Global UK Corporate Wellness Market

DUBLIN, April 22, 2024 (Globe Newswire) — The UK Corporate Wellness Market – Forecast 2024-2029 report has been added. ResearchAndMarkets.com Recruitment.

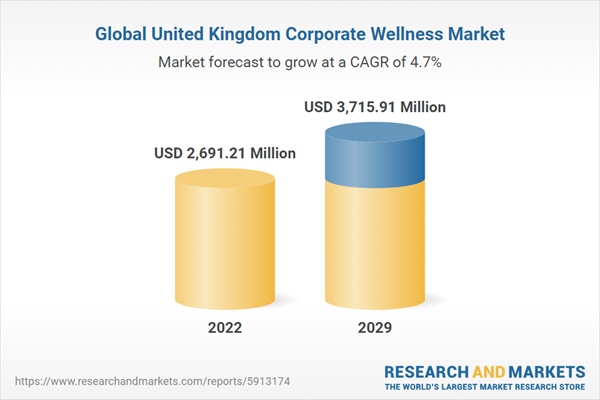

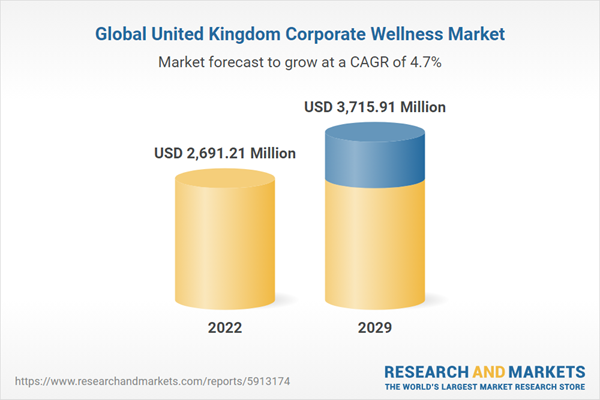

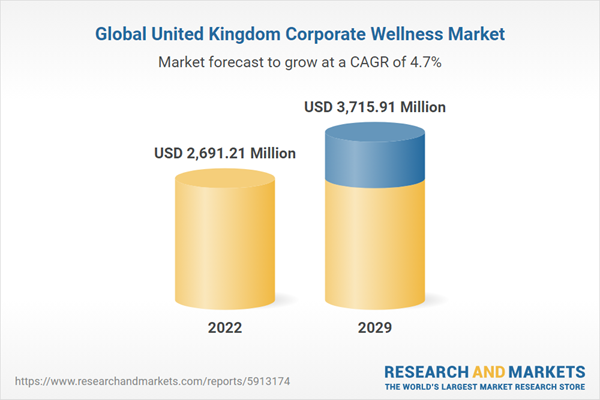

The UK corporate wellness market is expected to grow at a CAGR of 4.72% during the forecast period, thereby increasing the market size by 2029 from the initial market size of USD 2.69 billion recorded in 2022. is expected to reach USD 3.71 billion.

The UK corporate wellness market is experiencing significant rapid growth due to several key factors, including the prevalence of chronic diseases such as obesity and diabetes. This has led to increased healthcare costs for businesses and higher absenteeism rates for employees. To address these challenges, companies are turning to wellness programs as a strategic investment to reduce costs and improve overall productivity. Around 9.1 million people in the UK will be living with a serious illness by 2040, according to forecasts from health.org.uk, further underscoring the urgency of proactive measures in the corporate wellness sector. It has been. Additionally, there is a growing awareness of the interconnectedness between employee well-being and performance, highlighting the importance of a holistic approach to health within the workplace.

Additionally, companies are recognizing the value of mental health support in the overall well-being of their employees. Wellness programs often include stress reduction through mental health counseling and the benefits of mindfulness training to help employees manage anxiety and improve overall mental resilience. Mental health and smoking have become major issues for the UK in recent years. For example, in the UK, approximately 8.7% of respondents to the Opinion and Lifestyle Survey (OPN), representing approximately 4.5 million adults, said they used e-cigarettes daily or occasionally as of 2022. This shows an increase. According to 2021 data, 7.7% of individuals reported using e-cigarettes daily or occasionally. In line with this trend, UK companies are introducing comprehensive wellness programs that include a range of services. These may include yoga classes, chronic disease management, mental health counseling, physical therapy, and more. Of note are proactive approaches to addressing specific health concerns, such as programs designed to help individuals quit smoking or receive nutritional counseling. Incorporation of diverse wellness products will increase the need for growth in the corporate wellness market.

