Shutter Jack/RooM (via Getty Images)

Investment overview

Gorman Rapp Company (New York Stock Exchange:GRC) has been on a steady upward trend in recent months, with the stock up 10.91% since my last interview. One of the main improvements compared to the previous year was The company's recent report showed that it is able to charge higher prices for its products while maintaining roughly the same cost of goods. The market didn't necessarily react much when this report was released, partly because the beats up and down on expectations were also very small. I think the same traits we saw the last time we covered GRC are still present in late August. I'm covering the stock again to give my latest take on the stock for GRC, but in short, I'm still bullish on the business. I repeat my purchase rating.

Company segments

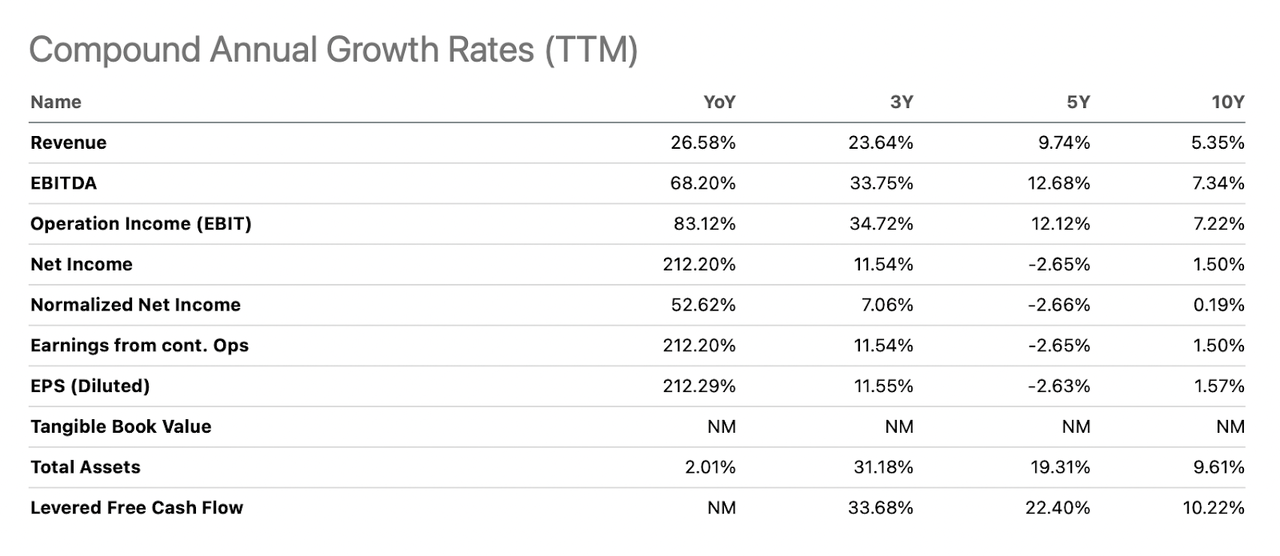

GRC has been in business for a very long time and is primarily focused on designing, manufacturing, and selling pumps and pump systems in the United States, which accounts for approximately 75% of the company's total sales. The remaining sales are international, with the majority coming from Europe and South America, which account for 28% and 19% of GRC's total international sales, respectively. GRC has a well-diversified footprint around the world, with sales growth of over 5.3% annually over the past three years, net income growth of over 11.5%, and consistent ratings over the past 10 years. is completed.

