KeyBank 2024 Small Business Monthly Flash Poll

Confidence among small business owners could be one of the first indicators of U.S. economic resilience

Vermont Business Magazine KeyBank, which has offices throughout Vermont, announced the results of its 2024 Small Business Month Survey. Overall, small business owners are concerned about the future of the economy, but remain resilient, perhaps because they have learned how to weather past economic downturns.

Public opinion poll results

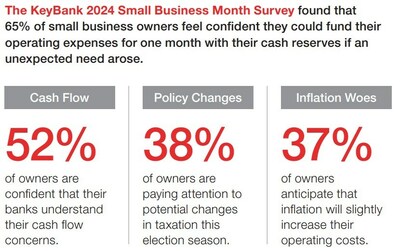

- unexpected funds – 65% of small business owners are confident that they have one month's worth of cash reserves to cover operating expenses should an unexpected business need arise.

- Key concerns regarding fraud – Fraud is a growing concern for small business owners, with their biggest concern being payment fraud, including fraudulent transactions and fraudulent electronic funds transfers (44%).

- survive the economic climate – 37% of small business owners expect their operating costs to increase due to inflation in the next 12 months.

- Possibility of policy changes – During an election year, small business owners are focused on taxes (38%), employment and labor laws (25%), and health care policy (25%).

- economic protection – To protect their businesses in a volatile economy, business owners are implementing cost-cutting measures (32%), increasing cash reserves (30%) and exploring alternative financing options (22%) ).

- Rely on the bank – More than half of businesses (52%) are confident that their bank understands their cash flow concerns.

“Running a business is no easy task,” said Mike Walters, President of Business Banking at KeyBank. We are facing a situation.” “Their resilience is a testament to how they have weathered years of financial instability, and by maintaining strong confidence they can strongly weather the last stages of inflation and remain on the path to economic growth. Masu.”

Small business owners are often the first to feel the effects of inflation and economic fluctuations, and are optimistic about their businesses despite remaining economic challenges. KeyBank’s 2024 Small Business Survey We found that 65% of small business owners are confident that their cash on hand will cover a month's worth of operating expenses, even if an unexpected need arises.

Still, 37% of business owners expect operating costs to increase slightly due to inflation, and 27% expect operating costs to increase significantly over the next 12 months. The biggest challenges small business owners expect this year are fluctuations in sales/revenue (35%), delayed payments from customers/customers (29%), and high overhead costs (28%).

Despite these concerns, small business owners are adapting well and taking precautions to protect their businesses, their employees and their communities. They are already implementing cost-cutting measures (32%), increasing cash reserves (30%) and exploring alternative financing options (22%). Their actions, one of the leading indicators of U.S. fiscal resilience, could be the first sign that the economic environment is improving.

“Running a business is no easy task,” said Mike Walters, President of Business Banking at KeyBank. We are facing a difficult situation.” “Their resilience is proof that they have weathered years of financial instability, and maintaining strong confidence will enable them to strongly weather the last phase of inflation and remain on the path to economic growth. .”

Leaders leverage banking relationships for education and resources

Banks are at a pivotal time to help their small business customers address cash flow and business operations concerns, and small business owners are turning to their banks for advice. The top three pieces of advice owners received were cutting costs by reducing discretionary spending (34%), establishing an emergency fund (22%), and diversifying revenue streams by introducing new products and services (20%) .

More than half (52%) of small business owners are confident that their banks understand their cash flow concerns, but almost 20% are unsure whether their banks do and This indicates that there is an opportunity for those involved to expand their relationships.

“In times of uncertainty, trusted advice from qualified professionals can be a lifeline for business owners, but many may be unaware of the advice and solutions that a relationship with a banker can provide.” '' Walters said. “Banking services extend beyond traditional checking and savings accounts to include cash flow and credit solutions. Maintaining strong relationships with banks can lead to uniquely customized strategies. there is.”

KeyBank, an SBA financial giant, has provided more than $4.5 billion in small business loans and lines of credit. To learn more about KeyBank opportunities and programs for small businesses, please visit: key.com/small-business. KeyBank offers a variety of tools, including: KeyBank Small Business Check-in, KeyBank Small Business Financial Review And that business cash flow calculator.

Fraud will be monitored

As business operations become primarily digital, fraud has become the biggest worry among small business owners, with fraudulent transactions and unauthorized electronic fund transfers (44%) followed by identity theft. (37%), payment fraud such as malware is their top concern. Ransomware attacks (28%) and phishing and email scams (27%). Fraud prevention has become a focal point for small business owners, who stay alert to evolving fraud techniques and take precautions to thwart potential future attacks. Learn more about the advice KeyBank offers business owners. Business security and risk management.

How to survive the US presidential election

Election season brings a period of uncertainty for Americans and increases the political noise for business owners, as potential policy changes can directly impact their businesses. While preparing for uncertainty, the top policy changes most executives are focused on are tax policy (38%), employment and labor laws (25%), and health care policy (25%). Small businesses are key to the nation's economic health, and while they are confident at this time, business owners are paying close attention to potential policy changes.

methodology

This survey was conducted online by Survey Monkey. 1,983 respondents between the ages of 18 and 99 who reside in the United States and own or operate a small business with annual gross revenue of less than $10 million completed the survey in March 2024.

About key bank

KeyBank (NYSE: key) roots go back nearly 200 years to Albany, New York. Headquartered in Cleveland, Ohio, KeyCorp is one of the nation's largest bank-based financial services companies with approximately $187 billion in assets as of March 31, 2024.

Key provides deposits, loans, cash management and investment services to individuals and businesses in 15 states under the KeyBank National Association name through a network of approximately 1,000 branches and approximately 1,200 ATMs. Key, also known as KeyBanc Capital Markets, provides sophisticated corporate and investment banking products, including mergers and acquisitions advice, public and private fixed income and equity, syndicates and derivatives, to the middle market in selected industries across the United States. We offer a wide range of services to companies. For more information, please visit:https://www.key.com/. KeyBank Member FDIC.

___________________________________

i Source: Statistics released by the U.S. Small Business Administration (SBA) in October 2023 regarding the total amount of loans approved through the SBA's 7(a) loan program during the federal fiscal year ending in October 2023.

SOURCE CLEVELAND, May 2, 2024 /PRNewswire/ — KeyBank

Support great journalism by visiting our archives and getting exclusive features like our award-winning profiles., Subscribe here!