investors in Barrett Business Service Co., Ltd. (NASDAQ:BBSI) had a strong week, with its stock up 4.2% to close at $120 after reporting its full-year results. Barrett Business Services reported revenue of US$1.1 billion, roughly in line with analyst estimates, but statutory earnings per share (EPS) beat expectations at US$7.39, beating analyst estimates by 3.6%. This is an important time for investors, as they can track a company's performance in the report, see what experts predict for next year, and see if there have been any changes to expectations for the business. With this in mind, we've gathered the latest statutory forecasts to find out what analysts are expecting for next year.

Check out our latest analysis for Barrett Business Services.

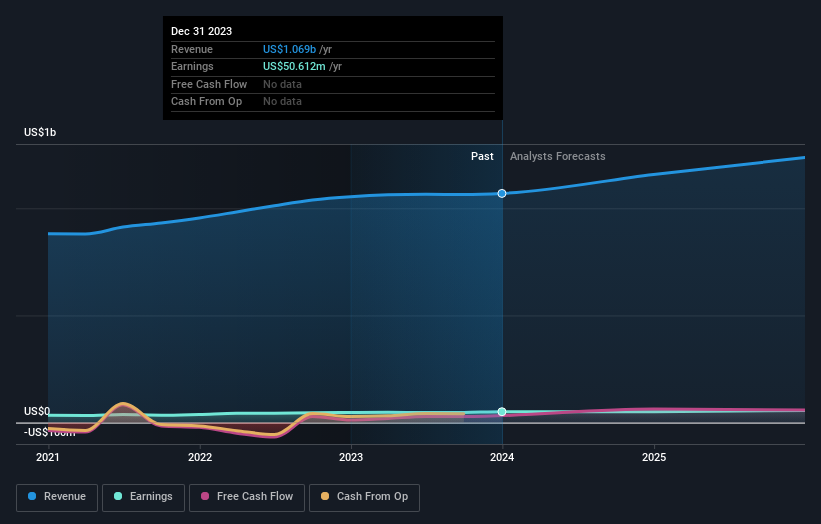

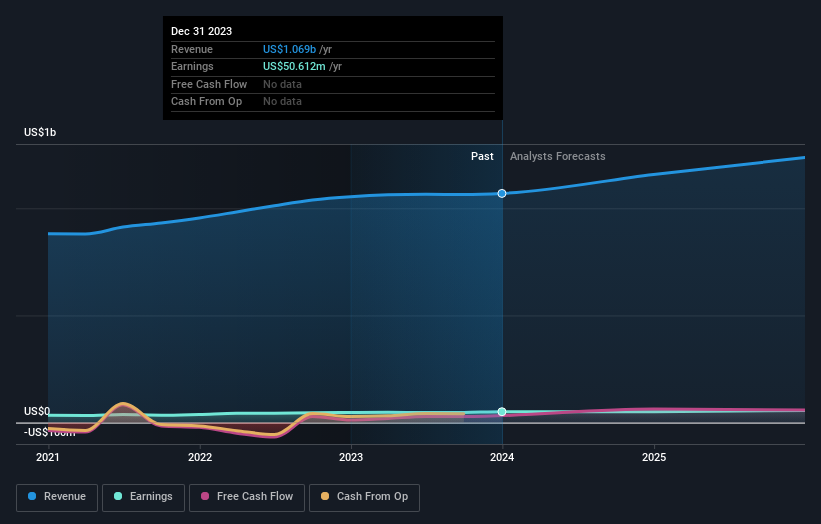

Taking into account the latest results, the latest consensus for Valet Business Services from 4 analysts is for revenue of US$1.16b in 2024. If this were met, it would mean that earnings would have grown by 8.3% over the last 12 months. Statutory earnings per share are expected to be US$7.66, roughly flat with the past 12 months. Ahead of this report, analysts had been modeling 2024 revenue of US$1.15b and earnings per share (EPS) of US$7.70. So it's clear that even though the analysts have updated their forecasts, nothing much has happened. Changes in business expectations following the latest results.

Remarkably, the price target rose 9.9% to $144 after analysts reaffirmed their sales and profit forecasts. Previously, there seemed to be some doubt as to whether the business would be able to live up to expectations. However, it is unwise to stick to a single price target, as the consensus target is effectively an average of analyst price targets. As a result, some investors like to look at a range of estimates to see if there is any disagreement regarding a company's valuation. There are mixed views on Bullet Business Services, with the most bullish analyst valuing it at $159 per share, and the most bearish at $135 per share. Still, such a narrow range of estimates suggests the analysts have a pretty good idea of the company's value.

Looking at the bigger picture now, one way to understand these forecasts is to see how they measure up against both past business performance and industry growth estimates. The latest forecasts indicate that Valet Business Services' growth rate is expected to accelerate significantly, with forecast revenue growth of 8.3% per annum to the end of 2024, significantly faster than the 3.4% annual growth rate over the past five years. it is clear. In contrast, our data shows that other companies in a similar industry (covered by analysts) are forecast to grow their revenue at 6.4% per year. It's clear that while the growth outlook has been brighter recently, analysts expect Valet Business Services to grow faster than the industry as a whole.

conclusion

Most importantly, there was no major change in sentiment, with the analysts reaffirming that the business is performing in line with previous earnings per share estimates. Fortunately, there are no major changes to revenue forecasts, and the business is still expected to grow faster than the broader industry. We note an increase in the price target, suggesting that the analyst believes the intrinsic value of the business is likely to improve over time.

Based on this idea, we think the long-term outlook for the business is far more relevant than next year's earnings. We publish forecasts from multiple Bullet Business Services analysts out to 2025, available for free on our platform here.

You can also see our analysis of Barrett Business Services' Board of Directors and CEO compensation and experience, and whether company insiders are buying stock.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.