April 16, 2024

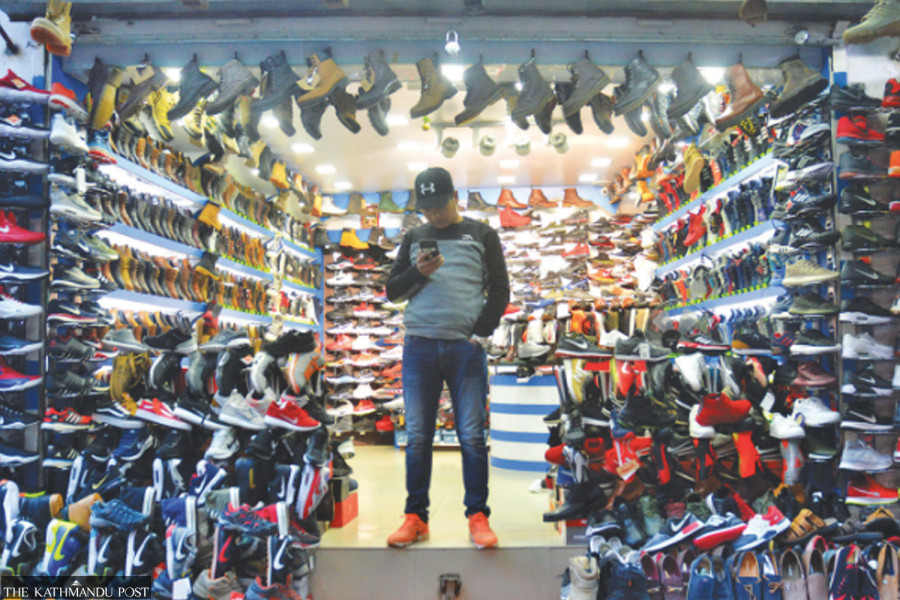

Kathmandu – “To-Let” signs hung in shops across the Kathmandu Valley have become a common sight over the past two years.

Shoppers say online stores that deliver goods and services to customers' homes have eaten into brick-and-mortar stores' huge market pie since the 2020 coronavirus pandemic.

Now it's the online shop's turn. The effects of the economic slowdown, which erodes people's incomes, have become more evident in online markets, with many businesses closing and employees being laid off.

Market players say the economic slowdown is hitting almost every sector, and e-commerce cannot be an exception.

The e-commerce sector has particularly grown post-pandemic, with most companies reporting 10x business growth.

Sastdeal, one of Nepal's largest domestic e-commerce companies, has gone bankrupt, resulting in the loss of 200 jobs.

“We closed three weeks ago after operating for a year and a half,” Sastodeal co-founder Amun Thapa said. “There is certainly no demand. Consumption has decreased dramatically.”

Sastodeal entered the market in 2011, providing an online shopping experience with 10 million users.

In June 2020, Dolma Impact Fund, the first international private equity fund, invested $1 million in Sastdeal.

The company has also entered into exclusive cross-border partnerships with India's Myntra and Flipkart.

“Looking at the current economic situation in the country, we thought it would be better to shut down for a while. There are no immediate signs of improvement,” Thapa said.

“However, there are also discussions about bringing in new management.”

Purchasing habits have changed significantly in Nepal, with tens of thousands of people shopping online. The country's transition from a cash-based economy to a burgeoning digital payments ecosystem has been a remarkable journey that has had a positive impact on financial inclusion and economic development.

The pandemic has accelerated the shift to online shopping. Nepal Rastra Bank, the central bank of Nepal, started keeping records of electronic payments from 2019-20.

But online fraud has begun to rise at an alarming rate, worrying tech-savvy customers who are increasingly turning to online shopping, especially in the wake of the coronavirus pandemic.

Many of the online shops that have sprung up in Nepal promise services they do not intend to provide.

Consumer rights activists say online fraud goes unchecked, leaving customers in the dilemma of whether to shop online or not.

On top of that, there is also the problem that delivery times are not on time and it takes time for online shops to process refunds.

Thapa also admitted that his customer base started to decline due to his inability to deliver on time. “Market competition was tough.”

The situation is not good for many other e-commerce players.

A year ago, Bjarke Mikkelsen, CEO of Alibaba Group subsidiary Dalaz Group, told Reuters the company would cut its workforce by 11% to prepare for “current market realities.”

He said the difficult market environment, including war in Europe, major supply chain disruptions, high inflation, increased taxes and the removal of essential government subsidies from the market, was behind the job cuts plan.

On February 27, Daraz Nepal announced layoffs.

“In recent years, we have worked to significantly improve cost control and operational efficiency. Despite our efforts to explore various solutions, our cost structure remains below our financial targets.” Daraz said in a statement.

“We are facing unprecedented challenges in the market and must act quickly to ensure our long-term sustainability and continued growth.”

Nepal's Daraz newspaper declined to comment.

The e-commerce bill, which is supposed to streamline the market, has been stalled in Congress for several months. This bill was originally drafted in 2021.

The lack of laws governing e-commerce is emboldening the wrong players. Many customers have complained about damaged products being delivered, receiving the wrong product, price discrepancies, and no return/refund policy.

Consumer rights activists and e-tailers say an e-commerce law is long overdue in Nepal. Lawmakers say they are being hijacked by business trends that allow unscrupulous market activity to flourish.

E-commerce entrepreneurs said the slowdown in economic growth has led to weak demand for fast-moving consumer goods (FMCG), fashion goods, accessories, electronic products and more.

“Overall online demand for products has decreased by 40%,” said Surakchya Adhikari, co-founder and chief operating officer of Thulo.com, another online shopping platform. Demand for luxury goods and electronic products has fallen to almost the bottom.

“People are also choosing cheaper products,” Adhikari said.

According to the 2021 Least Developed Countries Connectivity Report, e-commerce is related to a country's level of development, which partially explains the poor performance of least developed countries (LDCs).

According to the report, even in countries with high internet penetration rates, awareness of e-commerce platforms is low in least developed countries like Nepal.

At a recent panel discussion organized by Kantipur Media Group in Birgunj, panelists said the private sector has lost confidence and factories are closing down one by one.