apple Apple (AAPL) investors shrugged when the consumer electronics giant finally unveiled its artificial intelligence (AI) strategy on Monday, which it dubbed “Apple Intelligence.” But Apple shares soared on Tuesday as investors reconsidered the AI news.

X

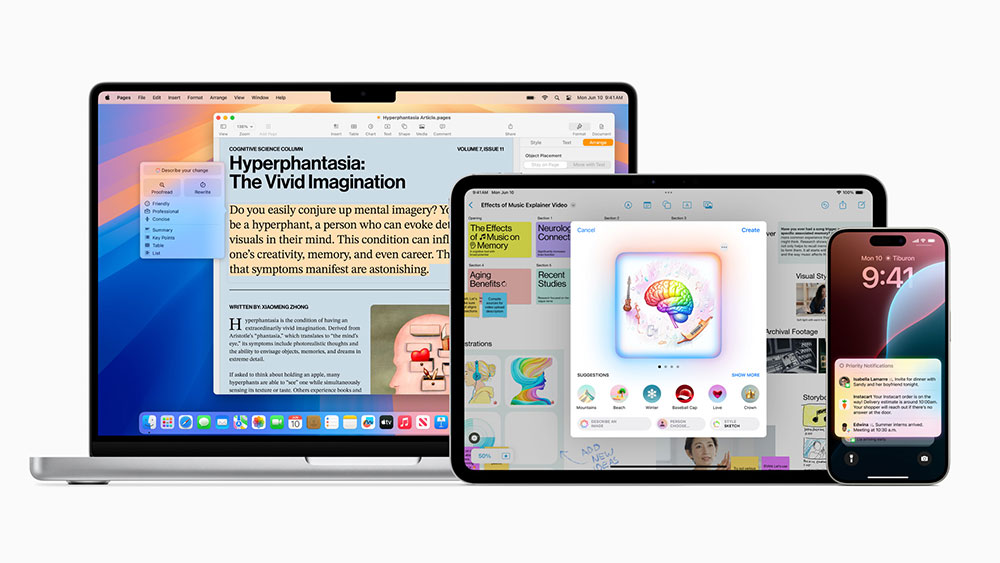

During its annual Worldwide Developers Conference keynote, Apple detailed its plans to add AI to its iPhones, iPads and Mac computers.

Apple's approach to AI includes both on-device and in-datacenter processing with a focus on privacy and security. The company uses its own AI models as well as third-party models, starting with ChatGPT from OpenAI.

Apple's AI services will be available this fall, but only on current iPhone 15 Pro models and Macs and iPads with M1 processors or later, with AI also planned for inclusion in the upcoming iPhone 16 devices and other new hardware.

But Wall Street analysts are divided on whether advances in AI will be enough to persuade consumers to upgrade to the new iPhone.

Apple shares hit buy point

On Monday, Apple shares fell 1.9% to close at 193.12. However, on the stock market today, Apple shares broke out of a cup base at a buy point of 199.62, according to IBD MarketSurge charts.

Apple shares rose 7.3% on Tuesday to close at 207.15.

Apple's announcement on Monday is just the first step in the company's generative AI strategy, TD Cowen analyst Krish Sankar said in a client note on Tuesday. After adding AI to its software platform this year, Apple will look to upgrade its semiconductors in 2025, he said.

Sunkar reiterated his buy recommendation on Apple shares with a $220 price target.

AI is a 'game changer' for Apple

Wedbush Securities analyst Daniel Ives said in a client note that Apple's foray into artificial intelligence is a “game changer” for the company. He said AI will drive Apple's next growth cycle over the next few years. He rates the stock an Outperform and has a $275 price target.

Ives predicted that “an AI-driven iPhone upgrade cycle will begin with the iPhone 16” later this year.

JPMorgan analyst Samik Chatterjee agrees, predicting that the iPhone upgrade cycle will begin with the iPhone 16 this fall and peak with the iPhone 17 in the second half of 2025. He rates Apple shares overweight and has a price target of $225.

In a note to clients on Monday, Chatterjee said the raft of new features announced will give many of the estimated 1.4 billion iPhone users a reason to upgrade, despite the lack of a “killer app.”

But other analysts were skeptical that Apple Intelligence would revive iPhone sales.

AI announcement described as “disappointing” and “insensitive”

KeyBanc Capital Markets analyst Brandon Nispel said in a client note that Apple's AI enhancements aren't compelling enough for average consumers to buy a new device.

Needham analyst Laura Martin called Apple's long-awaited AI strategy announcement “disappointing.”

“Nothing we heard during the WWDC keynote led us to believe that consumers will buy iPhones sooner than we currently expect,” Martin said in a note to clients on Tuesday. “GenAI was our greatest hope but has failed.”

She also said Apple appeared to be “deaf to Wall Street concerns” by waiting until later in the presentation to discuss AI.

“The stock price steadily declined as the 100-minute presentation progressed as retail investors had liquidity,” said Martin, who rates Apple shares a “buy” with a $220 price target.

No surprises in the WWDC presentation

Apple's WWDC keynote on Monday was a “news-selling event,” according to multiple analysts.

“Most of the announcements were communicated well in advance, leaving little room for surprise,” Daniel O'Regan, managing director of equity trading at Mizuho Securities, said in a client note on Tuesday.

O'Regan said the news, while expected, was “somewhat disappointing” given the rally in Apple's shares ahead of the event.

Siri is the key to Apple's AI

The centerpiece of Apple's AI strategy is an improved Siri digital assistant that responds to voice and text prompts. AI smarts allow Siri to work across apps and get information from Messages, Mail, Calendar, Photos and other apps. It can also summarize emails and web pages, transcribe phone calls and generate custom emojis and other images.

Apple's new AI features will be available only to “US English” users this fall, with support for other languages coming at a later date.

The North American market accounts for more than 30% of the iPhone user base, Morgan Stanley analyst Eric Woodring said in a client note on Tuesday, and about 25% of the world's population speaks English as either a first or second language, he said.

“Apple has made it clear that it wants to extend this functionality to new languages over time, which we see as key to broader adoption and device updates,” said Woodring, who rates Apple shares overweight with a $216 price target.

Follow Patrick Seitz on X (formerly Twitter). translator For more articles on consumer technology, software and semiconductor stocks, see here.

You may also like:

NVIDIA shares still have room to grow, analysts say

Microsoft and OpenAI team up to win AI race

AI boom boosts Taiwanese semiconductor sales

MarketSurge: Research, Charts, Data, and Coaching All in One Place

See stocks on the Leaders list that are nearing a buy point