This year is likely to be a good year for e-commerce, with the sector expected to take a large chunk of the overall retail pie. Last quarter's Commerce Department numbers prove this. E-commerce sales in the fourth quarter of 2023 increased by 7.5% compared to the fourth quarter of 2022 (0.8% sequentially), and total retail sales increased by his 2.8% (0.4% sequentially). E-commerce accounts for approximately 15.6% of total retail sales in the United States.

The convenience of online shopping remains the number one reason for e-commerce transaction volume, and this is especially true for Gen Z. Gen Z is becoming an increasingly important factor in sales. Many of these buyers grew up on the internet and are accustomed to being highly digital. You may also frequently visit popular social media platforms and be influenced by the latest trends there. This creates a whole new perspective in the field of e-commerce, which seems to be expanding with more advanced technologies such as AR/VR, social commerce, and the Metaverse.

Valuations have improved over the past year, reflecting significantly stronger growth prospects. There are several stocks in this very diverse industry that are worth buying today, but we've highlighted two of his stocks here: PDD Holdings and eBay.

About the industry

This industry includes companies that operate as online and mobile commerce companies such as Alibaba Group Holding Limited (BABA).

Current trends driving the Internet commerce industry

-

A comprehensive retail experience between Physical and digital continue to blur Because most consumers blend their online and offline activities. This usually takes the form of research online and buy in store, or buy online and pick up in store. Since convenience is a key requirement, experiences that speed delivery/pickup are likely to be preferred. This could lead to increased reliance on robots, self-driving delivery vehicles, and drones, potentially easing bottlenecks and making deliveries smoother and cheaper. So it's not just online-first retailers that are building a physical presence, but traditionally physical retailers are also digitizing to varying degrees or creating digital stores. Sometimes they are even poised.

-

Another notable trend is Subscription format For items that can be used repeatedly. This makes it easier for consumers to order and retailers to plan. Retailers usually offer some sort of discount to consumers who choose this option, making it even more appealing. This trend is expected to grow, as both tangible and intangible goods, low-value and high-value goods, are increasingly sold “as a service.”

-

Direct-to-consumer access is the only way to capture customer data, so retailers can't afford to give it up. Some large companies already offer services based on customer data (such as Amazon's Buyer Review Summary), so buyers are becoming accustomed to these services. Because customer satisfaction involves many details, the importance of data mining has grown over the years, and parties managing customer data can identify and service requests while providing the desired experience. is in the perfect position to Most of the major e-commerce players are also involved in payment processing, which gives them further insight into their customers' tastes, preferences, and purchasing habits. When machines read and process this data, they can create programs and processes to maximize customer satisfaction, increase sales, and minimize returns. artificial intelligenceAs used by companies such as Amazon, the competitiveness of the players is already determined. Therefore, leveraging big data has become essential for survival.

-

of Macroeconomic conditions continue to evolveHowever, we can probably say with some confidence that there will be no recession this year. On the other hand, a rate cut appears to be on the horizon, especially given the upcoming elections. Today's consumers are frugal, and less pressure on disposable income can only be a good thing. While supply chain issues have eased significantly for producers, labor conditions remain tight. Global uncertainties continue to impact currency impacts for internationally operating companies. At the same time, there is a real possibility that there will be one or more interest rate cuts this year, which will reduce pressure on both producers and consumers, which will be positive for the industry this year (especially in the second half of normal sales). Overall, industry players continue to realize the benefits of the operating leverage they have built over the past few years, especially given the fact that the retail e-commerce market continues to expand into new markets. Probably. As product segments and geographies diversify, consumers continue to return to the convenience of their shopping online.

-

The trends that Generation Z is spreading are: social commerce. Social commerce refers to the ability to discover, explore, buy, and check out through influencers on social media platforms. Brands typically have a storefront on these platforms, where influencers also discuss their products and drive traffic to them. Therefore, the social element of shopping that e-commerce has eliminated is coming back through this route. Since social commerce first became popular in China, it's no surprise that the Chinese social media platform TikTok, which is also very popular with Gen Z, is the number one place for social commerce. But Facebook, Instagram, etc. are also very popular. According to The Future of Commerce, 96.9 million Americans shop directly on social media. With 83% of Gen Z starting shopping on social media, it's clear where this trend is headed. According to this report, social commerce is expected to account for $2.9 trillion by 2026.

