Coupang is back in the spotlight. The New York-listed South Korean e-commerce company, which acquired Farfetch in January, reported its first-quarter results this month, marking the first time that the financial statements included losses from the embattled London-based luxury marketplace. Coupang's quarterly revenue rose 23% to $7.1 billion, but net income fell 95% to just $5 million.

This wasn't the only news to spook investors. Shortly after revealing that profits fell short of analysts' expectations, Coupang confirmed local media reports that South Korean tax authorities were investigating financial flows between the company's Korean subsidiary and overseas affiliates owned by U.S.-based Coupang Inc. Though authorities have classified the investigation as “irregular,” a Coupang spokesman described the probe as a “routine tax investigation” rather than an investigation into “suspected offshore tax evasion.” Chosun Ilbo.

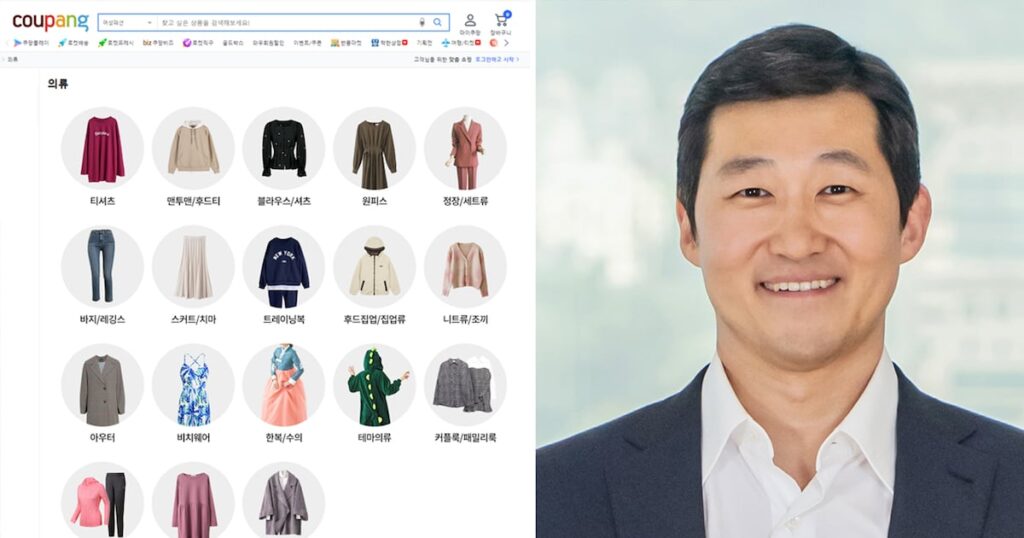

Coupang was portrayed as a “white knight” when it rescued Farfetch from the brink of bankruptcy with a $500 billion loan, but its luster began to fade as major luxury groups such as Kering ended their partnerships with the luxury market. After the acquisition, Farfetch's founder Jose Neves and eight other executives left, leaving Coupang CEO Beom Kim with the daunting task of getting Farfetch back on track.

The exodus has raised further concerns among investors about the future of Farfetch, which is owned by what many see as a mass-market platform unfamiliar with the nuances and complexities of the luxury industry. But Kim seems undeterred.

“We are already executing on our plan to self-fund Farfetch,” Kim said in a February conference call with analysts after Coupang's full-year earnings release, “and we think there are many paths to making this a worthwhile investment for shareholders.”

Ever since news of the deal broke six months ago, fashion industry insiders have been weighing in on the pros and cons of the alliance, but because so few outside of Korea have a deep understanding of the Coupang empire, few can offer an informed analysis.

What exactly does Coupang do?

Often referred to as the “Amazon of Korea” due to its size and domestic market position, Coupang is an e-commerce platform selling everything from mass-market fashion and beauty products to toys and home appliances, and offers a range of additional services such as quick commerce, online grocery store Rocket Fresh, food delivery platform Coupang Eats, video streaming service Coupang Play and digital payments platform Coupang Pay.

Coupang is registered in the US state of Delaware, but the majority of its operations are conducted in South Korea. The company was headquartered in Seoul until 2022, when it moved to Seattle following its listing on the New York Stock Exchange. As of a filing with the SEC, the company said that “more than 99% of our business is conducted in South Korea.”

Coupang's biggest rival in South Korea is Naver Shopping, the e-commerce division of web portal and search engine Naver. The two companies have been in a fierce battle over the past five years, with Coupang emerging victorious, according to Euromonitor International's 2023 report. Other companies vying for market share include Shinsegae Group's GMarket, Lotte's online shopping platform and SK Planet's 11Street.

