(Bloomberg) — A crypto token aimed at replicating common hedge fund trading has attracted widespread market buzz, attracting billions of dollars worth of tokens. But the project, known as Etena, has also raised skepticism about the sustainability of its yield, currently around 37%.

Most Read Articles on Bloomberg

Ethena and its USDe token, the so-called synthetic dollar, achieves that goal through basis trading, a cryptocurrency version that takes advantage of price differences between spot and futures markets. This strategy, known in cryptocurrencies as cash-and-carry trading, is becoming particularly profitable as token prices rise higher and higher and funding rates (the interest paid by bullish traders to maintain their futures positions) soar. It has recently been proven that the

Of course, higher yields tend to come with increased risk. Think of the turmoil in the crypto market in 2022, when the eye-watering rates for TerraUSD tokens turned out to be far from true. While Ethena's design is nothing like Terra's and may not pose similar systemic risks, the challenge for investors is: what can go wrong in an asset class that is notorious for going wrong? The next step is to analyze how serious it is.

“This is essentially a tokenized hedge fund, where the hedge fund manages a somewhat complex trading strategy on a number of different exchanges,” said Robert Leshner, partner at fintech venture fund Robot Ventures. ” he said on a recent podcast about Ethena. “The worst-case scenario is that hedge funds underperform across all of the various crypto exchanges for a variety of reasons that are inconsistent with the implied funding rate.”

Here's how it works: A trader creates his USDe tokens through an automated system by depositing stETH (a derivative of Ether, the second largest cryptocurrency) and other approved tokens. Ethena Labs, the entity behind USDe, then opens short positions through Ether futures and perpetual swaps, a type of crypto futures contract with no expiration date. This position is open on various crypto exchanges including Binance.

These short positions allow holders of sUSDe (project-locked USDe derivatives) to benefit from extremely high funding rates, which reached more than 100% annualized during this year's bull market.

“It's completely insane,” said Guy Young, founder and CEO of Esena Labs. “You can get that return without having to leverage or do anything crazy.”

Ethena's efforts are part of a broader ambition among digital asset startups to build decentralized cryptocurrencies that pay attractive yields while maintaining stable value, in this case tracking the U.S. dollar. . Decentralized finance still relies heavily on stablecoins like USDC and Tether, which are run by centralized companies. Unlike these tokens, which are backed by real-world assets, USDe is primarily backed by stETH.

Read: Crypto enthusiasts will be attracted to 20% stablecoin yield even after 2022 collapse

Ethena is not the first project to imitate basis trading. Lemma Finance’s stablecoin, USDL, also aims to maintain its dollar peg while taking long positions in the spot market and shorting futures. Other previous attempts have failed or failed to grow, especially those that relied heavily on decentralized futures markets, which are less liquid than centralized exchanges.

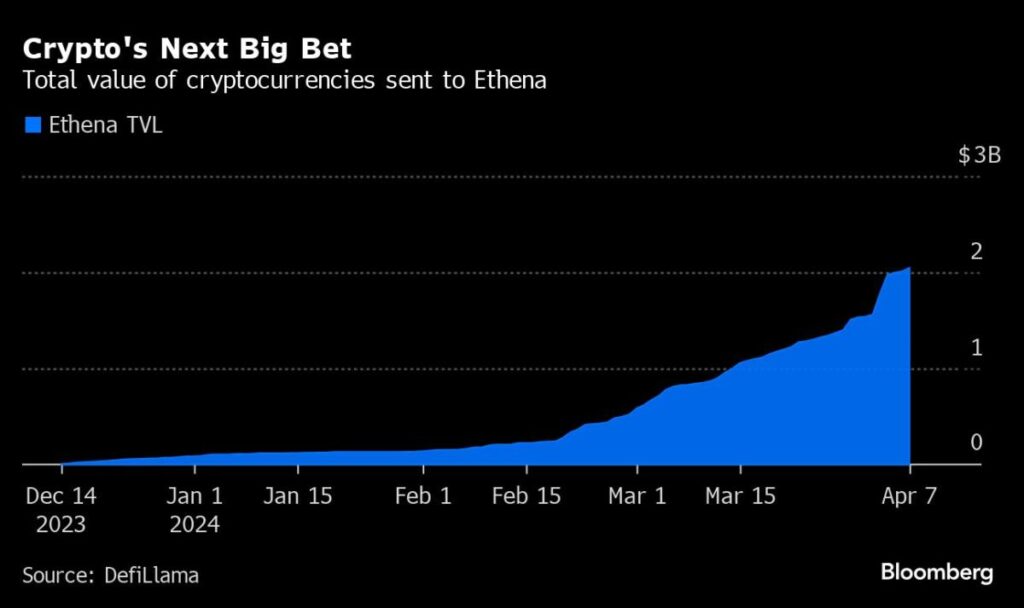

But Ethena has grown rapidly since its founding last year. According to tracker DefiLlama, more than $2 billion in cryptocurrencies has been deposited into the project. Much of the growth appears to be due to unmet demand for higher yields after the collapse of lenders like Genesis and BlockFi in 2022.

Ethena has become one of the most profitable crypto projects, recording over $25 million in revenue in March, according to Token Terminal.

basis trade

Jordi Alexander, founder of digital asset trading firm Serini Capital, says it is not difficult for professional trading firms to conduct basis trades on a variety of coins, not just Bitcoin and Ether. “Ethena's products are not tactical and need to rely solely on the major coins, BTC or ETH, to find enough open interest for the demand that needs to be met,” he said.

However, it's a different story for retailers and other small businesses who don't have the same resources or industry relationships. As such, Athena's goal is to democratize basis trading and avoid opaque intermediaries, according to Joshua Lim, strategic advisor to Athena, founder of trading firm Alberos Markets and former head of derivatives at Genesis. That's what it means.

Ethena works with several crypto market makers, including Amber Group, and can negotiate with centralized exchanges for benefits such as discounted trading fees and off-exchange storage.

“Think of this as a collective bargaining agreement where all these retail participants, all the people who are putting money into this basis deal, can negotiate better terms with the exchange,” Lim said. .

One concern is that Athena's performance so far proves the strategy only works in bullish market conditions.

Ethena itself also discloses USDe risks on its website. One is funding risk. This means potential losses if funding rates go negative for an extended period of time. Another is currency risk, which is a common concern in the post-FTX cryptocurrency market. There is also storage risk as this project relies on third-party partners to store customer assets. Collateral risk is another risk. Ethena uses his stETH as collateral for a derivatives position. Problems can arise if the trading price of stETH is significantly lower than Ether. Ether has benefited from the recovery in the crypto market this year, gaining about 50% so far in 2024.

While Terra founder Do Kwon was known for slamming his critics on social media, Ethena's team seems to be more open about the risks. Additionally, amid growing criticism and comparisons with Terra, USDe was rebranded from a stablecoin to a synthetic dollar in October.

Still, the team maintains that most risks are “unlikely” or “comfortable.”

“I think there’s a little bit of surface work here,” Tarun Chitra, founder and CEO of crypto risk modeling firm Gauntlet, said on a podcast with Leshner. “And that's whatever. The current market is stupid,” he said, adding that “even if there was an unwind, the explosion wouldn't be as bad because collateral is better in general.” I think so,” he added.

(Updates Ether price in fourth-to-last paragraph. A previous version of this article corrected the spelling of the name Jordi.)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP