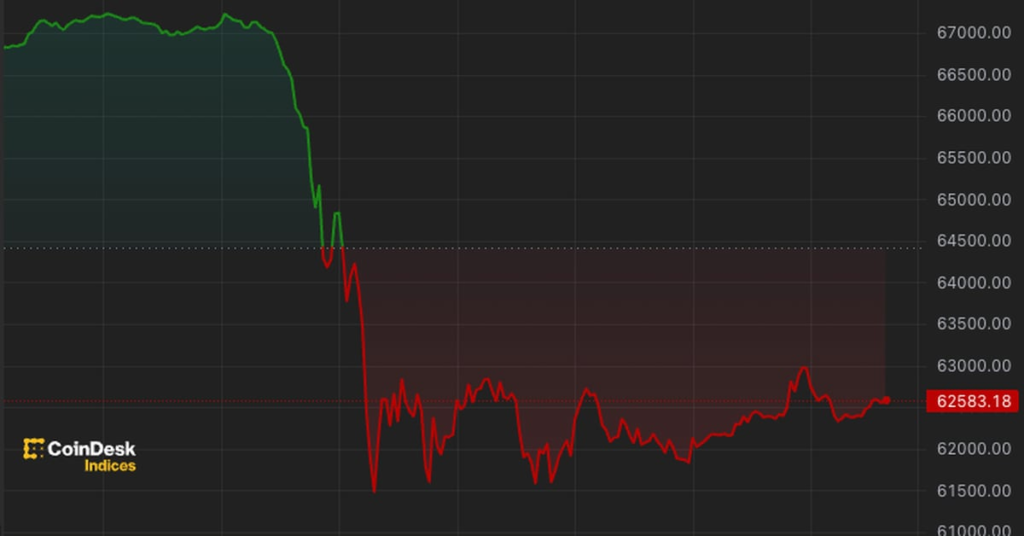

Bitcoin (BTC) and the broader cryptocurrency market fell nearly 10% on Saturday, with the price of the largest digital asset briefly below $62,000, before recovering to around $64,000 at press time.

That wasn't all. Other major digital assets have seen similar declines, including Ethereum (ETH), which has fallen 7% to just under $3,000 in the past 24 hours, BNB (BNB) (down 9%), and Solana (SOL) (down) I showed you. 12%, according to CoinGecko). Trading volumes also increased during the same period.

The decentralized finance (DeFi) sector has been particularly hard hit as a result of the market turmoil, with falling prices forcing liquidations and raising the possibility of havoc for some protocols.

Among the protocols in the spotlight is Ethena, the buzzy Ethereum project behind USDe, a “synthetic dollar” built to mirror the price of the U.S. dollar. Ethena has attracted more than $2 billion in deposits, but uses a controversial method that has not been tested in such unfavorable market conditions to maintain USDe's $1 “peg.”

Although the immediate cause of Saturday's market decline was not clear, former BitMEX CEO Arthur Hayes said in a blog post last week that the U.S. tax deadline of April 15 (this Monday) ) said that the dollar's liquidity would decline just before. Less liquidity leads to lower prices, he said.

Cryptocurrency market prices began to recover after the warned of a very serious attack. Another mistake. ”