Disney (DIS) said Tuesday that a key part of its streaming business was profitable for the first time, but the company expects the division to perform poorly this quarter, sending its stock down as much as 8% premarket.

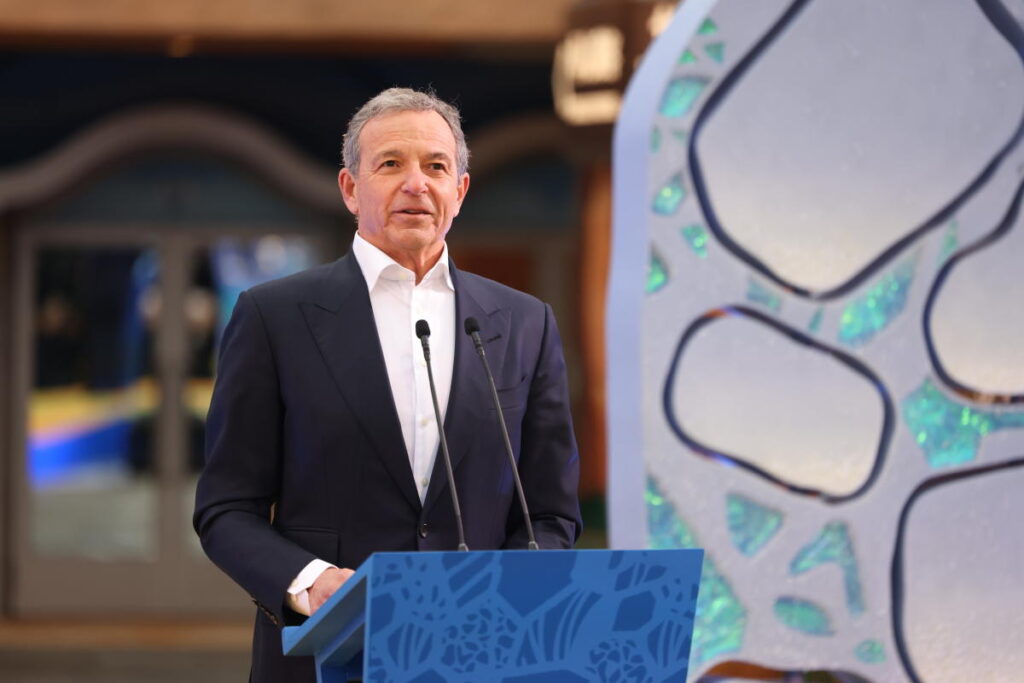

The forecast highlights Disney's challenges in achieving sustained profitability in streaming, a key priority as its linear TV business declines. Overall, investors have become more bullish on the stock in recent months due to CEO Bob Iger's recent turnaround plan. The company also just won a high-profile proxy battle with activist investor Nelson Peltz.

In Disney's second-quarter fiscal year, the direct-to-consumer (DTC) portion of its entertainment division, which includes Disney+ and Hulu, had operating income of $47 million, compared with a loss of $587 million in the year-ago period.

The company said it expects its entertainment division's DTC results to be in the red in the third quarter due to the loss of its Indian brand Disney+ Hotstar.

Additionally, not all of Disney's streaming services were profitable in the second quarter. Direct-to-consumer losses, including ESPN+, totaled $18 million, compared to a reported loss of $659 million in the same period last year. Disney expects to be fully profitable from streaming by the fourth quarter of this year.

The company reported second-quarter adjusted earnings per share of $1.21, significantly higher than the $1.10 expected by analysts compiled by Bloomberg and the $0.93 that Disney reported for Q2 2023. exceeded the dollar.

Revenue of $22.1 billion met consensus estimates and exceeded the $21.82 billion the company reported in the year-ago period.

“Soft guidance for entertainment streaming next quarter could dampen enthusiasm,” KeyBanc analyst Brandon Nispel said in a post-earnings note. “It strengthens Mr. Iger's contention that we are in the middle of it.”

The company also raised its full-year adjusted profit growth forecast to 25% from 20%. However, Disney took a hit after merging its Star India business with Reliance Industries and reported more than $2 billion in impairment charges.

Q2 highlights: streaming, park business

In the second quarter, the media giant reported an increase in Disney+ subscriber additions as Charter cable subscribers began receiving the free subscription service as part of their package.

Disney added more than 6 million core Disney+ subscribers in the second quarter, beating its own guidance and easily beating the Bloomberg consensus estimate of 4.7 million.

The company also sees average revenue per user (ARPU) remaining strong amid recent price hikes and a crackdown on password sharing. ARPU increased $0.44 sequentially to $7.28.

“I think the price of streaming services will definitely go up over time because we have “The content we offer is worth paying for.”

Meanwhile, the park business once again achieved strong quarterly results, with domestic operating income jumping from $1.52 billion in the same period last year to $1.61 billion.

The company attributed the decline to higher performance at Walt Disney World Resort and Disney Cruise Line, partially offset by lower performance at Disneyland Resort.

Overall, Disney said third-quarter operating income for its Experiences business should be “approximately similar to last year,” but said it expects “solid operating income growth” for the full year.

Was there one segment that underperformed this quarter? Sports.

ESPN's domestic operating income fell 9% year over year to $780 million, due to lower affiliate revenue and a decline in subscribers as more consumers cut the cord. The company also blamed the results on increased production costs due to College Football Playoff (CFP) programming.

Domestic linear network revenue for the entertainment division was similar, falling 11% year-over-year in the quarter. The segment's operating profit decreased by 18%. This is due to a decline in advertising revenue as well as a decline in affiliate revenue.

In February, Disney announced upcoming joint venture partnerships with Fox and Warner Bros. Discovery to strengthen its sports streaming capabilities. The company is also working on another sports streaming platform for ESPN, which is expected to debut in fall 2025.

In sports, Disney has reportedly agreed to increase its media rights deal with the NBA from $1.5 billion to $2.6 billion. The NBA's current rights agreement expires at the end of next season.

alexandra canal I'm a senior reporter at Yahoo Finance. Follow her on X @allie_canal, LinkedIn, Email alexandra.canal@yahoofinance.com.

Click here for the latest earnings report and analysis, earnings whispers and expectations, and company earnings news.

Read the latest financial and business news from Yahoo Finance