Share this article

![]()

![]()

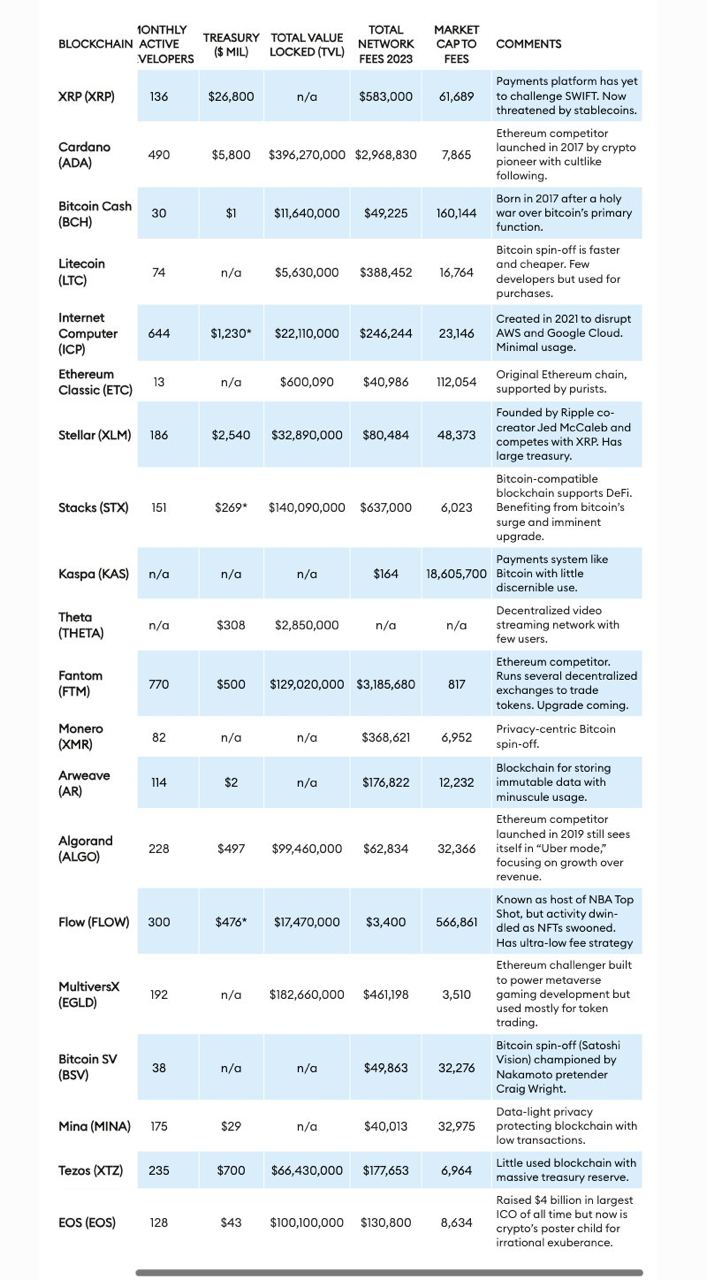

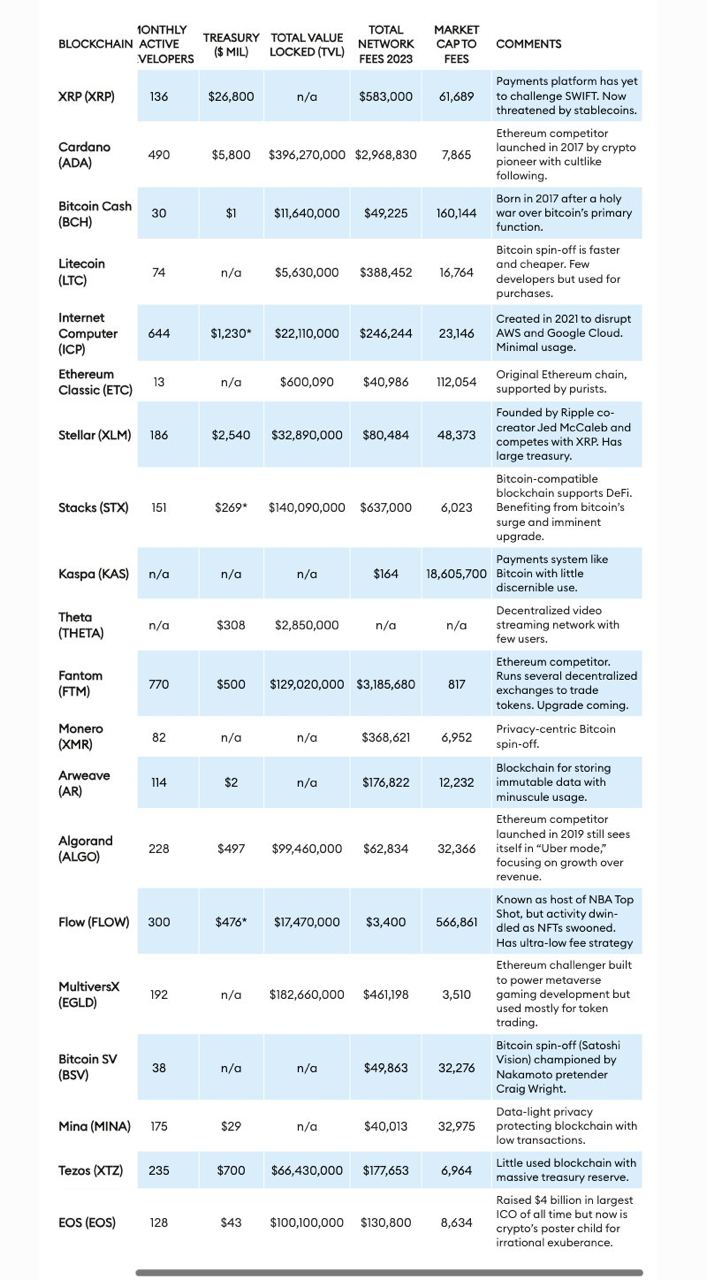

The number of tokens exceeds 14,000 and the cryptocurrency market capitalization reaches $2.4 trillion, but more is not necessarily better. Forbes has identified a group of 20 cryptocurrencies called “zombie blockchains.” These maintain high market valuations even though they have shown little or no real-world utility or user adoption.

The list includes well-known names such as Ripple (XRP), Cardano (ADA), Litecoin (LTC), Bitcoin Cash (BCH), and Ethereum Classic (ETC), all of which meet the terms It is characterized by the fact that it continues to operate and trade without meeting the requirements. practical purpose.

The term “zombie blockchain” refers to blockchain projects that exist but show no signs of life in terms of utility or substantial user base, similar to the undead.

These tokens continue to exist, and sometimes even prosper economically, not because they have achieved any technical or practical goals, but through speculative trading and large initial capital.

Forbes analysts noted that Ripple's XRP was initially designed to compete with the SWIFT banking network by facilitating fast international bank transfers with minimal fees. However, SWIFT cannot be destroyed and currently relies heavily on speculative trading for its high market value, with minimal revenue from actual network usage.

“While largely useless, the XRP token still boasts a market value of $36 billion, making it the sixth most valuable cryptocurrency,” the analyst explains.

“Ripple Labs is a crypto zombie. Its XRP tokens continue to be actively traded, worth around $2 billion per day, but for no purpose other than speculation.” “A better way to send money internationally has emerged through chains, especially stablecoins like Tether, which is pegged to the US dollar and has $100 billion in circulation,” they added.

