Those who are notified do not need to take any further action to receive loan forgiveness.Student loan servicer, an intermediary that collects student loan payments federal government The ministry said it would begin repaying the debt on behalf of the government within the next few days.Next week, the agency We plan to contact the debtor directly. Subject to early cancellation I am subscribed to a Save plan, but I am not currently registered.

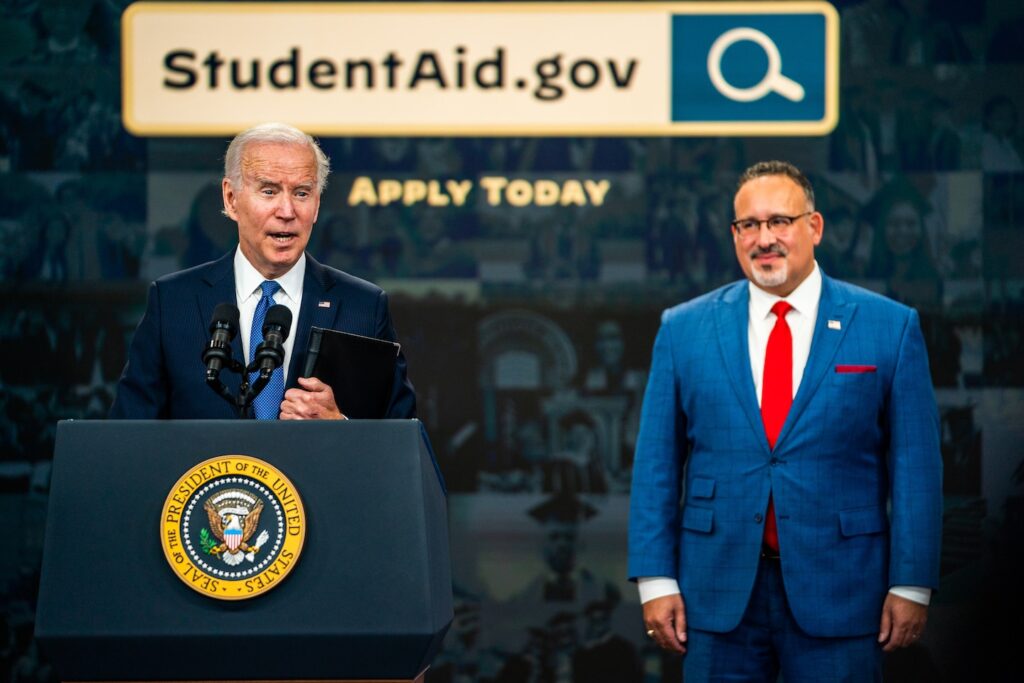

“This plan reflects our uncompromising commitment to providing as much relief as possible to as many borrowers as possible, as quickly as possible,” Education Secretary Miguel Cardona said in a call with reporters Tuesday. Ta. “We are offering real and immediate respite from the unacceptable reality that student loan payments compete with basic needs.”

With this student loan forgiveness, the Biden administration has approved approximately $138 billion in debt relief for 3.9 million people. Under the Biden administration, the Education Department has focused on reducing the debt burden for people who borrowed money to attend college and expanding or loosening rules for existing relief programs. It is also developing another plan to provide relief to more borrowers after a loan forgiveness plan introduced by Biden in 2022 was struck down by the Supreme Court last year.

Following the court ruling, the Biden administration finalized the Save Plan.

Approximately 7.5 million people have More than 40 million people with federal student loan debt are enrolled in Save. With this plan, your monthly student loan payments are fixed at your income and family size. other An income-oriented plan. One big difference is the new plan. Increases the amount of income protected from liability calculations Payments from 150 percent to 225 percent of the federal poverty line.

That means any single borrower making less than $15 an hour will be spared the payment.who earns more The department says it will save an estimated $1,000 a year. Even if a borrower's monthly payments are $0, he can receive credit toward forgiveness. According to the Department of Education, the 4.3 million people enrolled in the plan have monthly payments of $0.

The department began implementing several features of the Save plan in conjunction with the resumption of student loan payments in October. This summer, federal officials will begin capping undergraduate loan payments from 10% to 5% of income for students above the federal poverty threshold of 225%. A borrower with undergraduate and graduate debt will pay on a weighted average 5-10% on the debt.

A fast-track path to cancellation could have a big impact on people who attended community college, dropped out of college, or are at risk of defaulting on their loans. The Department of Education estimates that 85 percent of prospective community college borrowers, who typically take out small loans, could become debt-free within 10 years under the Save Plan.