Bitcoin (BTC) has experienced a decline of approximately 19% since hitting its all-time high (ATH) on March 14, 2024. This situation raises concerns about the longevity of the current bull market.

However, despite the recent correction, many analysts believe this represents a healthy consolidation of the ongoing bull market, not the end.

Bitcoin correction signals market health, not the end of a bull market

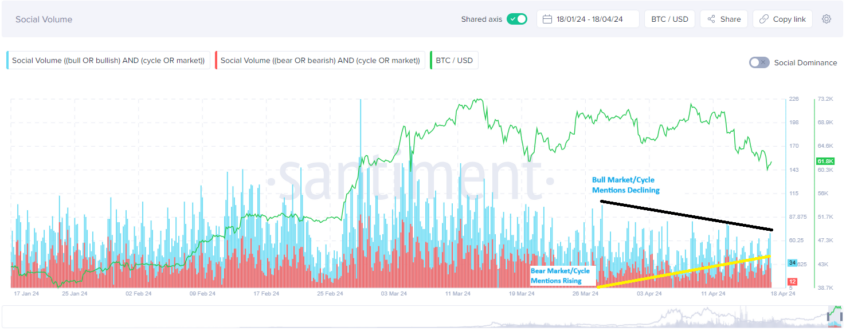

On-chain data platform Santiment reports a change in market sentiment. Data shows that references to a “bull market/bull cycle” have increased since late March. Additionally, FOMO (fear of missing out) feelings are down and FUD (fear, uncertainty, and doubt) is up.

However, prices have historically trended against the general sentiment of the public. Therefore, a recovery could occur before or immediately after the approaching Bitcoin halving.

Read more: What happened during the last Bitcoin halving? Predictions for 2024

The increase in references to a “bull market/cycle” is consistent with Bitcoin's current price performance. At the time of writing, Bitcoin is trading at $61,988.

Interestingly, Bitcoin's price decline contradicts the typical narrative surrounding Bitcoin's halving. This quadrennial event has a history of being associated with soaring BTC prices. The upcoming Bitcoin halving is scheduled for approximately April 20, 2024, at a block height of 840,000.

Many experts believe that this year's Bitcoin halving could change BTC's typical price spike. This prediction is due in particular to the recent approval of the US Spot Bitcoin ETF.

Nevertheless, analysts view the current correction as a healthy move. Cryptocurrency analyst Cryptocon emphasized the need for a correction amidst a bull market. He identifies the 20-week EMA as a key support level for Bitcoin at $55,600.

“As long as Bitcoin continues to retest this moving average, it will continue to follow a smooth curve similar to 2017 and reach the top,” he said. explained.

Renowned analyst Plan B also maintains his long-term bullish outlook for Bitcoin.

“[In my opinion], this Bitcoin halving will be no different… BTC's highest price will exceed $300,000 in 2025. ” Plan B Said.

Hannah Hung, principal data analyst at Spot On Chain, echoed Plan B and Cryptocon, saying price increases tend to occur around 6-12 months after a halving.

Expert opinion is consistent with Bitcoin's historical data. After the first halving in November 2012, the price rose from about $12 to more than $1,000 by late 2013. Similarly, during the second halving in July 2016, Bitcoin's price skyrocketed from around $650 to nearly $20,000 by December 2017. The third halving was in May. The price increased from about $8,000 in 2020 to $69,000 by November 2021.

Read more: Bitcoin Halving Countdown

Despite the positive outlook for Bitcoin prices in the long term, the Bitcoin halving may still be a concern for miners. Due to this year's halving, the reward for mining a Bitcoin block will be reduced from 6.25 BTC to 3.125 BTC, which will have a significant impact on miners' profitability. As a result, miners face pressure to innovate and find ways to reduce costs while maintaining or increasing Bitcoin production.

Although this event may impact miners' profitability, a January 2024 study by CoinShares revealed that some miners will be able to survive. In fact, miners with large amounts of Bitcoin and strong capital tend to do better in bull markets.

However, those with limited cash reserves and higher operating costs per BTC are more vulnerable to Bitcoin price declines.

The recent correction, looming halving, and newly approved US spot ETFs create a complex environment for predicting Bitcoin prices. But overall, long-term bullish sentiment remains strong among most industry experts.

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.