Zacks Industry Rank Indicates Strength

Zacks Internet – Commerce Industry is a sizable group within the broader Zacks Retail & Wholesale sector. It has a Zacks Industry Rank of #59, which puts it in the top 23% of over 250 Zacks industries.

Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a multiple of more than 2 to 1. So, the Zacks Industry Rank for this group is essentially the average of the Zacks Rank of all of its member stocks. , indicating a positive short-term outlook.

E-commerce ranks among the top 50% of Zacks-ranked industries as a result of its performance relative to other industries. What we can see in the aggregate forecast revisions is that sentiment has strengthened significantly, especially since July. The total profit forecast for 2024 is he will increase by 37.1%, and in 2025 he will increase by 24.4%. Given the rate cuts expected this year, things look set for the second half of the year.

Before we introduce some stocks to consider for your portfolio, let's take a look at the big picture recent stock market performance and valuations for the industry.

Leading the industry in shareholder returns

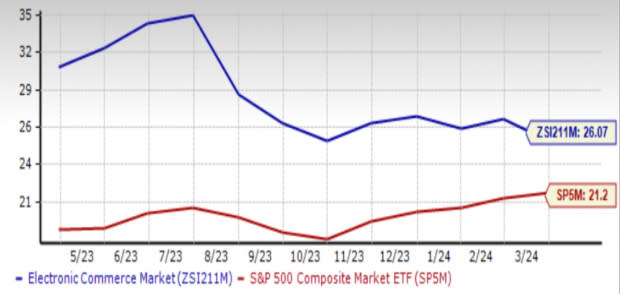

Over the past year, the Zacks E-Commerce industry has traded at a significant premium to both the broader Retail & Wholesale sector and the S&P 500.

Shares in this industry have increased a total of 50.1% over the past year. In comparison, the broader Zacks Retail-Wholesale sector rose 29.2% and the S&P 500 index rose 27.1%.

1 year price performance

Image source: Zacks Investment Research

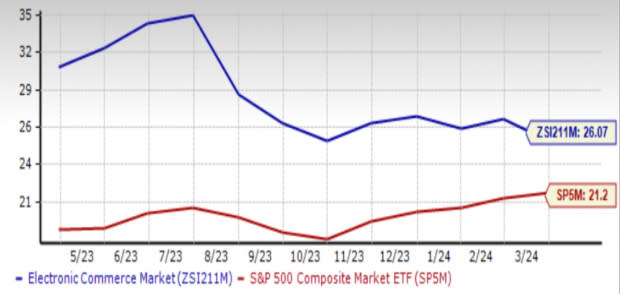

Current valuation is attractive

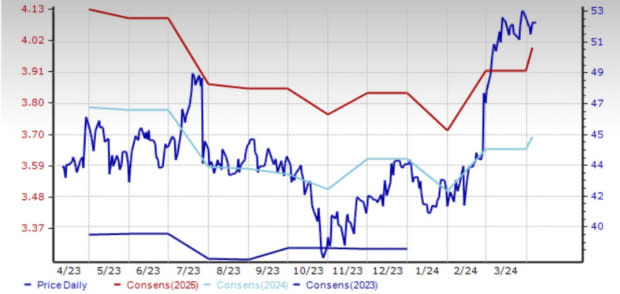

On a 12-month forward price-to-earnings (P/E) basis, the industry's multiple is 26.07x, a discount compared to the past year's median of 27.14x, but still at a premium to the S&P. 500 companies is his 21.2x, and the broader retail sector he is 22.71x.

Futures 12 Month Price Earnings Ratio (PER)

Image source: Zacks Investment Research

Two stocks worth considering

The improving outlook and attractive valuations mean there are many stocks worth choosing from right now. Especially since there is so much diversity in this industry in terms of operations, business models, and locations.

PDD Holdings Co., Ltd. (PDD): Based in Dublin, Ireland, PDD Holdings (formerly Pinduoduo) (previously based in Shanghai, China until March 2023) owns and operates a portfolio of businesses. The company's Pinduoduo e-commerce platform sells agricultural products, apparel, shoes, bags, mother and childcare products, food and beverages, electronics, furniture and household goods, cosmetics and other personal care, sports and fitness supplies, and auto accessories. We offer His Temu platform is an innovative online marketplace that leverages online advertising, social media, coupon codes, and games to attract and retain users.

