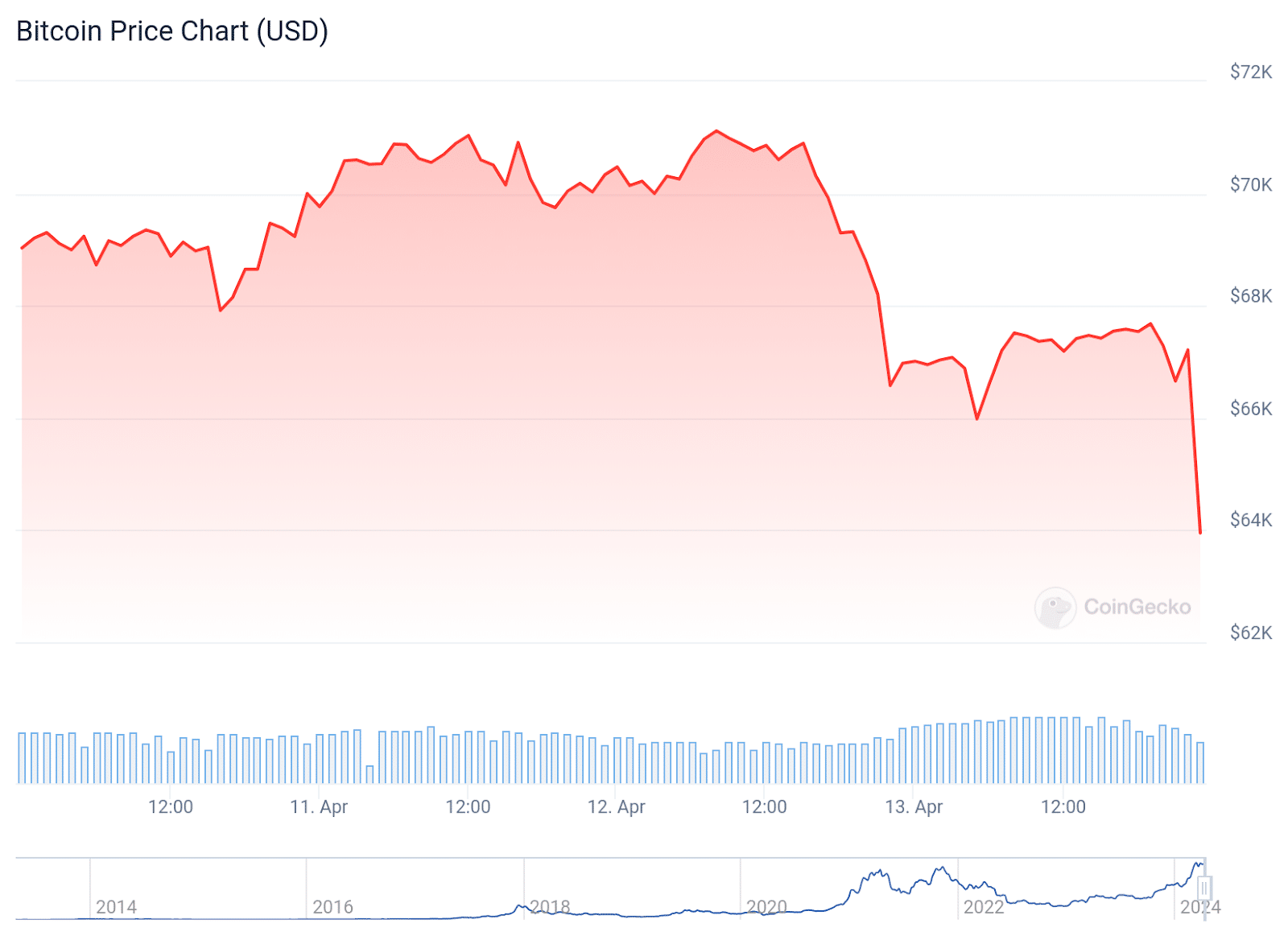

Cryptocurrency markets reacted after Iran's drone attack on Israel on April 13th. Bitcoin (BTC) fell more than 8% from its value to trade at $61,514.

The correction marked a continuation of the trend that began on April 12 and worsened the following day.

Analysts estimate that the cryptocurrency market liquidated more than $860 million in assets in two days. The price of Bitcoin initially fell from $71,000 to $65,000, and then further fell to the $61,000 level.

Market watchers suggested the initial drop was due to news from the Federal Reserve suggesting it was in no hurry to cut interest rates.

This stance is driven by the persistence of inflation levels, which is causing anxiety at home and influencing expectations about policy adjustment globally.

The second drop was due to rising tensions between Iran and Israel, and crypto traders were the first to react to the news as traditional financial markets were closed for the weekend.

Last checked, Bitcoin was trading at $64,123, which is still 5% lower than it was 24 hours ago. For the 7-day and 14-day periods, the losses are 7.5% and 8.6%, respectively. The 30-day price decline is just over 6%.

The world's largest cryptocurrency by market capitalization is down 13% from its all-time high of $73,798 in March, but is still more than double what it was a year ago.

QCP experts said Iran's attack on Israel has caused great anxiety in the market. Ethereum (ETH) fell to $2,850, and other cryptocurrencies also fell by an average of 20-30%.

According to CoinGecko, among the top 100 cryptocurrencies by market capitalization, only Leo Token (LEO), Bittensor (TAO), Celestia (TIA), and Wormhole (W) rose in the past 24 hours. .

The cryptocurrency data aggregator also showed that since April 13, the total market capitalization of the sector has fallen by 5.2% to $2.43 trillion.

But despite the situation, some analysts say the decline is normal.

Into The Cryptoverse Founder Benjamin Cowan pointed It turns out that the cryptocurrency market has experienced similar declines before. Meanwhile, MicroStrategy Executive Chairman Michael Saylor reiterated his now-famous line that disruption is good for Bitcoin.