Arthur Hayes, co-founder and former CEO of crypto exchange BitMEX, provided X with a detailed analysis of the economic situation in the United States and its potential impact on the crypto market. Renowned for his incisive commentary and deep understanding of both traditional and digital finance, Hayes' insights have garnered attention from industry insiders.

Why will the cryptocurrency bull market return on Monday?

in post, Hayes noted a significant increase in the Treasury and General Account (TGA), which he attributed to an influx of approximately $200 billion from tax revenue. “As expected, tax revenues have added approximately $200 billion to the TGA,” Hayes said, setting the stage for a broader discussion of the potential impact on financial markets.

Hayes then turned his focus to Treasury Secretary Janet Yellen's future decisions regarding the management of the TGA. In a tone that was both respectful and grim, he outlined several potential scenarios that could have a significant impact on market liquidity. “Forget about the May Fed meeting. Announcements on refunds for Q2 2024 will be released next week. What kind of games will be played? [Janet] “There are several options for Yellen to play,” Hayes said.

First, he suggested that Yellen could begin injecting $1 trillion in liquidity into the economy by “zeroing the TGA and halting bond issuance.” This strategy involves using funds accumulated in the TGA for federal spending without issuing new debt, which directly increases the money supply.

Second, Hayes estimated that liquidity would increase by $400 billion by “moving more borrowing into Treasury bills and removing funds from RRP.” This strategy involves the Treasury selecting shorter-dated bond products that increase bond sales while charging lower interest rates than usual. This could lead to funds being withdrawn from the overnight reverse repo market, where financial institutions temporarily store surplus funds.

According to Hayes, if Yellen decides to stop issuing long-term Treasuries and increase bill issuance while depleting both the TGA and RRP accounts, the combination of these two approaches would result in “$1.4 trillion. This could lead to a liquidity injection. “The Fed has nothing to do with it. Yellen is a bad guy and she deserves all the respect she deserves,” Hayes said. This statement underscores his belief that the Treasury Department's actions have a significant impact on Federal Reserve policy in the current economic climate.

Hayes predicted that such actions could lead to a bullish reaction in the stock market and, more importantly, a rapid acceleration of the cryptocurrency market. “If any of these three options occur, we would expect an increase in stock prices and, most importantly, a re-acceleration of the crypto bull market,” he explained.

The implications of such a fiscal strategy are significant. Increased liquidity typically makes low-yield investments such as bonds less attractive and encourages the pursuit of higher returns in riskier assets such as stocks and cryptocurrencies. Additionally, a shift in market sentiment to “risk-on” could lead to significant capital inflows into the crypto space, which is seen as a volatile but high-growth investment frontier.

In conclusion, Hayes' analysis suggests that next week could be important for market watchers as the refund announcement takes place on Monday, April 29th. His perspective, based on deep financial expertise, points to the potential for significant changes in U.S. fiscal policy that could ripple through global markets. For crypto investors, these developments can signal significant developments and highlight the need for vigilance and preparation in response to new economic signals.

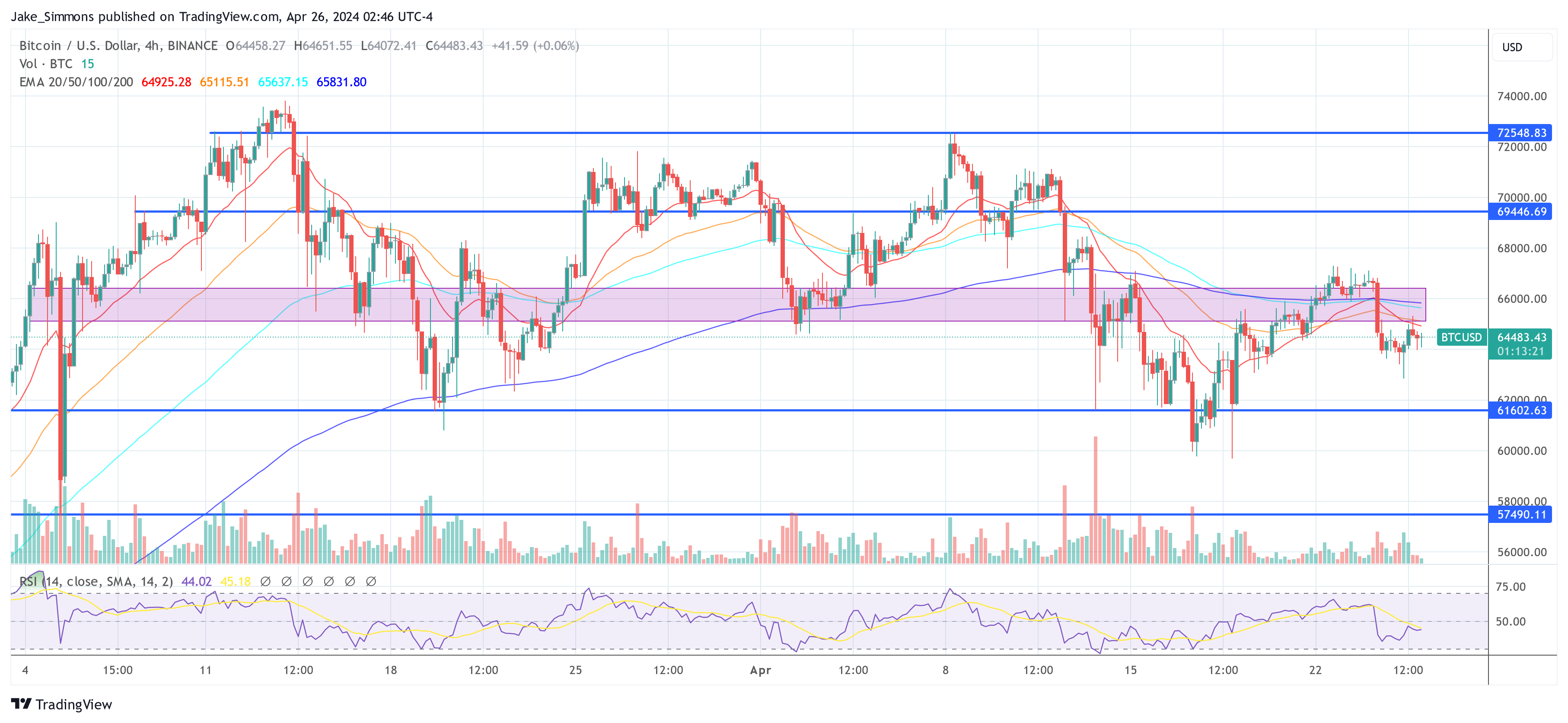

At the time of writing, BTC was trading at $64,483.

Featured image from Shutterstock, chart from TradingView.com