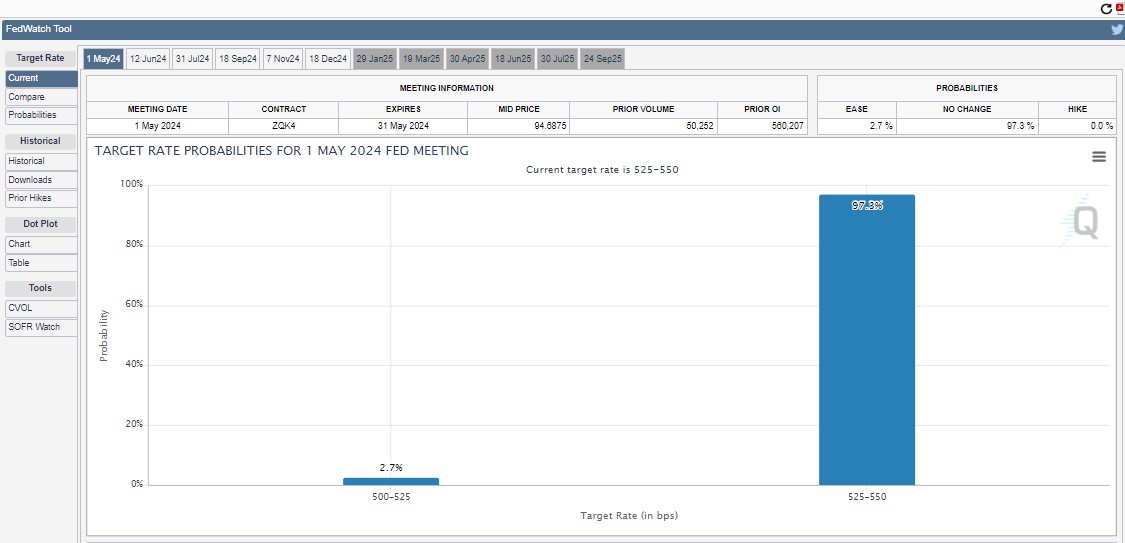

Estimate According to the CME FedWatch tool, there is a 97.3% chance that the Fed will keep interest rates between 525 and 550 basis points at the next FOMC meeting in May, leaving the chance of a rate cut just 2.7%.

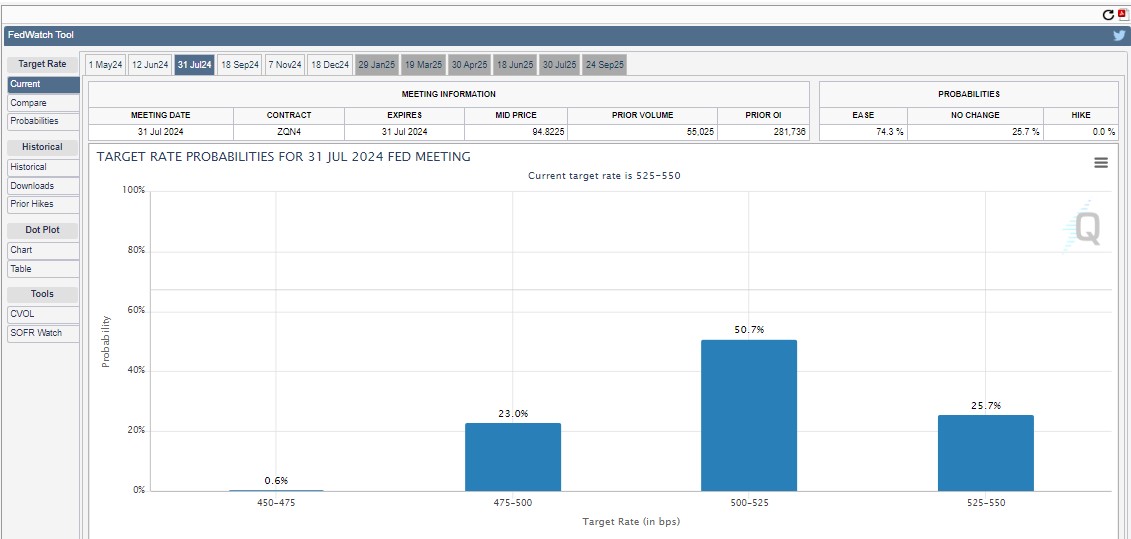

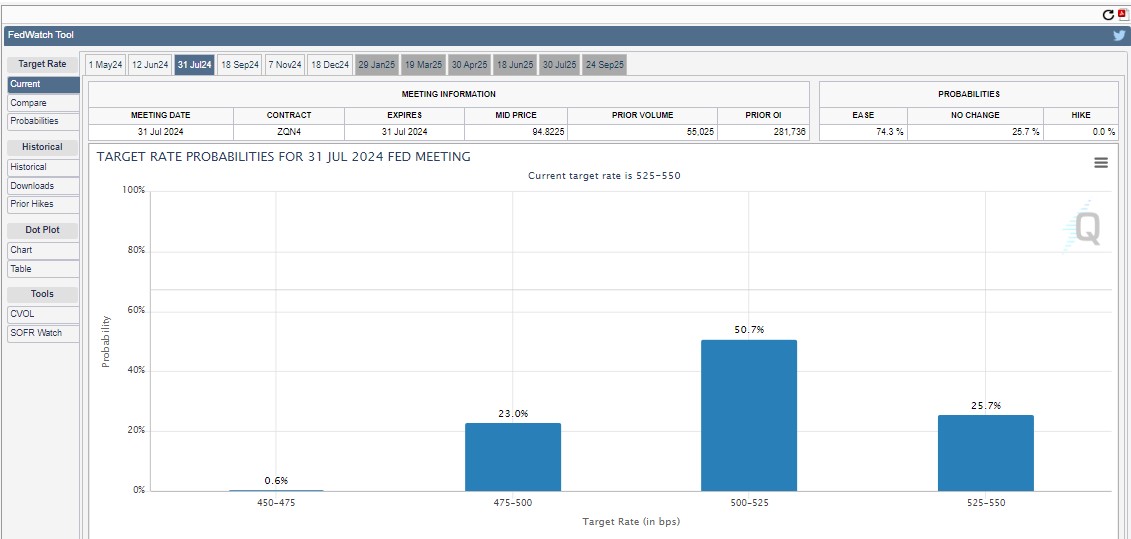

Despite the current uncertainty, markets are pricing in a likely rate cut starting in July.

Economists polled by Reuters expect the headline CPI to rise 3.4% from a year ago, which would mean a slight decline in inflation and bring it closer to the Fed's target.

Federal Reserve Chairman Jerome Powell stressed last week that he needed more evidence that inflation was falling before cutting rates. Other Fed officials also expressed a preference for a more cautious and stricter approach to monetary easing.

Bitcoin's declining momentum has disrupted the crypto market, with most altcoins in correction mode. After surging 8% on Monday, Ethereum (ETH) has pared back those gains and is now down 4.5% over the past 24 hours, according to data from CoinGecko.

However, not all coins are following suit. Open Network (TON) and Phantom (FTM) bucked this trend, each surging 8% today.

Share this article

![]()

![]()