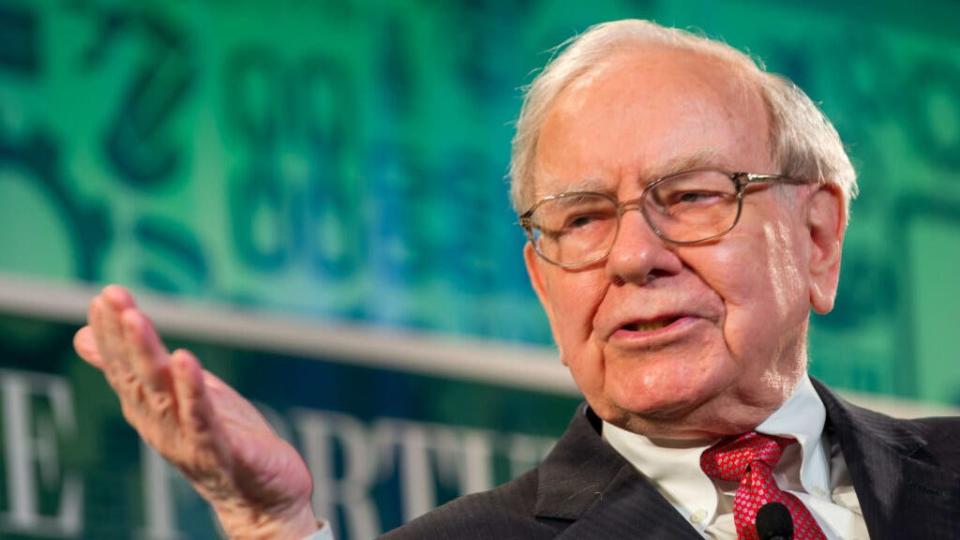

While many top asset managers and investors are investing in, or at least open to, cryptocurrencies and Bitcoin, a few remain hesitant to embrace the asset. The most prominent figure in the anti-Bitcoin camp is legendary investor Warren Buffett.

Buffett's strategy of investing in solid companies that consistently generate cash and value has been a huge success. This has allowed his company, Berkshire Hathaway, to survive through the peaks and troughs of the market.

Do not miss it:

Buffett is well known for his anti-Bitcoin stance, and stated this in a 2018 interview with Yahoo! Treasurer, “When you buy something like Bitcoin or cryptocurrencies, you're not actually creating anything. You're just hoping that the next person will pay you more.'' ”

At the 2022 Berkshire shareholder meeting, Buffett explained his stance on Bitcoin, saying, “If you say you own all the Bitcoin in the world and someone offers it to you for $25, , I wouldn't respond, because what would I do with it?'' “That? I'd have to sell it back to you somehow. That wouldn't do any good.''

Buffett is against Bitcoin and cryptocurrencies in general. But this stance doesn't fully translate into his company's investments. Berkshire Hathaway has made a significant investment in Brazilian fintech company Nu Holdings, which was one of the best performers in 2023.

Founded in 2013, Nu initially offered low-cost bank accounts and personal loans through a much more digital format than its competitors. In 2022, the company launched Nucripto, where users can buy and sell over 15 of his tokens.

Although the company's cryptocurrency business accounts for a relatively small portion of its revenue, it is still active in the cryptocurrency space and its customer base continues to expand. It also launched its own cryptocurrency called Nucoin.

Buffett invested $500 million in New Holdings through a Series G funding round before the company went public in December 2021. A few months later, Buffett invested another $250 million, bringing the total investment to $750 million.

The investment paid off. Nu has increased by nearly 50% in 2024 alone, and recently hit a new all-time high. This is also the result of his strong 2023, with the stock increasing by almost 100%.

These huge profits could shift Buffett's focus to cryptocurrencies. Seeing the profits made in crypto-related businesses, investors may reconsider their strategies and stance towards cryptocurrencies. Bitcoin has outperformed most major indexes so far in 2024. Bitcoin is up nearly 70% in 2024, far outpacing the S&P 500, which is up just over 10% in 2024.

With Bitcoin and cryptocurrencies back in the spotlight, much attention has been focused on Berkshire Hathaway and Buffett considering whether to continue investing in Bitcoin-related businesses or the token itself. ing.

Read next:

“The Active Investor's Secret Weapon'' Step up your stock market game with the #1 News & Everything else trading tool: Benzinga Pro – Click here to start your 14-day trial now!

Want the latest stock analysis from Benzinga?

The article Berkshire Hathaway continues to profit from cryptocurrencies despite warnings from Warren Buffett who called Bitcoin 'rat poison' appeared first on Benzinga.com.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.