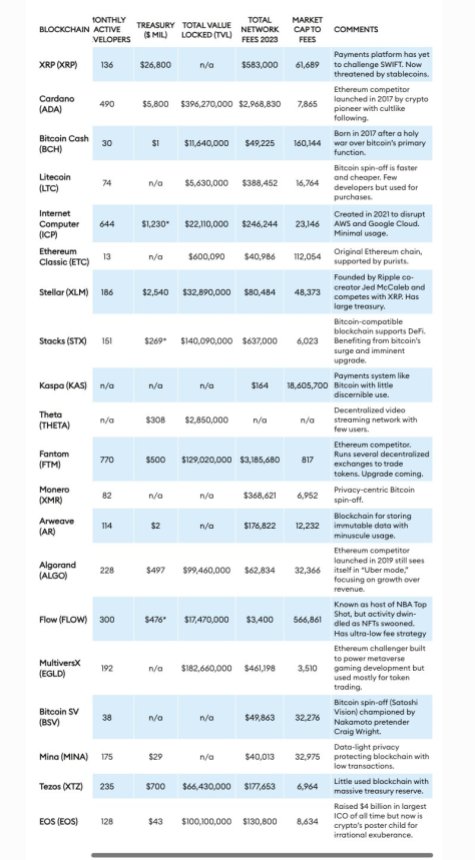

In a controversial report, Forbes published a list of 20 “Crypto Billion Dollar Zombies.” layer 1 (L1) Token. The news outlet defines it as a crypto asset that has a significant valuation but has “limited uses other than speculative trading.”

These cryptocurrencies and projects include Ripple, XRP, Ethereum Classic (ETC), Tezos (XTZ), Algorand (ALGO), Cardano (ADA), and more.

Featured XRP and Ethereum Classic

Ripple Labs, the company that developed XRP, attracted attention as a famous cryptocurrency zombie. Despite XRP's active trading volume of approximately $2 billion daily, Forbes claims that the token's primary purpose remains “speculative” and “lacks any meaningful utility.” .

However, Ripple Labs and XRP are not alone in this regard. According to Forbes, 50 blockchain, excluding Bitcoin (BTC) and Ethereum (ETH), currently trade at a value of over $1 billion, and at least 20 of them are classified as “functional zombies.” Despite their “limited user base,” these 20 blockchains have a combined market value of $116 billion.

According to Forbes, an example of a “functional zombie” is Ethereum Classic, which maintains the distinction of being original. Ethereum chain.

ETC has a market value of $4.6 billion, but will generate less than $41,000 in fees in 2023, raising questions about the viability of blockchain for news organizations.

Another crypto project featured in the Forbes report is Tezos, which raised $230 million through an initial coin offering (ICO) in 2017.

Tezos' XTZ token currently has a market capitalization of $1.2 billion.However, blockchain fees are income In February 2024, it was $5,640, and for all of 2023, it totaled just $177,653.

Algorand, once touted as the “Ethereum killer” for its ability to process 7,500 transactions per second, faces similar challenges.

Despite having a market capitalization of $2 billion and a Treasury holding of $500 million, Algorand earned $63,000 in blockchain transaction fees throughout 2023. For Forbes, this calls into question its actual adoption and usefulness.

Crypto “zombie” blockchain

Forbes categorizes zombie blockchains into two groups. Spin-offs and direct competitors of established blockchains. Bitcoin And Ethereum.

Spinoff zombies include Bitcoin Cash (BCH), Litecoin (LTC), Monero (XMR), Bitcoin SV (BSV), and Ethereum Classic.

These blockchains, valued at a total of $23 billion, were reportedly born out of “disagreements” between programmers over their governance and direction. original chain.

Forbes points out that when such a conflict occurs, a hard fork occurs, resulting in a new network that shares the same transaction history as its predecessor. The agency claims its market value “often exceeds” its real-world usage.

Overall, this report highlights the growing disconnect between the valuation of a particular project in the crypto industry and its actual utility and usage. Therefore, Forbes calls these projects “zombies.”

Featured image from Shutterstock, chart from TradingView.com