Geopolitical tensions escalated dramatically last weekend in the wake of the unprecedented conflict between Iran and Israel. The events that took place on Saturday night instantly shook global markets, including the crypto sector. However, at the time of reporting, there was a notable recovery in the cryptocurrency market.

The rapid recovery in cryptocurrency value demonstrates the robustness of the market and its ability to withstand unexpected global events.

Bitcoin still maintains strong support at $60,000 level

Concerns about escalating tensions caused a sharp decline in Bitcoin (BTC), the world's most valuable cryptocurrency, dropping to $60,800 during the conflict. Additionally, BeInCrypto previously reported that approximately $962.4 million was lost during the market decline.

Cryptocurrency analyst Ash Crypto explained that the economic downturn is a reaction to the expected outcome of the war, which is the rise in prices of commodities such as oil and gold. These outcomes lead to high inflation and reduce the likelihood of central banks cutting interest rates.

Read more: Bitcoin Price Prediction 2024/2025/2030

According to Ash Crypto, this situation is creating a bearish environment for both stocks and crypto assets.

“As BTC and alt currencies started collapsing, those with highly leveraged positions started liquidating, which led to more forced sell-offs,” said Ash Crypto. I got it.similar to a similar decline during the onset of the coronavirus infection in 2020 and the beginning of the Russia-Ukraine conflict.

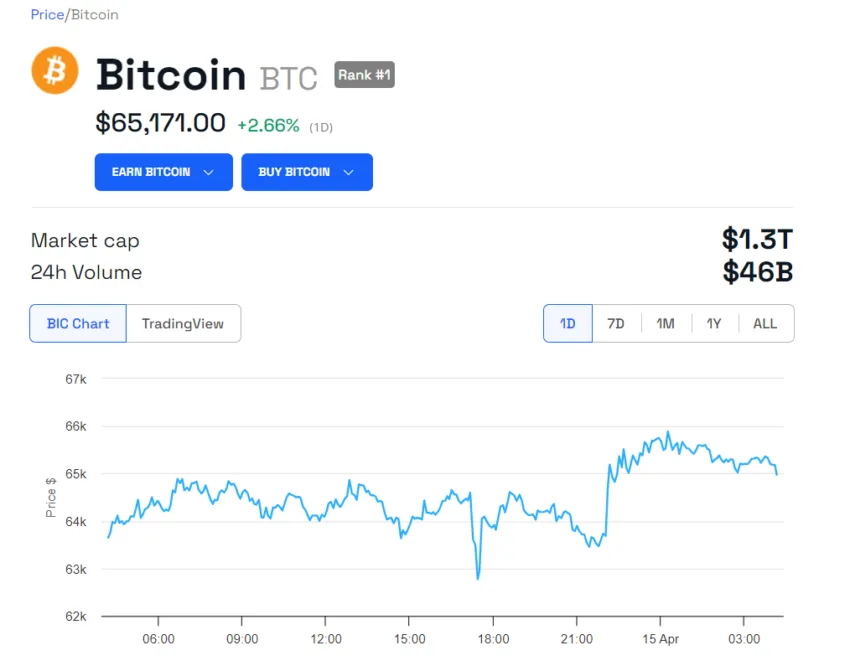

However, Bitcoin and major altcoins have rebounded significantly. At the time of writing, Bitcoin is trading at $65,170, registering an increase of 2.66% in the past 24 hours. Ethereum (ETH) and Solana (SOL) saw an even bigger rally, rising 7% and 12.8%, respectively.

Given the impact of geopolitical tensions on the crypto market, Galaxy Digital CEO Mike Novogratz predicted a price recovery after the initial decline.

“War costs $$$…. We hope it doesn’t get any bigger, but after the risk flash, BTC will resume its uptrend,” Novogratz said. I have written On X (old Twitter).

Novogratz hoped that cooler heads would prevail and prevent large-scale regional conflicts. This sentiment is very important for the continued growth of cryptocurrencies, as the market prefers stability.

Read more: How to buy Bitcoin (BTC) and everything you need to know

Despite the volatility, Ash Crypto remains bullish on Bitcoin’s near-term performance.

“BTC is currently trading above $63,000, with the $60,000 level providing strong support. If the $60,000 level cannot sustain, most new whales (ETF buyers) will not buy BTC. “There is a strong support level between $56,000 and $58,000,” Ash Crypto outlined.

He further pointed to history, noting that black swan events often precede parabolic rallies within crypto markets.

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy and Disclaimer have been updated.