Cryptocurrency traders in China are thriving despite the country's strict measures against mining and digital currency trading.

In 2020, China was an active player in the crypto market, accounting for over 75% of the global Bitcoin (BTC) mining hashrate. All that changed after the government cracked down on all cryptocurrencies. But recently, regulations appear to be loosening slightly as investors seek out promising new assets.

Chinese Bitcoin traders remain a significant force in Bitcoin trading. Their participation in the recent crypto sell-off is motivated by market price fluctuations rather than new restrictions imposed by Chinese regulators.

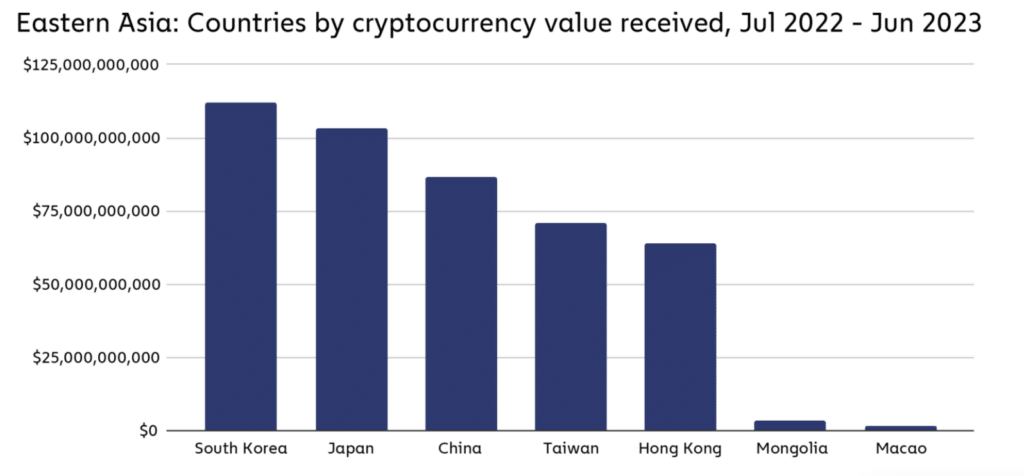

Despite ban, China trades with billions of dollars

According to Chainalysis, from July 2022 to June 2023, China's cryptocurrency market processed $86.4 billion in cryptocurrency trading volume. Large retail transactions between $10,000 and $1 million account for 3.6% of total transactions, nearly double the global average.

Chainalysis experts speculate that the Chinese government may be stepping up efforts in cryptocurrencies following recent events in Hong Kong, with speculation that Hong Kong could become a testing ground for such efforts. states that it is increasing.

How to get around the restrictions

Despite crypto trading being banned in China from 2021, investors are returning to cryptocurrencies due to losses in the Chinese stock market over the past three years, Reuters reports. Dylan Lan, a financial executive in Shanghai, calls Bitcoin “a safe asset like gold.”

In early 2023, after noticing the downturn in China's economy and stock market, Lan began moving some of his funds into cryptocurrencies.

Although officially banned, cryptocurrency trading is still available in China. Citizens continue to trade digital tokens like Bitcoin on platforms like OKX and Binance, or through over-the-counter methods. Another option is to purchase cryptocurrencies using a foreign bank account.

Various payment methods

China's crypto ban has prompted investors to manage their funds more creatively. As reported by Reuters, Dylan Lunn, for example, used an ATM card from a small rural bank to purchase cryptocurrencies through unofficial dealers. He kept his transactions below 50,000 yuan ($6,978) to avoid attention from authorities.

Traders have found various ways to transfer cryptocurrencies, including cash and bank transfers. Cities like Chengdu and Yunnan province have become hubs for these traders, offering a respite from central government scrutiny concentrated elsewhere.

According to the Wall Street Journal, Chinese investors are also turning to social networks such as WeChat and Telegram for crypto trading. They use these platforms to bypass the need for centralized exchanges and connect with other people within specialized groups.

In regions where enforcement is less stringent, physical trading of digital assets is widespread. Traders often gather in public places such as cafes or laundromats to exchange wallet addresses and conduct transactions through cash or banks.

Hong Kong

Hong Kong also offers savings opportunities, as Chinese citizens are given the right to buy $50,000 in foreign currency annually, which some use to buy cryptocurrencies on the Hong Kong market.

As China's $135.7 trillion real estate market continues to struggle, more people may soon turn to cryptocurrencies to try to catch up. Despite government efforts to prop up the sector, which was once a key driver of the world's second-largest economy, the country's real estate market is set to decline in 2023, with new home prices set to decline by the most in nearly nine years. finished.

An anonymous Hong Kong cryptocurrency exchange executive told Reuters that mainland investors are entering the cryptocurrency market almost every day. China's economic downturn has made “mainland investment risky, uncertain and disappointing, which is why people are looking to allocate their assets overseas.”

And it's not just individual investors. Chinese brokers and other financial institutions are also starting to enter the crypto market. The need for growth opportunities on the mainland led them to explore cryptocurrency business in Hong Kong.

“If you are a Chinese broker facing a downturn in the stock market, weak IPO demand, and other business contraction, you need a growth story to tell your shareholders and board of directors.”

