After the Bitcoin halving, US crypto stocks rose 20%, driven by the broader market rally.

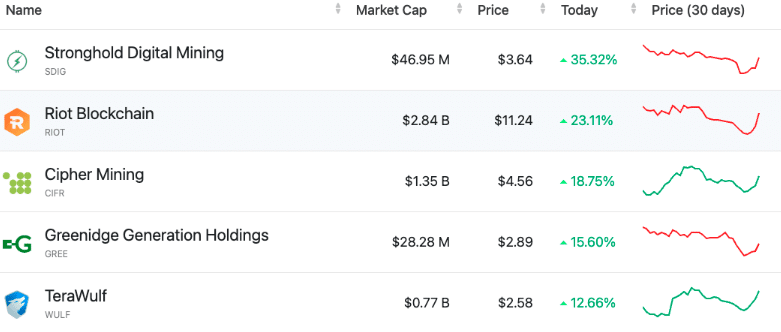

Top gainers on April 22 were Marathon Digital (MARA), CleanSpark (CLSK), Riot Platforms (RIOT), Cipher Mining (CIFR), and Hut 8 (HUT), all with over 20% growth. I recorded it. SDIG (Stronghold) topped the ranks with his 35.3% increase, followed closely by Riot with his 23% increase.

The Valkyrie Bitcoin Miner ETF (WGMI), which includes mining stocks and chipmakers like NVDA, also rose 11%. The profits from mining the currency were not as low as originally thought, as the mining reward was halved to 3.125 BTC per block.

Investment analysts attributed the 1.1% and 0.8% gains in the Nasdaq Composite and S&P 500 to tensions in the Middle East and upcoming earnings reports from tech companies, but long-term risks remain. I believe that These include inflation, rising bond yields, and the possibility of Fed interest rate adjustments.

As a result, the price of Bitcoin itself also increased by 4.2% after the halving, reaching $66,620. Notably, Coinbase and MicroStrategy also benefited from positive developments, while crypto market bulls supported the market's bullish sentiment.

Also read: Impact of Bitcoin halving: $206 million drained from blockchain stocks