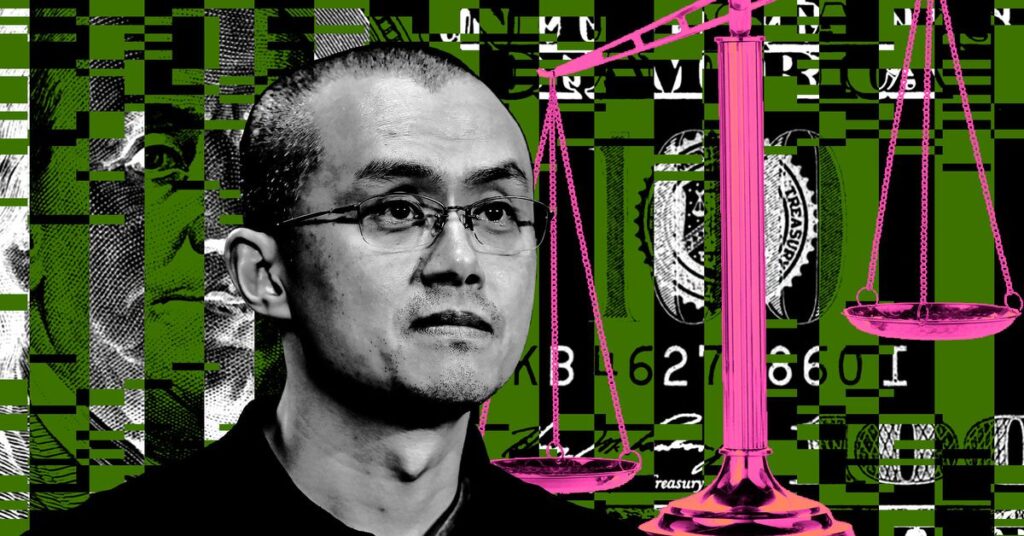

Binance founder Changpeng Chao was sentenced to four months in prison for failing to establish adequate anti-money laundering measures. Mr. Zhao, once the head of the world's largest cryptocurrency exchange, pleaded guilty in November 2023.

Judge Richard Jones said Zhao prioritized “Binance's growth and profits over compliance with U.S. laws and regulations.” Although Jones believes it is unlikely that Zhao will reoffend, the scale of the crime is noteworthy.

Binance “violated U.S. law on an unprecedented scale”

Although Zhao is not as famous as FTX fraudster Sam Bankman Freed, he is a more important figure in the crypto world. The Chinese-Canadian entrepreneur founded Binance in 2017. He was asked to step down as the exchange's CEO as part of a plea agreement, but remains the company's controlling shareholder, one of the people said. bloomberg It was a “huge shitty casino.” Binance has listed far more tokens than competitors such as Coinbase.

The prosecutor's office recommended a three-year prison term, twice the 18-month sentencing guidelines, in a memorandum, stating that “the scope and impact of Mr. Cho's illegal acts were enormous.'' They also suggested that Zhao's sentence should “reflect the significant harm to the national security of the United States caused by his criminal conduct.”

Prosecutors say Binance has admitted to violating sanctions by more than $898 million, “violating U.S. law on an unprecedented scale.” Chao and other Binance executives did not comply with U.S. laws, including the Bank Secrecy Act (BSA), and did not properly implement anti-money laundering efforts. As a result, Iranian customers were able to conduct at least $1.1 million in transactions with US customers in violation of sanctions. Other sanctioned countries such as Cuba and Syria were also able to trade.

In his own sentencing memorandum, Mr. Zhao's lawyers said that Mr. Zhao did not deserve a prison sentence because “no defendant has ever been sentenced to prison in a similar BSA case.” Chao left his home in the UAE to enter the guilty plea. He has been in the United States “for five and a half months, away from his home, partner, and young children,” his lawyers wrote. Additionally, Binance has taken steps to amend its anti-money laundering procedures, they wrote.

In the crypto world, Mr. Zhao has long been known as a cowboy known for his disregard for U.S. laws. In October 2022, Sam Bankman Fried, CEO of rival exchange FTX, tweeted (and deleted) that he was “thrilled to see it.” [Zhao] We will continue to represent the industry in Washington, DC! Oh, he's still allowed to go to his DC, right?'' A week later, Zhao tweeted that he was selling his FTX token holdings following the blockbuster article. coin desk. This was a significant amount since Binance had invested in FTX from the beginning. “We do not support people who lobby other industry players behind the scenes,” Zhao said. Said.

Chao has already agreed to pay a $50 million fine, a small amount compared to the estimated $33 billion wealth he amassed at Binance. He also agreed not to appeal any sentence within 18 months.