- BNB's funding interest rate has been almost negative since the beginning of the month.

- In the coin spot market, BNB accumulation remains stable.

binance coin [BNB] The perpetual futures market is starting to show signs of weakness. This month, it had the most negative funding rate among the top five major crypto assets, according to data from Coinglass..

According to information obtained from data providers, from April 4th to 8th, the coin’s funding rate across exchanges was negative.

Funding rates are used in perpetual futures contracts to ensure that the contract price of an asset remains close to the spot price.

When the contract price of an asset is higher than the spot price, traders who bet on the price going up (long traders) pay fees to traders who bet on the price going down (short traders). When this happens, the asset's funding rate becomes positive.

Conversely, if the execution price is lower than the spot price, the short trader will pay fees to the trader holding the long position, resulting in a negative funding rate. When an asset has a negative funding rate, more traders will hold short positions than those expecting the price to rise.

Separately, Coinglass said BNB futures market sentiment has improved over the past four days as the funding rate remains positive. Along with this, the coin's futures open interest is also rising.

At $747 million at the time of writing, BNB futures open interest has increased by 29% since April 8th.

market is stable

At the time of writing, BNB was trading at $611. Its value has increased by 5% in the last week, according to data from CoinMarketCap.

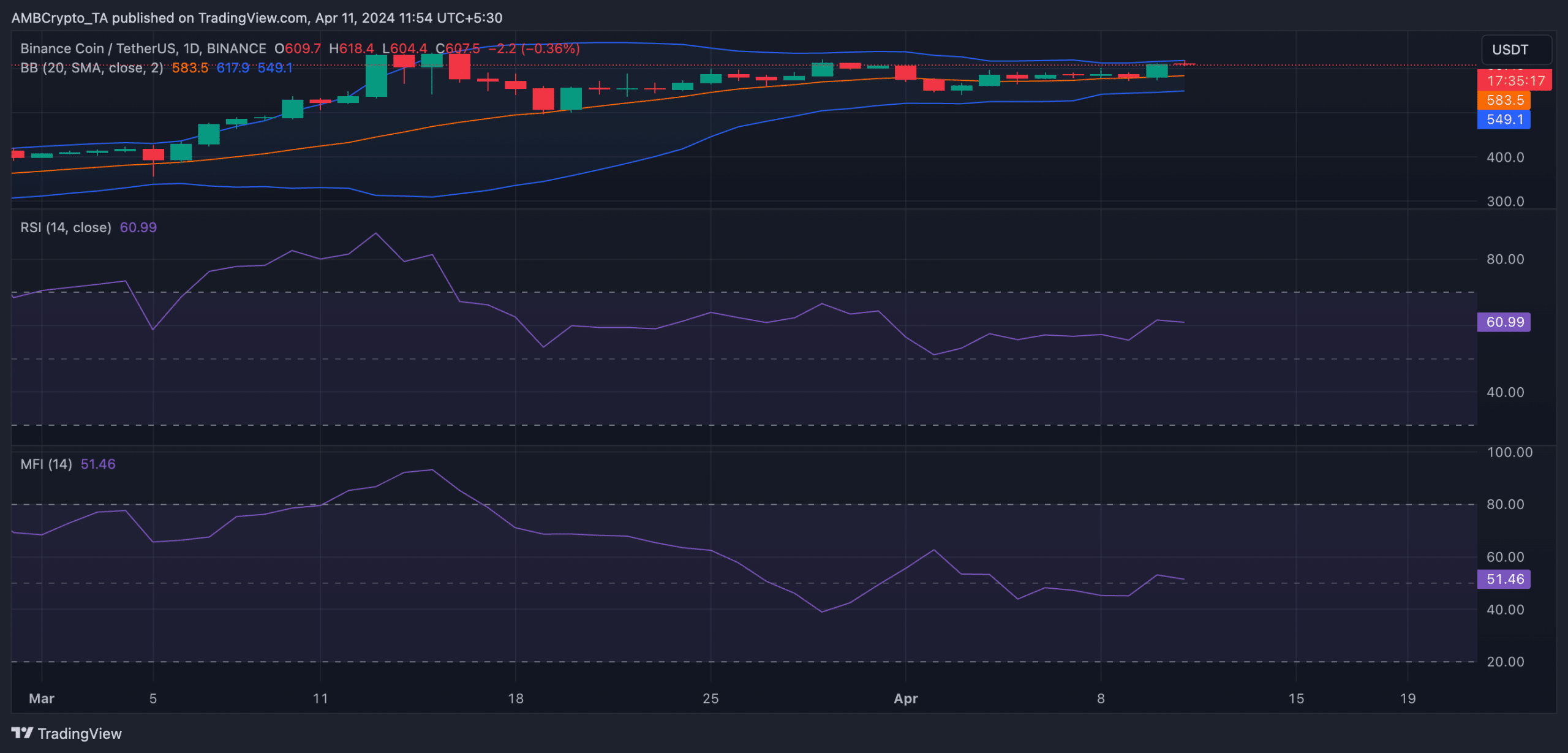

Market volatility has decreased significantly as the coin attempts to consolidate within its range. An evaluation of BNB's Bollinger Bands showed that there is a narrow gap between the upper and lower bands that make up the indicator.

If the gap between these two bands is narrow, market volatility will be low. However, traders also interpret this as a signal that a breakout or significant price movement may occur in the short term.

read binance coin [BNB] Price prediction for 2024-2025

Additionally, BNB's key momentum indicators were above their respective center lines at the time of writing. The relative strength index (RSI) was 61.19 and the money flow index (MFI) was 51.44.

These values indicate continued accumulation of BNB among market participants.

Source: BNB/USDT on TradingView