Anonymous Hong Kong Cryptocurrency Exchange Executive

Fintech platforms such as Ant Group's Alipay and Tencent's WeChat Pay have also made it easier for citizens to invest in cryptocurrencies. This will allow users to convert RMB into stable digital coins at dealers and use them to trade cryptocurrencies on various exchanges.

According to Chainalysis, ties between China and Hong Kong are becoming increasingly close, and Hong Kong's growing status as a crypto hub could indicate that the Chinese government is shifting gears towards digital assets, or at least its approach to cryptocurrencies. Some speculate that this may be a sign that they are becoming more open.

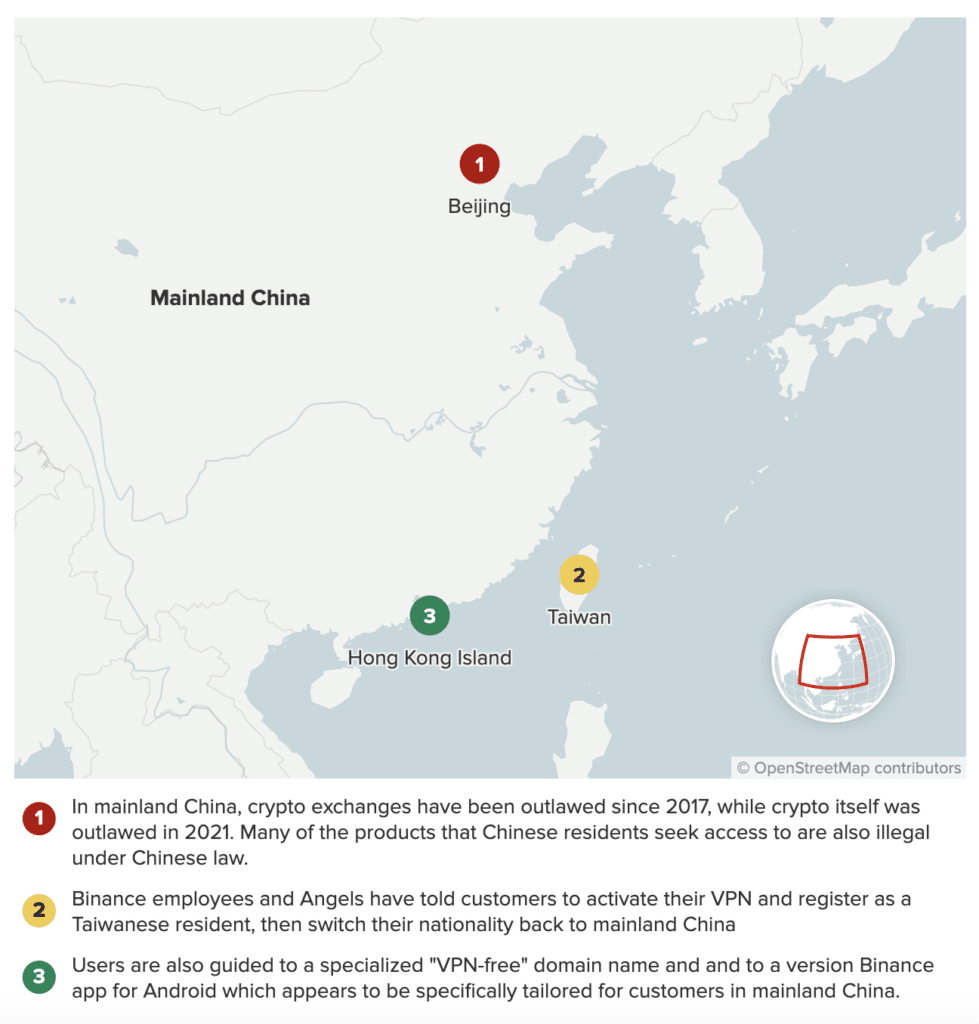

Incorrect geolocation

Some users saved their accounts on trading platforms, used VPNs to bypass geo-restrictions, and continued to use their accounts after the ban. In May 2023 alone, the turnover of Chinese traders on Binance will reach $90 billion, which is about 20% of the total. According to CNBC, exchange employees advised users from China to bypass KYC checks.

A report last year revealed that some traders opened crypto accounts using fake documents, including citizenship.

These traders attempt to circumvent know-your-customer (KYC) protocols and register accounts that violate regulatory measures by providing false residence and banking details. This unconventional approach to cryptocurrency trading stands in stark contrast to the country's strict regulatory environment.

China is looking to cryptocurrencies for salvation

The soaring price of Bitcoin and other cryptocurrencies is due to the underperformance of traditional Chinese investments. The crackdown on the real estate sector and the ongoing economic transition are making traditional investment vehicles such as stocks and real estate less attractive. Indeed, a dominant state-owned enterprise sector, opaque governance, regulatory uncertainty, and a weak credit rating system pose significant economic challenges.

The current situation has accelerated the stock market crash and raised concerns about the future of China's economic environment. Therefore, cryptocurrencies have emerged as a viable alternative, offering stability and the potential for growth amidst the turmoil in China's economy. The increase in cryptocurrency investment by Chinese traders is a sign of the times, reflecting a strategic shift in response to changes in the economic and regulatory environment.