International Business Machines Corporation (NYSE:IBM) shareholders are probably a little disappointed, as the company's stock fell 2.5% to $165 in the week after its latest Q1 results. Sales were US$14 billion, roughly in line with analyst expectations, but statutory earnings per share (EPS) were lower than expected, coming in at US$1.72, 32% above expectations. Earnings earnings are an important time for investors as they can track a company's performance, see what analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. With this in mind, we've gathered the latest statutory forecasts to find out what analysts are expecting for next year.

Check out our latest analysis for International Business Machines.

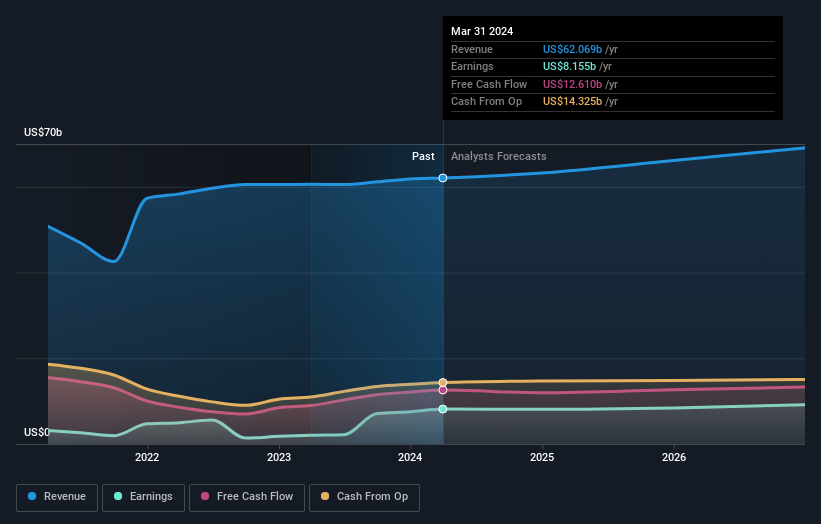

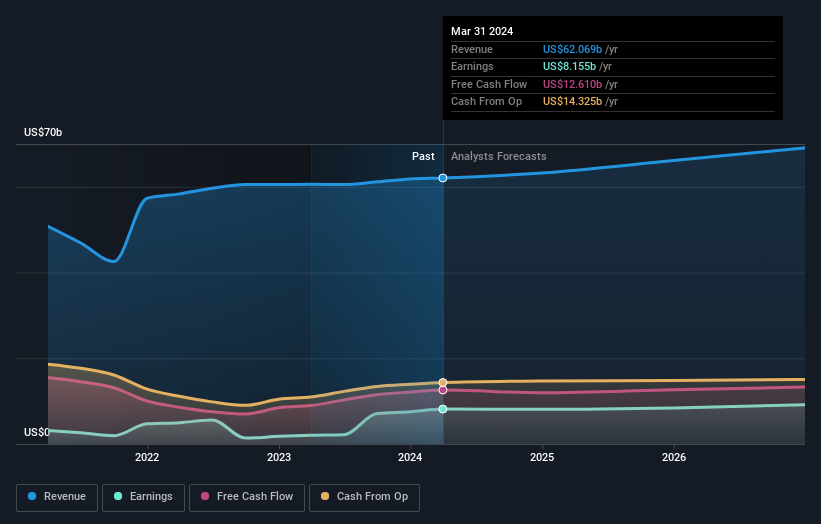

Taking into account the latest results, International Business Machines' 18 analysts now expect revenue in 2024 to be US$63.2b, about the same as the previous 12 months. Statutory earnings per share are expected to decline 2.6% to US$8.65 over the same period. Ahead of this report, analysts had modeled sales of US$63.6b and earnings per share (EPS) of US$8.66 in 2024. The analyst consensus appears to be that nothing changes these results. Their view of the business, assuming no significant changes to estimates.

Analysts reaffirmed their $181 price target, indicating the business is performing well and in line with expectations. The consensus price target is just the average of the individual analyst targets, so it's useful to see how wide the range of underlying forecasts is. Currently, the most bullish analyst values International Business Machines at $215 per share, while the most bearish values it at $130. There are certainly some different views on the stock price, but in our view the range of estimates is not wide enough to suggest that the situation is unpredictable.

One way to get more context about these forecasts is to compare them to their past performance and to the performance of other companies in the same industry. For example, International Business Machines' growth rate is expected to accelerate significantly, with revenue projected to grow by 2.5% on an annualized basis until the end of 2024. This is significantly higher than the historic decline of 5.0% per year over the past five years. Comparing this to analyst forecasts for the industry as a whole, we see that industry revenue (in aggregate) is expected to grow 9.5% annually for the foreseeable future. Therefore, while International Business Machines' revenue growth is expected to improve, it is still expected to grow slower than the industry.

conclusion

Most importantly, there's been no major change in sentiment, with the analysts reaffirming that the business is performing in line with previous earnings per share expectations. Happily, the analysts also reaffirmed their earnings forecasts, suggesting things are in line with expectations. However, our data indicates that International Business Machines' earnings are expected to be worse than the broader industry. There was no actual change to the consensus target price, suggesting that the intrinsic value of the business has not changed significantly at the latest estimate.

Based on this idea, we think the long-term outlook for the business is far more relevant than next year's earnings. We have his forecasts from several International Business Machines analysts out to 2026, available for free on our platform here.

For example, International Business Machines requires you to be aware of risks. 1 warning sign I think you should know.

Have feedback on this article? Interested in its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.