Share of companies realizing international e-commerce global e-online (NASDAQ:GLBE) Shares rose on Monday after the company announced its first quarter 2024 financial results. As of 11:30 a.m. ET, Global-e stock was up just 6%, compared with a 20% jump earlier in the day.

Growth is faster than expected

Global-e's software allows companies to easily operate e-commerce businesses across borders. In the first quarter, the company's merchandise volume was $930 million, up 32% year over year and exceeding management's most optimistic guidance of $915 million.

Global-e's sales and adjusted earnings were slightly higher than expected, given that it has more business than expected. As a result, management modestly raised his 2024 guidance for both categories. Ultimately, I think it's this increased financial guidance that is why investors are rooting for Global-e stock to rise today.

Global-e is increasing profitability

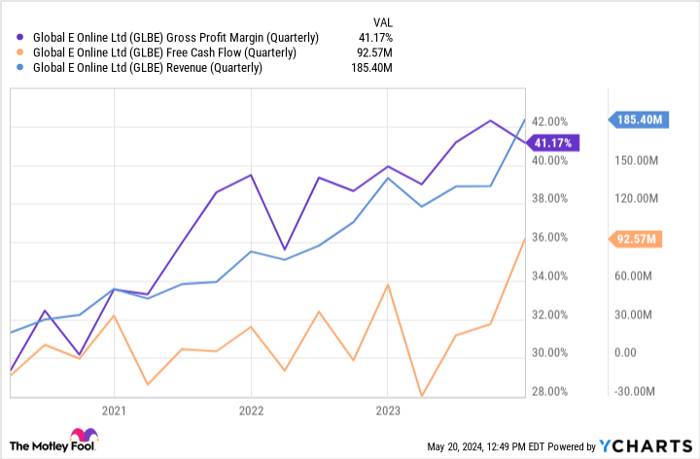

There are currently two particularly encouraging trends in Global-e's business. First, the company's gross profit margin has consistently increased as it has grown. As the graph shows, the same is true for free cash flow.

GLBE Gross Margin (Quarterly) Data by YCharts

That's how a software company like Global-e should be, but it's not always the case. Therefore, shareholders should be encouraged that the company is gaining operating leverage as it grows.

At the midpoint of management's revised guidance, Global-e expects sales to increase approximately 32% this year, thanks to several key partnerships. That's nothing to sneeze at. And if all these trends continue on their current trajectory, that bodes well for Global-e shareholders in the long term.

Should I invest $1,000 in Global-E Online right now?

Before purchasing stocks on Global-E Online, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Global-E Online wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

when to think about it NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, you have $566,624!*

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor The service is 4 times more The resurgence of the S&P 500 since 2002*.

See 10 stocks »

*Stock Advisor will return as of May 13, 2024

John Quast has no position in any stocks mentioned. The Motley Fool is affiliated with and recommends Global-E Online. The Motley Fool has a disclosure policy.