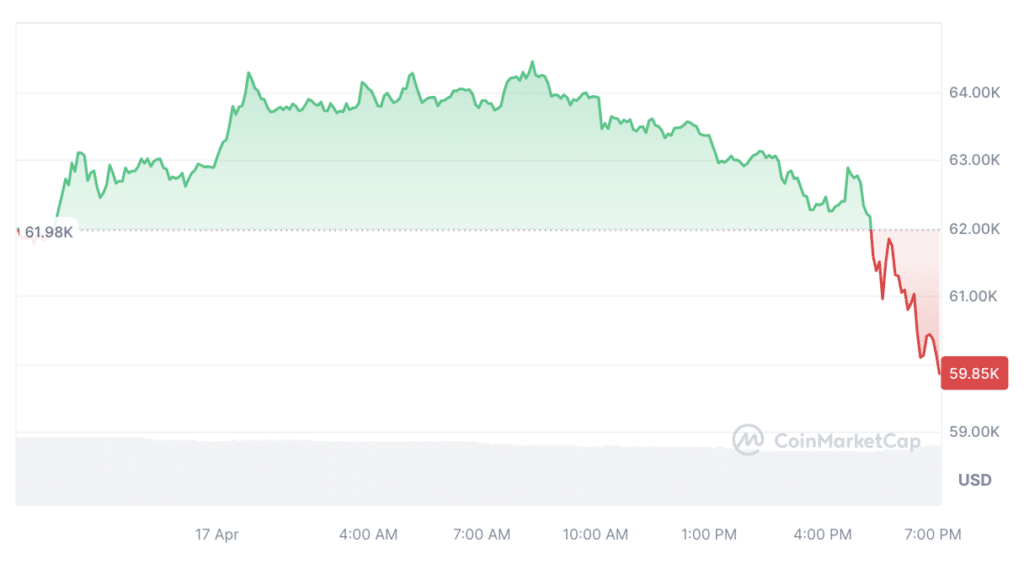

As the halving approached, Bitcoin's price quickly fell below the $60,000 level.

Bitcoin (BTC) price has fallen more than 3% in the past 24 hours and is trading at $59,800 at the time of writing, according to data from CoinMarketCap. Cryptocurrency trading volume fell by about 12% to $40 billion.

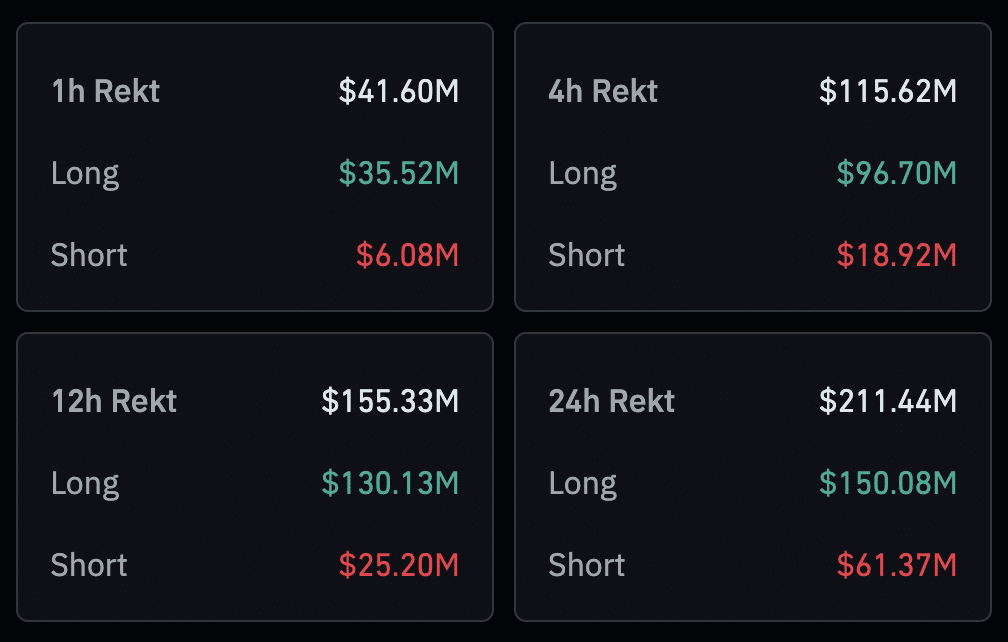

CoinGlass data shows that traders are actively liquidating their positions. In the past four hours, traders offloaded $115 million worth of assets, of which $96.7 million were long positions and the rest were short positions. The largest proportion of liquidations occurred on the OKX virtual currency exchange, with a total amount of $43.81 million.

With the BTC halving looming in the coming days, traders may exit their positions due to the earthquake. The halving would reduce miners' rewards by 50% and limit the number of coins uploaded to the market, a feature that some Bitcoin supporters are optimistic about.

Leading up to the halving, the coin's volatility increased and not just because of the halving. Investors pulled money from popular Bitcoin ETFs after Federal Reserve Chairman Jerome Powell said the central bank needs to see more progress on inflation before cutting interest rates. The fact that it continues is also a reason for the sale.

Markus Thielen, head of research at 10x Research, points out that crypto miners began accumulating Bitcoin in January 2024 to magnify the imbalance between supply and demand. As a result, the price of BTC skyrocketed, reaching an all-time high in March.

Meanwhile, digital asset mining companies will gradually erase the coins they accumulated after the halving, putting pressure on the price of cryptocurrencies.