The crypto market took an unexpected hit on April 12, when the natural price decline of Bitcoin and prominent altcoins led to large-scale liquidations. The cause of this widespread price decline remains largely unknown, although there are many plausible reasons, including the recent correction in U.S. stock markets.

Approximately $500 million is liquidated in one hour during cryptocurrency flash crash

Bitcoin fell 4.49% over the past day to $66,052, according to data from CoinMarketCap. As expected, BTC's decline reverberated through the market, with prominent altcoins Ethereum and Solana posting daily losses of as much as 8.12% and 12.16%, respectively.

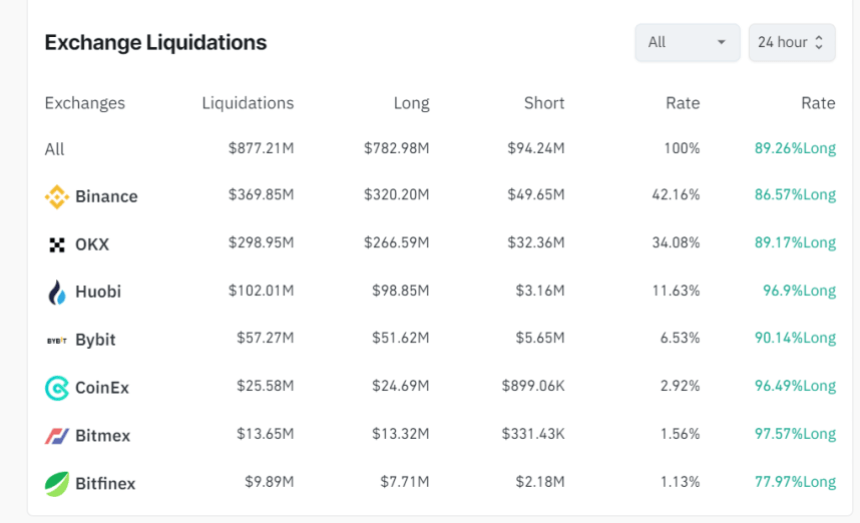

As previously mentioned, these losses amounted to 277,843 traders losing their leveraged positions as total crypto liquidations reached $877.21 million in the past 24 hours, based on data from Coinglass . Of these numbers, long positions accounted for $782.98 million, while short traders lost just $94.24 million.

Specifically, as a result of the general price decline, $467 million of leveraged positions were closed within an hour. The highest liquidation amount was his $369.85 million recorded on Binance, and the single largest liquidation order was worth $7.19 million and occurred on his ETH-USD market on the OKX exchange.

Interestingly, Bitcoin's price decline correlated with the decline in the US stock market, with the S&P 500 index down 1.6% to trade at a low of $5,108. This market rout was preceded by recent CPI data, which showed inflation rose to 3.5% in March compared to the same month a year ago.

Such reports only indicate that the Federal Reserve is unlikely to cut interest rates anytime soon as it aims to push inflation down to its annual target of 2%. is. This prediction is extremely bearish for the crypto market in general, as the Fed's interest rate cuts give investors the confidence to pursue riskier assets such as BTC with potentially higher yields.

Bitcoin experiences network growth as halving approaches

On a more positive note, Bitcoin recorded an increase in non-empty wallets on the network ahead of the April 19 halving event. Blockchain analytics platform Santiment reported that the number of BTC wallets holding active coins has increased to 370,000 BTC wallets in the past six days. Interestingly, the analysis team is helping investors maintain this cumulative trend through the Bitcoin halving event.

As of this writing, Bitcoin is trading at $66,882, with daily trading volume increasing by 44.80% and is now valued at $43.8 billion. However, Bitcoin price has generally been less impressive lately, dropping 1.33% and 6.20% in the past 7 and 30 days, respectively.

Featured image from The Independent, chart from Tradingview