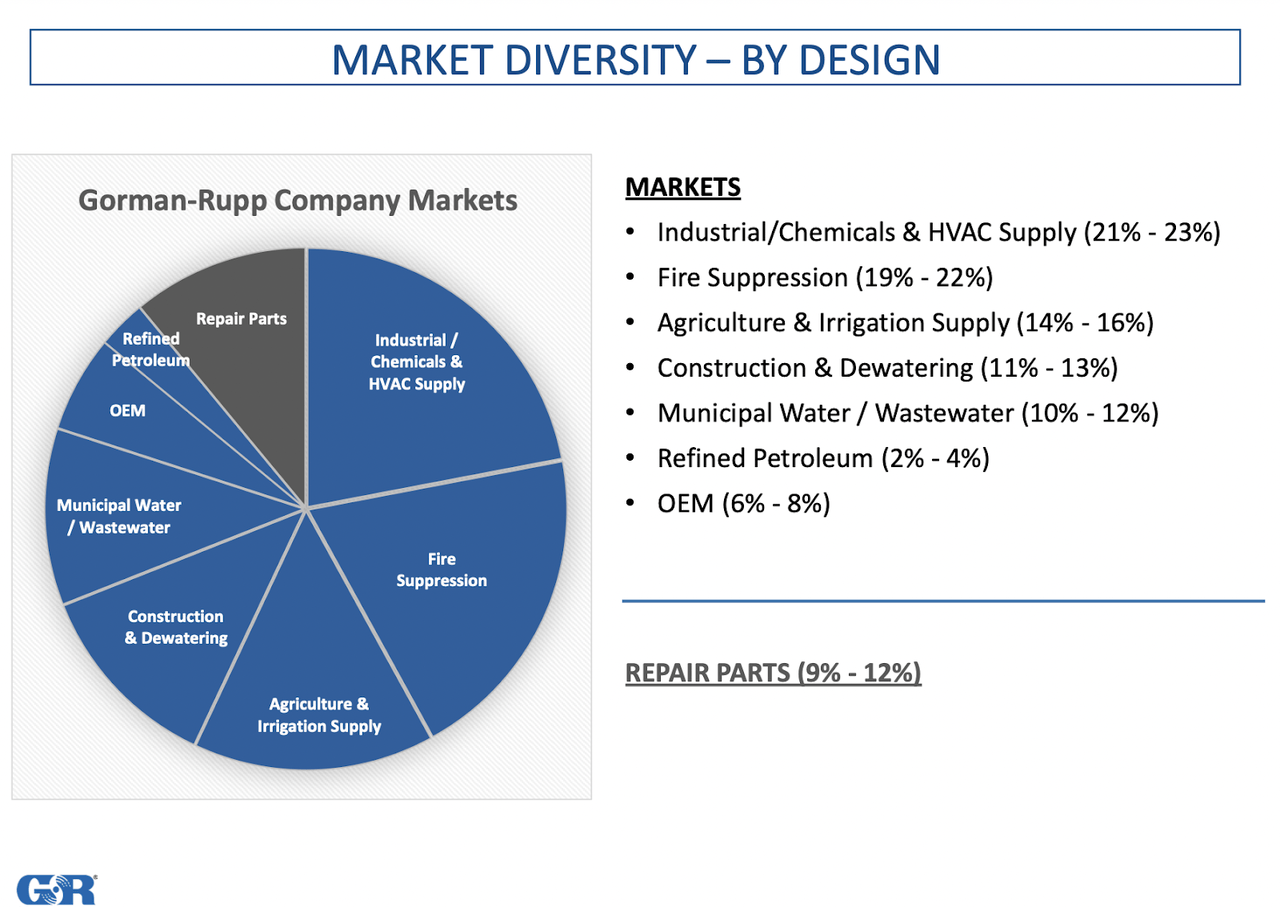

Market overview (presentation for investors)

GRC has manufactured a variety of pumps, including self-priming centrifugal pumps, magnetically driven centrifugal pumps, submersible pumps, and high-pressure booster pumps. These products are used in a variety of applications in water management, wastewater treatment, construction, industrial processes and the petroleum sector. The wide range of products offered means that GRC is also well diversified in terms of target markets, with industrial/chemicals and HVAC currently the largest supply and contributing to the company's overall revenue. 21% to 23%, and fire extinguisher supply 19% to 22%. Although these two markets are not necessarily high growth markets, we still see steady demand for GRC. Both are estimated to generate a CAGR of 2.5% to 6.5% over the next seven years.

