Ngoc Mai, an online seller in Hanoi, has made VND800 million ($31,400) in revenue since 2022 but never reported it to tax authorities.

She recently received a notice to pay VND45 million in taxes and fines, of which the fine made up two-thirds.

The General Department of Taxation estimates that 3.1 million individuals and households are operating businesses, but many of them have yet to register their businesses or pay taxes.

Hanoi tax authorities collected taxes and penalties from 41 online sellers in the first quarter of this year.

It also monitors 6,510 individuals and small businesses for tax purposes.

Lawyer Nguyen Dinh Hiep said anyone selling goods or services online must register their business with authorities within 10 days.

Any delay could result in a fine of VND15 million, he warned.

Online sellers typically have to pay 1 percent value-added tax and 0.5 percent personal income tax, and can be penalized 0.03 percent per day for late payments, he said.

Some fear they could face hefty penalties for late tax payments on small sales and purchases made years ago.

Nam Anh from Hanoi sold some children's clothes online for VND600,000 in 2019 and is now facing a fine of VND4 million.

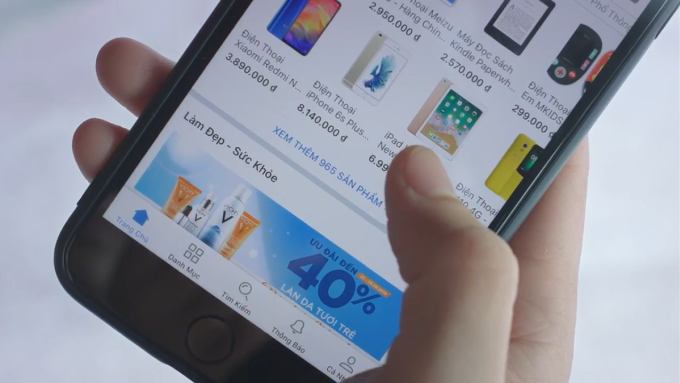

Tang Tang began selling on e-commerce platform Shopee in 2020 but did not register her business.

Her sales reached 100 million VND.

“I would like to register now but I am afraid the fines will be almost as much as the benefits.”

However, lawyer Hiep said merchants with annual sales of less than VND100 million do not have to pay income tax.

Last year, VND97 trillion in taxes were collected on e-commerce transactions, up 14 percent from the previous year.

Prime Minister Pham Minh Chinh recently ordered the Ministry of Finance to require e-commerce companies to provide digital invoices in an effort to strengthen oversight.