Smoking cessation and increased stress drive market growth

Long working hours, tight deadlines, and conflicting demands prevalent in the workplace have a negative impact on employee health, causing physical and mental health problems. This not only leads to decreased productivity but also increased absenteeism. Increasing competition in professional fields is putting undue stress on employees and disrupting the delicate balance between work and personal life. A striking example of this challenge is evident in Champion Health's 2023 Workplace Health Report, which reveals a significant increase in the number of people experiencing moderate to high levels of stress among UK employees. is revealed. The report shows that this will increase from 67% in 2022 to 76% in 2023, highlighting the rising stress levels faced by employees. This stress phenomenon is intricately related to people's smoking habits. In 2022, approximately 12.9% of individuals over the age of 18 in the UK, approximately 6.4 million people in total, reported smoking cigarettes. In the same year, the proportion of current smokers was highest among those aged 25 to 34 (16.3%) and lowest among those aged 65 and older (8.3%). Among men, 14.6% of men were smokers, compared to 11.2% of women.

Many medical studies suggest a link between smoking and stress, and nicotine dependence can worsen stress levels. Smokers describe distinct daily mood patterns in which they experience normal mood while smoking, but feel unwell between cigarettes. This complex relationship highlights the challenges of dealing with stress and smoking simultaneously. In response to these challenges, organizations like the National Center for Smoking Cessation Training (NCSCT) have emerged. This social enterprise is dedicated to supporting the implementation of effective, evidence-based tobacco control programs and smoking cessation interventions. These initiatives are being delivered through local smoking cessation services and in partnership with NHS colleagues and aim to address the complex interplay between workplace stress, smoking habits and the overall health of the workforce. Masu.

Additionally, the UK corporate wellness market is expected to grow due to the increasing prevalence of chronic diseases such as diabetes and obesity brought about by fast-paced lifestyles. Furthermore, 76% of workers experience moderate to high or high levels of stress, and 33% say stress negatively impacts their ability to work. Recently, organizations have focused on promoting mental and physical health of their employees and this is expected to have a positive impact on the market growth.

Major developments in the market

-

April 2023 – ACAS publishes new guidelines for employers on stress management, as 33% of UK workers feel their company does not deal with work-related stress effectively. Acas hired YouGov to survey UK workers about their perceptions of their company's effectiveness in dealing with work-related stress. Additionally, the survey found that 34% of workers think their workplace is good at managing stress, while 23% are not sure. According to the March ACAS survey, three in five workers (63%) said they were feeling stressed due to rising costs of living.

Market segmentation:

By type:

By company size:

By region:

-

England

-

wales

-

Scotland

-

Northern Ireland

Key attributes:

|

report attributes |

detail |

|

number of pages |

78 |

|

Forecast period |

2022-2029 |

|

Estimated market value in 2022 (USD) |

$2,691.21 million |

|

Projected market value to 2029 (USD) |

$3,715.91 million |

|

compound annual growth rate |

4.7% |

|

Target area |

England |

Main topics covered:

1.First of all

1.1. Market overview

1.2. Market definition

1.3. Scope of research

1.4. Market Segmentation

1.5. Currency

1.6. Assumptions

1.7. Base year and forecast year timeline

1.8. Key benefits for stakeholders

2. Research method

3. Executive summary

3.1. Main findings

3.2. Analyst view

4. Market dynamics

4.1. Market drivers

4.2. Market constraints

4.3. Porter's Five Forces Analysis

4.4. Industry value chain analysis

4.5. CXO perspective

5. UK Corporate Wellness Market by Type

5.1. Introduction

5.2. Weight management and fitness

5.3. No smoking

5.4. Stress management

5.5. Others

6. UK Corporate Wellness Market by Company Size

6.1. Introduction

6.2. Small

6.3. Medium

6.4. Big

7. UK Corporate Wellness Market by Region

7.1. Introduction

7.2. England

7.3. Wales

7.4. Scotland

7.5.Northern Ireland

8. Competitive environment and analysis

8.1. Key players and strategic analysis

8.2. Market share analysis

8.3. Mergers, Acquisitions, Agreements and Collaborations

8.4. Competitive Dashboard

9. Company profile

For more information about this report, please visit https://www.researchandmarkets.com/r/r6lmp8.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900