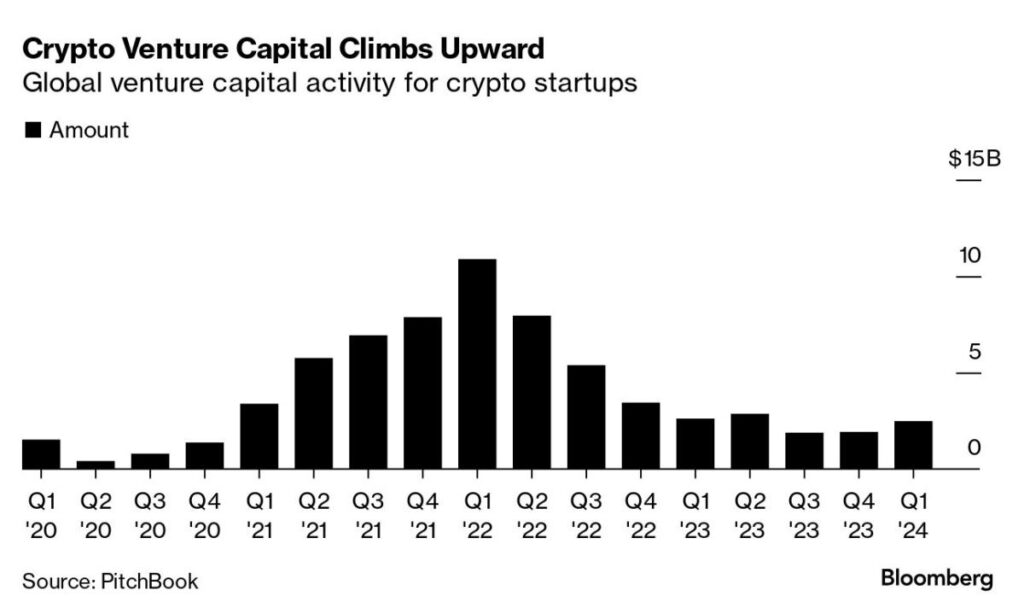

(Bloomberg) — Crypto startup trading is back. After a tough year for crypto and blockchain companies, venture capital investment in the industry rose by nearly a third from the previous quarter, new data shows.

Most Read Articles on Bloomberg

According to PitchBook data, VC investments in crypto startups reached $2.5 billion in the first quarter of 2024, up 32% from the previous quarter and roughly on par with the same period last year. At the same time, cryptocurrency startups are raising more funding and venture firms are launching new digital asset funds.

“Investors are spending money again,” said Robert Lee, a crypto analyst at PitchBook. “For the past two years and 18 months, they have continued to hold on to the funds they raised.”

Lee said the renewed enthusiasm for cryptocurrencies was partially sparked by the approval of a Bitcoin exchange-traded fund in January and interest in the intersection of cryptocurrencies and artificial intelligence. During the downturn from 2023 to late 2022, VCs were reluctant to utilize funds raised during the previous crypto bull market. This year, that started to change.

Anand Iyer, managing general partner at early-stage venture fund Canonical Crypto, said fundraising activity has picked up in recent months. He noted that some of the founders currently raising money are not new to the industry. “They actually built something last cycle and it didn’t work out,” Iyer said.

The early features of cryptocurrencies that were evident during the last bull market have also returned. For example, the recent craze for meme coins has echoes of past fads. Websites like Pump.fun now allow anyone with an Internet connection to create nonsensical tokens inspired by animals, pop culture, and virtually any other theme. “They're all interesting, but they're very cultural for cryptocurrencies,” Iyer said.

Other VCs are seeing signs of industry maturation.

John Lo, a managing partner who oversees digital asset investments at Recharge Capital, was previously a member of the management team at decentralized cryptocurrency exchange Sushi under the pseudonym “Omakase” and used the pseudonym “Omakase” to hide his identity during webinar appearances. I also used anime character filters.

Lo said that while some teams still raise money under pseudonyms, the trend is a nostalgic “remnant” of the crypto culture of the past. Rather, he and his team are excited about the impact of traditional financial institutions moving deeper into cryptocurrencies, as evidenced by the approval of a Bitcoin ETF.

“We are seeing the use and adoption of Bitcoin on a scale we have never seen before,” he said.

At the same time, there is still room for improvement. Recharge is focused on supporting startups that can build better crypto infrastructure and make the industry more attractive to investors. “Cryptocurrency is still in its infancy,” Lo said.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP