-

Bitcoin hit a new all-time high of $69,200 on Tuesday, but has since fallen sharply to $59,700.

-

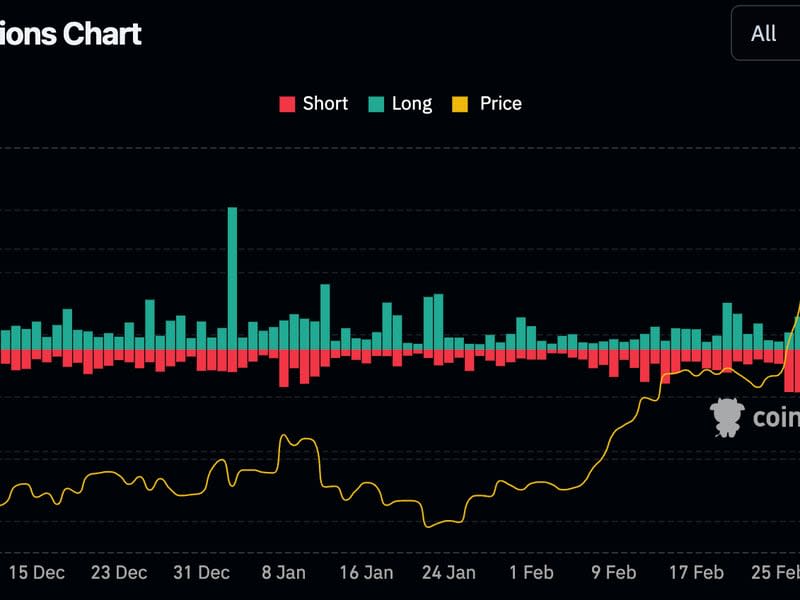

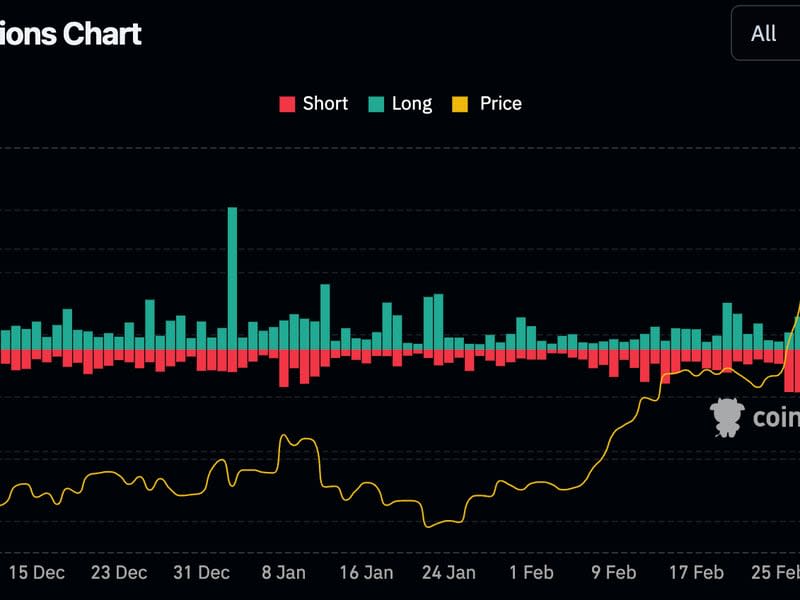

The correction triggered a chain of liquidations that flushed out $1 billion worth of leveraged derivatives positions across all digital assets, according to CoinGlass data.

Bitcoin {{BTC}} has fallen more than 10% from its new high on Tuesday, as heavy selling on cryptocurrency exchanges capped a price rally of more than $69,000 and briefly dipped below $60,000.

BTC rose to $69,200 earlier in the day, but more than 300 BTC worth about $20 million was sold, with a concentration of large sell orders at higher price levels, according to the order book on crypto exchange Binance. It sold for $69,000 and shows over 500 BTC sold at 20:00. 70,000 dollars.

The selling pressure created a big barrier to the price of Bitcoin, causing the cryptocurrency price to fall. After the CoinDesk Bitcoin Index (XBX) hit an all-time high of $69,208 at 15:04 UTC, BTC fell more than $1,000 in one minute. The selloff then accelerated in waves, with the price first dropping below $65,000 and then falling further to $59,700, according to CoinDesk Bitcoin Index data. As of this writing, BTC had recovered to $62,800.

read more: Bitcoin hits an all-time high.what happens next

This pullback caused BTC to drop 7% in the past 24 hours, leading to a drop in the market-wide CoinDesk 20 index (CD20) down 3%, but held up better due to the relatively strong performance of Ether {{ETH}} and Solana {{SOL}}. Other altcoin majors such as Cardano's {{ADA}}, Dogecoin {{DOGE}}, and Shiba Inu {{SHIB}} fell around 10%-12%.

Cryptocurrency liquidation surges

This wild price action has caused severe deleveraging, with $1.1 billion worth of derivatives trading positions liquidated across all digital assets in the past 24 hours, according to CoinGlass data. According to Coinglass, about $870 million of the liquidated positions were long, or bets that asset prices would rise.

Liquidation is when a trader does not have enough funds to cover the loss of the position, some or all of the trader's initial capital down or “margin” is lost and the exchange closes a leveraged trading position. Occurs when When asset prices plummet, the effect can trigger a wave of liquidations, exacerbating losses and price declines. Large liquidation events often indicate local highs or lows in asset prices.

Tuesday's action also exceeded last August's $1 billion leveraged flash, when Bitcoin suddenly fell from $28,000 to below $25,000. This move marked a near-local low in price, but it took several weeks for Bitcoin to actually start rising again.

Will Clemente, co-founder of Reflexivity Research, said Tuesday's events reminded him of Bitcoin's movements around Thanksgiving in 2020. At the time, bulls were focused on an impending drop to the $20,000 level, but Bitcoin cratered and crashed after reaching $19,500. That's about $16,000 in a very short period of time.

“Any dip is to shake off the leveraged monkey and buy now,” Clemente said in the X post.

This move is reminiscent of the -15% leverage wipeout that occurred after testing ATH for the first time in 2020, which Portnoy called the “Thanksgiving Massacre.” Any dip is for shaking off the leveraged monkeys and buying at this point. I just sit there with my hands up, doing nothing.

— Will (@WClementeIII) March 5, 2024

Updated (March 5, 19:45 UTC): Updated headline and price as Bitcoin's decline accelerates. Add settlement data.

Updated (March 5th 20:55 UTC): Adds historical background and analyst comments.