Similarly, hard forks such as Litecoin, Bitcoin Cash, Bitcoin SV, and Ethereum Classic are worth over $1 billion, but are underutilized and serve more as speculative investments than practical uses. says Forbes magazine.

These tokens often arise from disagreements within the developer community and persist due to their historical significance or the inertia of speculative trading.

“Liquidity is what keeps these zombies alive,” analysts quoted the VC statement as saying.

Analysts also pointed out that “Ethereum killers” such as Tezos (XTZ), Algorand (ALGO), and Cardano (ADA) are a major part of this phenomenon.

Despite technological advances and significant valuation, these tokens have not seen large-scale adoption or activity. Although they offer advanced transaction processing capabilities, these capabilities are difficult to translate into widespread acceptance or developer involvement.

“Some blockchain zombies seem to be making transactions based solely on the popularity of their creators. Another competitor to Ethereum, Cardano, whose co-founder Charles Hoskinson is a co-founder of Ethereum It was founded in 2017 after a falling out with its founder Buterin.'' Analysts suggested that speculative interest in Cardano is primarily driven by the founder's prominence.

The Forbes report also notes the lack of governance and financial accountability mechanisms at these blockchain entities, which operate without regulatory oversight or obligations to shareholders. This will lead to efforts to assess its viability and financial health, as seen in cases like Ethereum Classic, which continues to be actively traded despite suffering major security breaches. I'm making it complicated.

Share this article

![]()

![]()