Growth rate (find alpha)

Going forward, I expect GRC's average annual earnings growth rate to be slightly higher than its 10-year average of 5.35%. The price increases that GRC was able to implement are the reason I say this. The company is likely to continue on this trajectory, given the needs of some of the markets it works with and the trend toward continued high capital spending. For example, fire extinguishers are likely to become a major market for business over the next decade. Global warming will make wildfires, and fires in general, more prominent and more likely to occur. Building a robust defense strategy against this requires investing in and purchasing products manufactured by GRC.

Performance highlights

Income statement (income report)

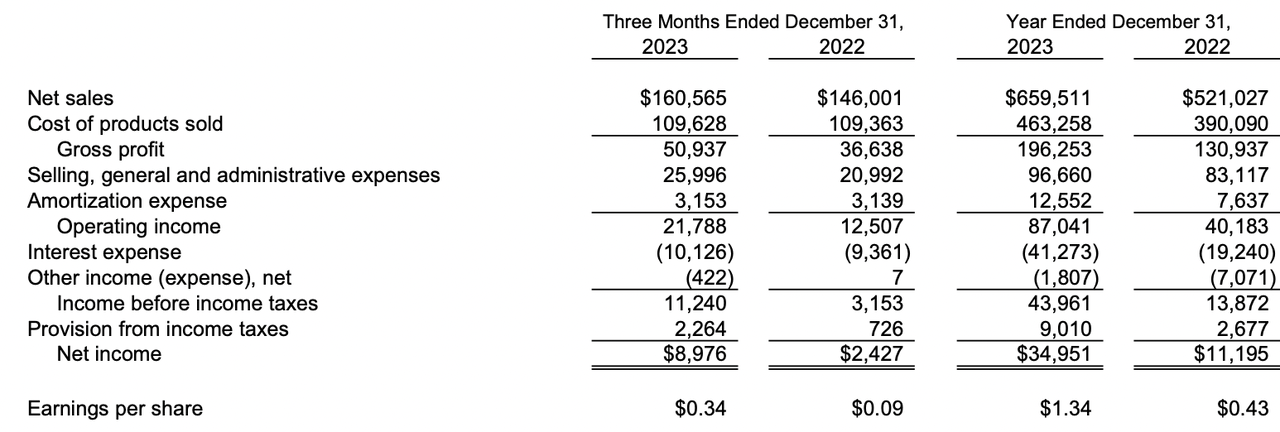

GRC's most recent earnings report was released not too long ago, and on February 2, GRC announced that both sales and bottom line were slightly above expectations. While our fourth quarter and fiscal year 2023 reports showed continued demand for the business, it's worth noting not only the impact of strong fill rate sales, but also the The increase in sales and price increases were also major contributors to the business's strong performance. GRC had full-year sales of $659 million and EPS of $1.34. Management noted in the report that the company's multi-market approach has helped it achieve continued growth even in a high-interest market environment. GRC's strength lies in the diversification of its business, and we will continue to aggressively pursue this goal.

Asset base (profit report)

On the balance sheet, I think GRC continues to improve and now has cash of $30 million and inventory at a manageable level of $104 million. Total assets also increased to $890 million, an increase of $18 million year over year. However, with debt at $382 million and a mangled bet, and EBITDA at TTM of $115 million, the ratio between the two is net less than 4, which is the threshold I tend to look for. Furthermore, long-term debt has actually decreased year over year, and GRC does not believe it needs to take on any more debt. If they can grow organically without debt, I see that as a very qualitative aspect of the business and also a reason for a higher valuation.

