Bitcoin (BTC) price broke above $51,000 on February 14, forming a rare Valentine's Day winning pattern, but ETF inflows hint at a possible retest of $55,000. There is.

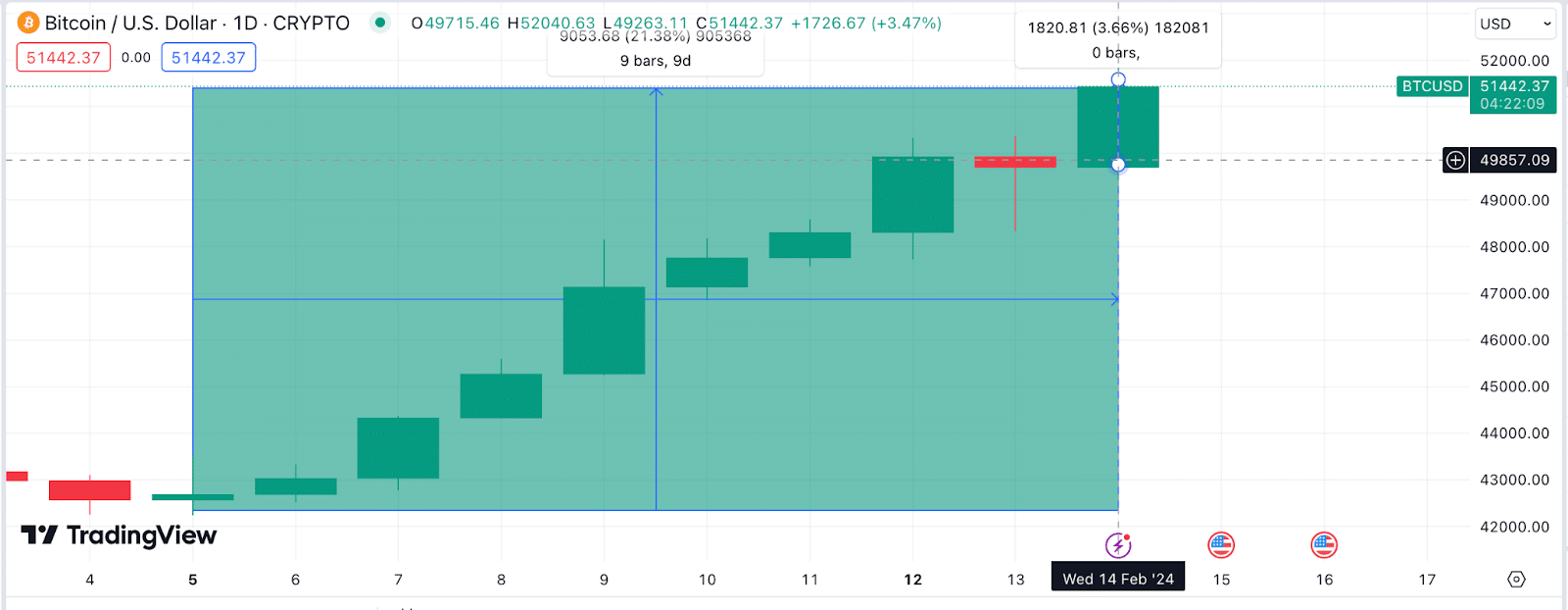

Bitcoin made history on Valentine’s Day, with BTC price rising to a new year high of $52,040 within the daily time frame on February 14th.

Bitcoin records Valentine’s Day winning streak for 5 consecutive years

Thanks to an unusually high buying trend among institutional investors, BTC price has surpassed the $52,000 mark for the first time since 2021, marking a month-to-date increase of 20%.

Data shows that over the past four Valentine's Days dating back to 2020, Bitcoin prices have increased by 1.3%, 3.03%, 1.13%, and 1.9%, respectively.

BTC price rose 3.66% in the intra-day time frame on February 14th, hitting a high of $52,040, extending Valentine's winning streak to five years in a row.

Breaking it down further, since 2020, holders who bought BTC on the eve of Valentine's Day and sold it at midnight would have made a total profit of $4,196.

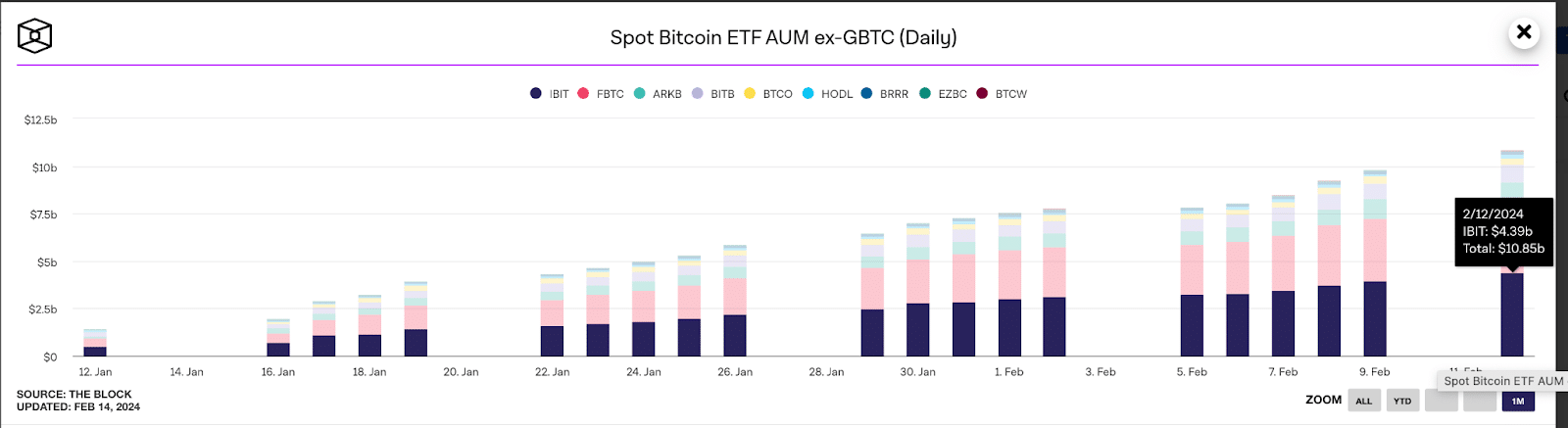

Looking beyond the price chart, the BTC Spot ETF has seen significant inflows this week, which could propel the rally towards $55,000.

Bitcoin ETF assets under management exceed $10 billion

In another bullish Valentine's Day record, net inflows into the BTC Spot ETF hit a record $631 million. Investors have been pouring money into spot ETF derivative products this week as initial uncertainty subsides ahead of Grayscale's (GBTC) $1 billion sale.

As of February 14, the cumulative assets under management (AUM) of all 10 newly launched spot ETF products reached $10.9 billion.

ETF entities captured in TheBlock's calculations include BlackRock, Fidelity, ARK Invest/21Shares, Bitwise, Franklin, Invesco/Galaxy, VanEck, Valkyrie, WisdomTree, and Hashdex.

As of the end of the first trading day on January 11, these companies had total assets under management of $851 million. This means that the capital stock has increased by 1,150% in the past 31 days, with a cumulative daily growth rate of approximately 9.2%, or $77 million per day.

Indeed, this chart shows that investors are becoming more confident after the initial weeks of uncertainty, and this is reflected in the acceleration of capital inflows.

If this buying trend continues at the current rate, BTC price looks poised to enter another rally towards the $55,000 area within the next few days.