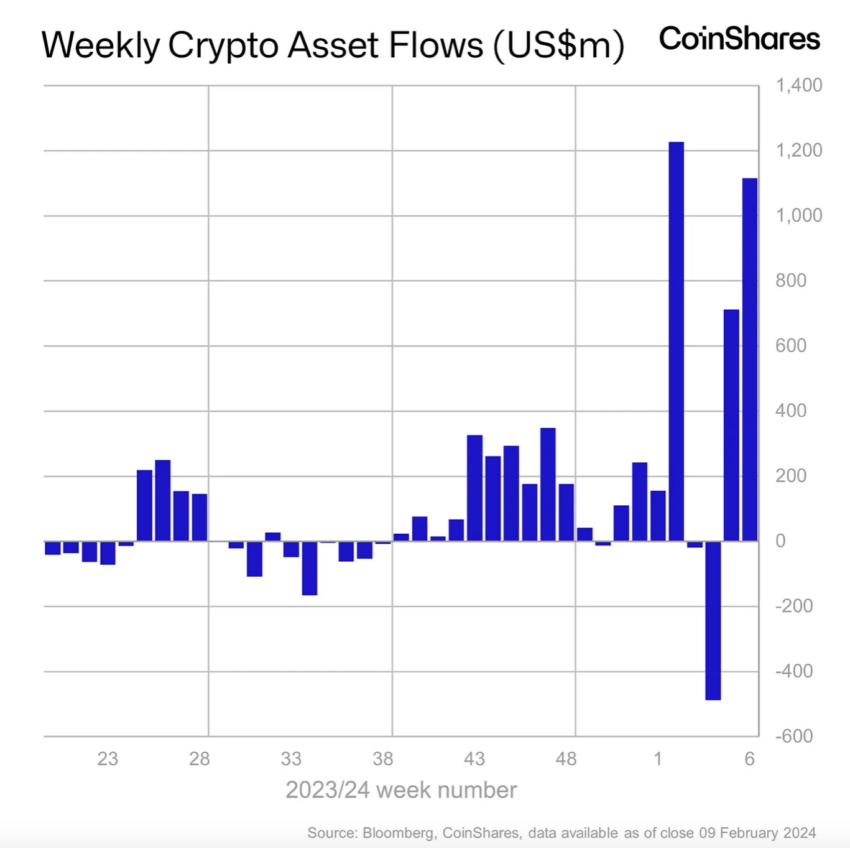

According to a recent report, crypto products received $1.1 billion in inflows last week, primarily in Bitcoin (BTC), accounting for 98% of total inflows. Ethereum (ETH) and Cardano were also observed to see a surge in momentum over a 7-day period.

Despite a bullish trend throughout the week, the report said $17 million was lost in Canada and $10 million was lost in Germany.

Cryptocurrency inflows surged last week

Bitcoin exchange-traded funds (ETFs) accounted for the majority of inflows last week, with total assets under management (AuM) reaching $59 billion, the highest level since early 2022, according to a recent report from CoinShares. It became clear.

“Digital asset investment products saw inflows of USD 1.1 billion, bringing year-to-date inflows to USD 2.7 billion. AuM stands at USD 59 billion, its highest level since early 2022.”

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

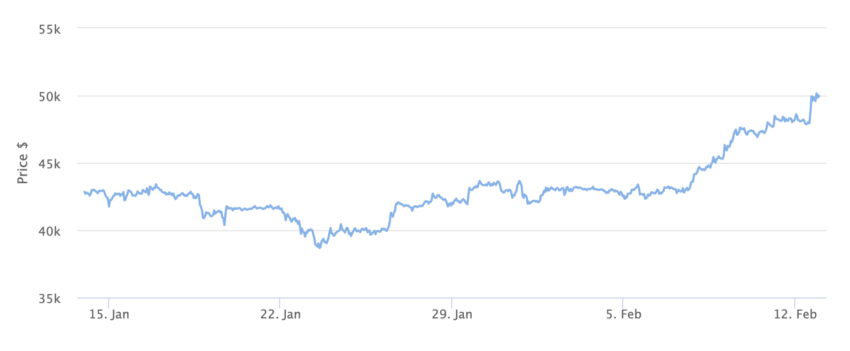

It was in November 2021 that Bitcoin reached an all-time high of USD 65,000.

Many crypto investors consider capital inflows as an indicator of future price trends.

Given that Bitcoin's once-in-four-year halving is looming in April, speculation is mounting about how this event will change the narrative around large capital inflows.

Recent factors affecting the virtual currency market

Investors are expecting prices to skyrocket immediately after the halving.

But despite the price surge and heavy inflows, Google search trends for Bitcoin itself are actually approaching a bear market.

Read more: Bitcoin Price Prediction 2024/2025/2030

On February 12th, BeInCrypto reported that engagement compared to ETF approval week was down approximately 80%, returning to bear market levels once again.

However, it may also be due to fewer people discovering Bitcoin for the first time due to mainstream media coverage and positive price news, compared to previous cycles when Bitcoin was still a relatively unknown asset. there is.

Earlier today, Bitcoin briefly surpassed the $50,000 price mark for the first time in two years. At the time of publication, the price of Bitcoin is $49,912.

However, the biggest players in the Bitcoin industry continue to accumulate more and more digital assets.

On February 11th, BeInCrypto also reported that Bitcoin had accumulated an additional 140,000 BTC in the past three weeks, injecting $6.16 billion into Bitcoin.

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.