Bitcoin mining companies are facing a significant drop in stock prices in anticipation of the upcoming halving.

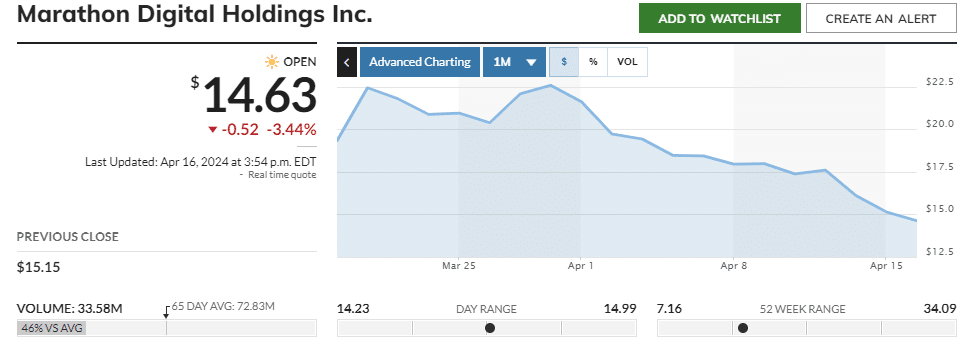

Shares of Marathon Digital Holdings, Riot Platforms, and CleanSpark fell for the third day in a row. Marathon Digital Holdings, the largest public Bitcoin miner, has lost nearly 25% of its stock value in the last month, and Riot Platforms has lost nearly 30%. Additionally, the Valkyrie Bitcoin Miners exchange-traded fund has lost about 28% in value this month.

Stock prices continue to fall due to increased short selling in crypto mining stocks and geopolitical tensions from the recent conflict between Iran and Israel, with investors turning to safer assets.

Despite these challenges, CEOs of these mining companies remain optimistic, according to Bloomberg. Mining companies' cost-effective operations, advanced mining techniques, and increased demand for cryptocurrencies could offset the expected $10 billion annual revenue loss from the upcoming Bitcoin halving.

Additionally, the companies hope that a surge in demand from the new spot ETF will boost Bitcoin's price enough to offset the negative impact of the update. These ETFs have collectively attracted $12.4 billion in net inflows since their introduction by traditional asset managers in January.

The recent approval of a Bitcoin ETF in Hong Kong has also sparked great optimism among crypto leaders. Sumit Gupta, co-founder of CoinDCX, one of India's largest exchanges, expressed enthusiasm about Asia's first large-scale ETF approval in comments shared with crypto.news.

“Historically, institutional involvement has served as a driver for the increased attention and traction observed in various asset classes. The trajectory of the cryptocurrency industry is moving towards increasing adoption, albeit gradually, for future growth and mainstream acceptance. It shows promising prospects.”

– Sumit Gupta, Co-founder of CoinDCX