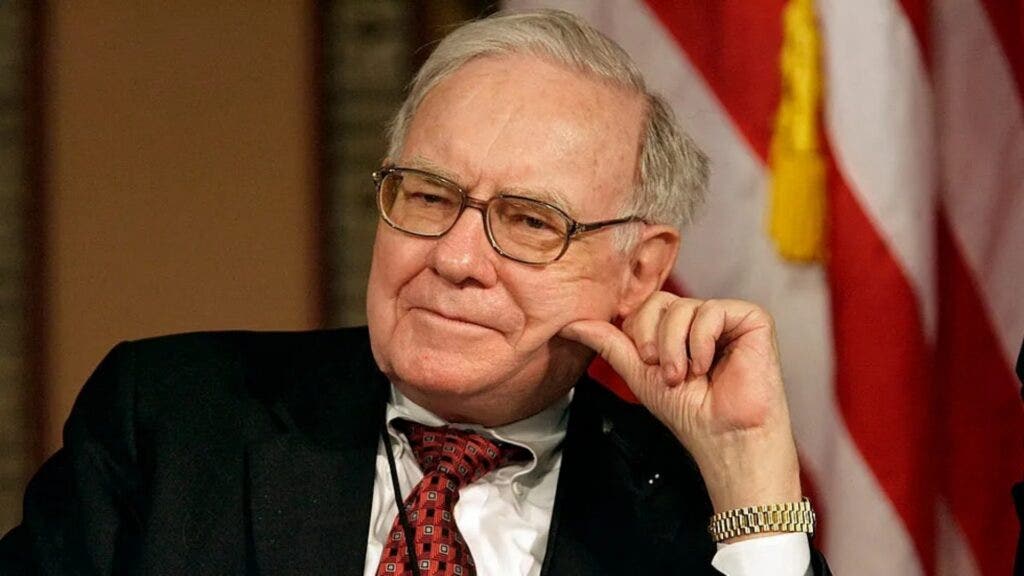

Warren Buffett is known for his shrewd business methods and tough negotiation tactics. his company, Berkshire Hathaway Companyis one of the world's largest conglomerates and investment companies. The company has acquired dozens of companies over the years and has more than 75 wholly owned or controlled subsidiaries. The company owns billions of dollars worth of stock in companies such as: Apple., Amazon.com Inc., mastercard corporation others.

Through decades of shrewd investing, smart acquisitions, and business acumen, Buffett has amassed an incredible portfolio and company value of nearly $1 trillion. A longtime Nebraska resident, Buffett earned a bachelor's degree in business administration from the University of Nebraska-Lincoln in 1950. Some 60 years later, he returned to the university and gave a speech to his graduating class, talking about things like: The most valuable things he learned at an early age helped push him to where he is today.

Do not miss it:

Buffett said there is nothing more important to understand than accounting.

“People ask me what they should take in business school,” Buffett said. “You have to understand accounting. It's a language. If you're in business and you don't understand accounting, it's like being in a foreign country without knowing the language.”

Not only is this a valuable tool for understanding the business world, but Buffet says it has brought in “a lot of money.”

Trend: Invest like a millionaire. a special occasion to Epic Games invests in $17 billion gaming empire.

Accounting is not an abstract principle used only in textbooks. Buffett tells how he used accounting to buy popular home manufacturing company Clayton Homes in early 2003.

Most acquisitions require extensive due diligence, meetings, negotiations and other processes before the acquisition takes place. While many of these things are likely still being done, Buffett gave a unique billion-dollar example of how he used accounting to acquire businesses.

“We agreed to it for $1.7 billion. I made that deal over the phone without ever meeting with the people there,” Buffett said. “But I read the 10-K, the 10-Q, and the annual report and understood it well.”

Buffett has acknowledged using his accounting skills and Securities and Exchange Commission disclosures of target companies to analyze companies and gauge their quality based on decisions revealed in filings.

While there was likely a lot of due diligence and meetings that followed these calls, the accounting process allowed Buffett to make a multi-billion dollar acquisition decision with minimal upfront costs. Even so, I was confident that I was making a significant profit from the acquisition.

Continue reading:

“The Active Investor's Secret Weapon'' Step up your stock market game with the #1 News & Everything else trading tool: Benzinga Pro – Click here to start your 14-day trial now!

Want the latest stock analysis from Benzinga?

The article Warren Buffett used the 'most important thing' in business to pay $1.7 billion for his business without ever meeting the founders appeared first on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.