Although the company has a strong presence in its domestic market, it has struggled to establish a strong presence in international markets such as Japan, where it ceased operations last year less than two years after launch. However, in Taiwan, Coupang has reportedly grown at a faster pace than its Korean operations in the first 10 months of operations. The company also provides support services in markets such as Singapore, mainland China and India.

Coupang entered the luxury market last year with the launch of Rocket Luxury, where customers can purchase beauty products from brands including Estée Lauder, MAC and Bobbi Brown through its Rocket Delivery service. Five months after that launch, Coupang announced its entry into the luxury fashion market through the acquisition of multi-brand online retailer Farfetch.

Coupang reported full-year operating profit of $473 million for fiscal 2023, a sharp turnaround from a loss of $112 million a year earlier. Revenue for 2023 increased 18% to $24.3 billion.

How did you grow up so fast?

Founder Beom Kim was born in Seoul in 1978 and moved to the US with his family when he was seven. The 45-year-old businessman dropped out of Harvard Business School after six months and founded Vintage Media Company, a magazine for college graduates, but sold it in 2009 and returned to Korea the same year.

Kim founded Coupang in May 2010 as a discount-focused service with Groupon-like features. But Coupang quickly evolved into a more traditional e-commerce platform that bought products directly from third parties and sold them to end customers. Kim wanted to transform the business into a logistics-driven online ecosystem.

The company's popularity has soared since it launched a subsidiary, Rocket Delivery, in 2014 to offer Coupang customers fast same-day and next-day delivery of their purchases, leading to an expansion of the platform's consumer goods offerings.

The company received a $1 billion investment from Japan's SoftBank the following year, and another $2 billion in 2018, at which point the company was valued at $9 billion. Other major investors included BlackRock, Sequoia Capital, and Fidelity Investments. At that point, the company had 25,000 employees.

Less than a year after its second round of investment, the company introduced Coupang Eats and Rocket Fresh. Over time, demand for Coupang's services has skyrocketed across all segments, leading the company to deliver over 3 million packages per day, far surpassing its competitors on that basis.

Its IPO on the New York Stock Exchange in March 2021 raised $3.4 billion in working capital.

What will Coupang gain from Farfetch?

Coupang is likely inspired by a wide variety of other mass-market e-commerce companies in Asia that have branched out into luxury fashion: Alibaba Group's Tmall and JD.com both have strong footprints in China with luxury-focused sub-platforms, while Rakuten and Zozo have more recently followed suit in Japan, moving upmarket in the luxury fashion space.

Whether the timing is coincidental or not, Coupang's acquisition of Farfetch puts the company in direct competition with Shinsegae Group's SSG.com in the Korean luxury sector. Less than a month after the Farfetch acquisition was announced, SSG opened South Korea's first official branded store for luxury e-commerce platform Net-a-Porter.

“Coupang is acquiring Farfetch, [its] “It will provide greater access to luxury brands,” said Pascal Martin, partner at OC&C Strategy Consultants.

“Online platforms like Coupang often find it difficult to build commercial relationships with luxury brands. Farfetch's greatest asset is its existing relationships with luxury brands, but it wasn't always this way. It took time for Farfetch to build trust with these brands. There was a lot of resistance in the beginning.”

Experts say there were other factors at play in the acquisition besides access to luxury goods: By adding Farfetch to its portfolio, Coupang would inherit a foothold in the U.S. and European markets and gain direct access to customers outside its existing Asian markets.

“Farfetch's customer base is primarily American, but truly global,” Martin said. “Coupang's customers today are primarily Korean, with a growing presence in other Asian countries.”

What are the chances that Farfetch will turn things around?

Meanwhile, “Coupang is attractive because it is large, growing and is also a multi-market player with Asia at its core, which is essential for the luxury sector in which Farfetch operates,” he added.

“[Coupang] “The company has strong logistics capabilities, an area where Farfetch is weaker in comparison, so there could be operational synergies that could benefit Farfetch's operations,” Martin explained.

Kim recently said Coupang remains focused on capturing the “enormous opportunities” in the Korean and Taiwanese retail markets and will “continue to make billions of dollars in capital investments over the next few years.”

But the Coupang-Farfetch deal comes at a time of growing skepticism about the future of the broader multi-brand luxury e-commerce sector, with well-known players like Matches closing and the fate of Yooke's Net-a-Porter still uncertain.

Farfetch investors are also concerned that Coupang could roll out promotional strategies on Farfetch that could further jeopardize the relationships with luxury brands that Farfetch has worked so hard to build over the years. “Coupang needs to be careful not to completely erode those relationships with brands,” Martin said.

But for now, Coupang's biggest challenge is to stem Farfetch's losses and ensure its long-term commercial viability. “Without cost reductions, there will be no recovery in performance. [and] “There is no opportunity for restructuring,” Martin warned.