Given the strong demand and improving consumer sentiment seen in the fourth quarter, the company is now focused on leveraging the latest technology to deliver high-quality products and solutions. PDD plans to spend RMB 10 billion in 2024, with an eye on technology enhancement and core agricultural business, marking the second consecutive year of investment of this scale. Management believes this improves the customer experience and builds a tenacious community that positively impacts both buyers and sellers.

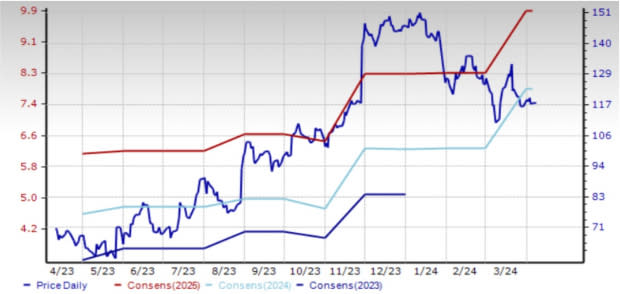

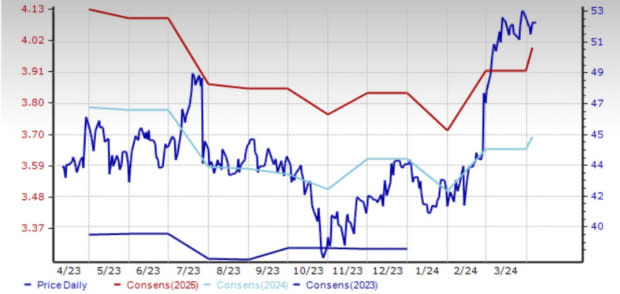

In the past 30 days, analysts have raised PDD's 2024 estimates by $1.29 (18%) and their 2025 estimates by $1.75 (19.6%). Analysts currently expect the company's sales and profits to increase by 49.8% and 29.1%, respectively, this year, and further increase by 35.3% and 25.8% next year.

Shares of this Zacks #1 Rank (Strong Buy) company have increased 65.3% over the past year.

Price and consensus: PDD

Image source: Zacks Investment Research

eBay Inc.ebay): Based in San Jose, California, eBay operates an online marketplace platform that connects buyers and sellers in the United States, United Kingdom, China, and Germany. It also has a series of mobile apps to facilitate these operations.

eBay is taking steps to leverage AI, particularly generative AI, to improve customer experiences and drive outcomes. Optimizing shipping across multiple warehouses allows sellers to manage their business more efficiently while providing more reliable delivery schedules to their customers. The company recently initiated restructuring measures to reduce its workforce by 1,000 people. Management believes this will align costs with growth targets and improve profitability in the AI era.

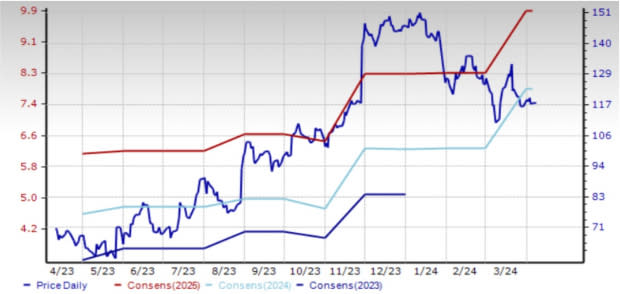

Over the past 30 days, the Zacks Consensus Estimate for 2024 has increased 5 cents, or about 1%. 08 cents increase in 2025 Analysts expect earnings growth of 9.2% in 2024 and 7.5% in 2025.

The Zacks Rank #2 stock has gained 20.1% over the past year.

Price and consensus: EBAY

Image source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today you can download 7 Best Stocks for the Next 30 Days.Click to get this free report

eBay Inc. (EBAY): Free stock price analysis report

PDD Holdings Co., Ltd. (PDD): Free Stock Price Analysis Report

Click here to read this article on Zacks.com.

Zacks Investment Research