EPS estimates (we're looking for alpha version)

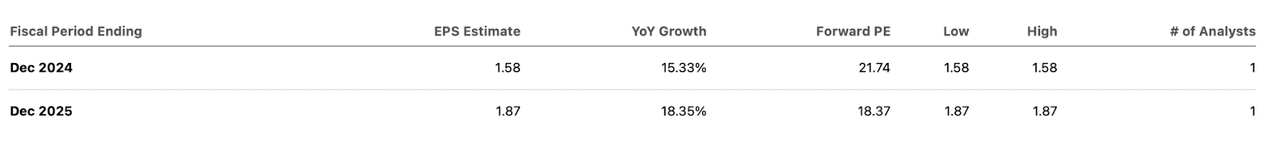

GRC's EPS growth is estimated to continue, but sales will likely slow over the next few years. I think the reason EPS is growing faster than sales is due to GRC's ability to continue to drive up prices like it has for the past four quarters, but I also think it's thanks to lower interest rates later this year. Long-term debt of $382 million equates to his TTM interest expense of $41 million. If this were cut in half, GRC's EPS would increase by more than his 50% and the valuation would be even lower. If interest rates go down and average around 2% in 2025, I think the net income will be between $45 million and $50 million in GRC, or $1.91 at the high end.

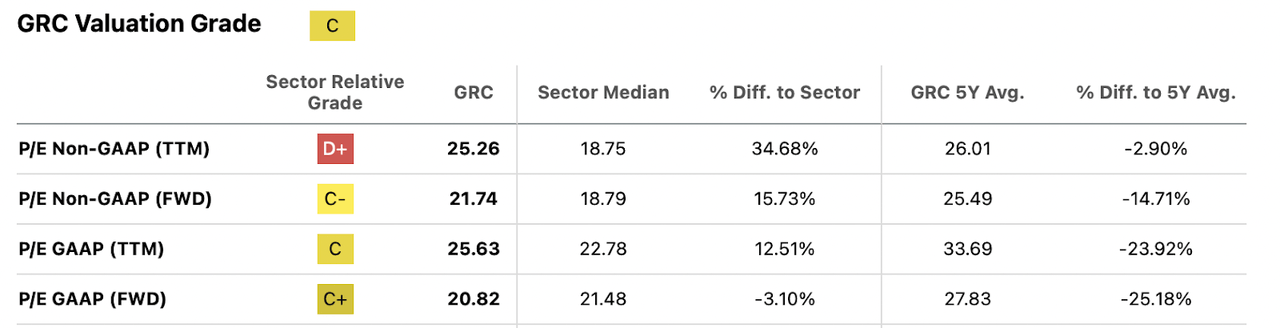

Corporate evaluation (in search of alpha)

Keeping in mind 2025 EPS and discounting GRC's five-year average P/E ratio by 20%, the price target is $38, or 13.3% upside for investors. Combined with the 2.1% dividend yield, I would argue that investors are getting a pretty satisfying return on his GRC. EPS guidance includes a reduction to his 2% in 2025, but takes into account organic his EPS growth that could result from GRC increasing the price of its products as it has in the past 12 months Please note that it is not. Overall, it paints the picture of a very solid business with continued EPS growth and an attractive price to enter a position.

risk

GRC's risks primarily relate to the continued strength of the market. We've seen how the company has remained resilient over the past few quarters, and I think GRC's revenue and orders will plummet if many companies cut back on capital spending.

Until now, sales have tended to be easily affected by the slump in the construction market. His two main markets I mentioned account for almost 50% of the business's total revenue, but agriculture and construction are also important markets for the business, together accounting for almost 30%. Over the past few years, lower domestic gas and oil production appears to have meant lower sales for GRC. Noting the strong capital spending of companies in the construction and industrial sector is a great way to gauge the prospects for GRC and other companies. While we believe the fundamentals remain strong at the moment, the broader economic downturn could change the situation, creating risks for both GRC and investors. GRC is valued as a company capable of significantly growing its EPS over the next few years, and trades at a 15.7% premium to the Industrials sector. There is also a risk that GRC will not achieve strong EPS growth, in which case the valuation will appear too high, creating the risk of a correction.

The last word

GRC is a company I've covered before, but since they announced their 2023 Q4 results just a few days ago, I thought it was time to cover it again. I think the results were solid. Other than continued pricing strength, I didn't notice anything major. The stock is up over 10% since my last article, and I see it continuing to do well, with over 13% upside potential for investors in 2024. I'll repeat the same rating as the first time, it's a buy.