(Bloomberg) — For crypto enthusiasts, buying and holding Bitcoin is the only trading game in town, with returns of about 50% on new investments so far this year alone. Masu.

Most Read Articles on Bloomberg

But for quantitative hedge fund investors and a number of academic researchers, there is a better way to capture gains in volatile assets while profiting from huge drawdowns. It is simply following the wisdom, or foolishness, of the crowd.

A growing body of research, from Man Group Inc., the world's largest publicly traded hedge fund manager, to academics at the University of Cambridge and beyond, is finding that trend-following quantitative strategies are particularly well-suited to high-profile rising stocks and investors, and are profitable. It shows that it is high. Bitcoin price decline. Quantitative funds like $2 billion Florin Court Capital LLC have been implementing such strategies since 2017, with crypto exposure fueling their cross-asset trend-following trades. For individual traders, newly launched ETFs offer broader access to strategies that capitalize on Bitcoin's fluctuations.

“Regardless of speed, the risk-adjusted returns of momentum strategies have historically been better than buy-and-hold strategies,” said Tarek Abu Zeid, partner and senior client portfolio manager at Man AHL. “Trend following is about extracting behavioral biases. We see excesses, FOMO, and panic in cryptocurrencies, but these can be captured with systematic strategies.”

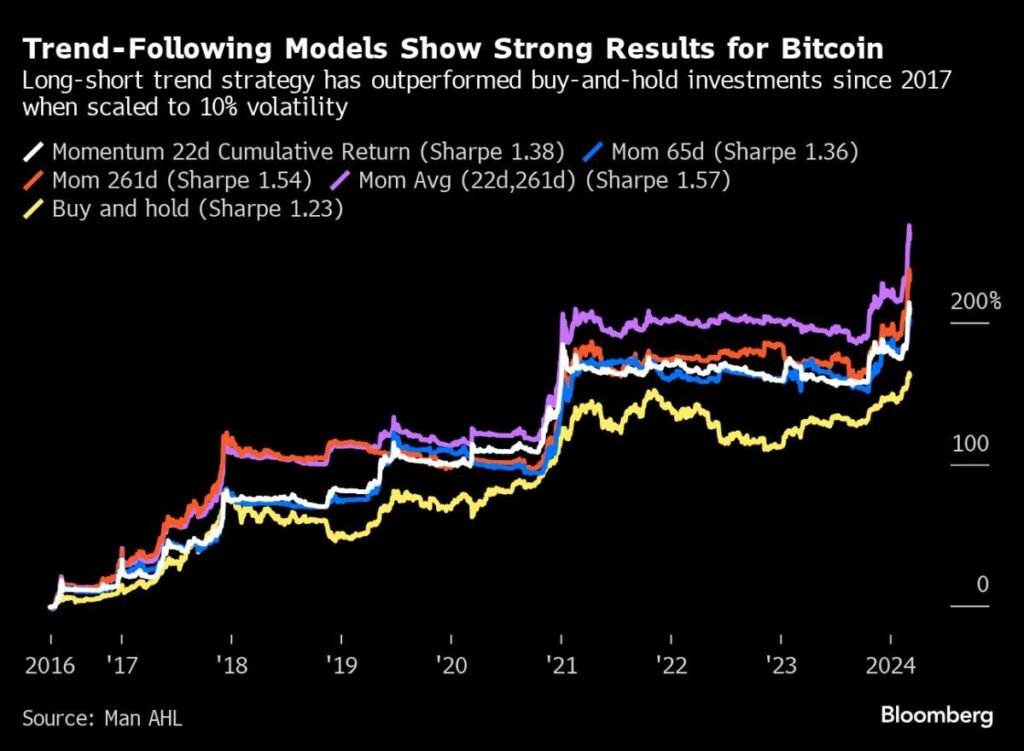

Researchers at Man Group's Man AHL division have found that since 2017, a proxy long-short trend strategy in both Bitcoin and Ether has shown that if scaled with 10% volatility, the coin's buy-and-hold I found that I was outperforming my investment. This strategy takes profits during rallies and takes short positions when the trend is negative.

Man Group, whose assets under management rose to a record $167.5 billion at the end of 2023, has previously said it trades cryptocurrencies as part of its existing strategy. AQR Capital Management LLC, a major quantitative investment firm, has also publicly stated that it trades virtual currency futures using a trend-following strategy. Florin Court, who specializes in exotic and alternative markets, has been trading both Bitcoin and Ether since he started trading cryptocurrencies in 2017, and has seen the fund's performance improve significantly since the beginning of the year. There is.

“Cryptocurrencies are right under our noses, and for the most part they behave much like some of the more volatile commodity markets,” said Doug Greenig, founder of Florin Court Capital. . “You need good trend models and systematic risk management.”

Greenig said they are taking a conservative approach by avoiding unregulated crypto exchanges and other significant counterparty risks that the crypto industry is notorious for. Relatively small cryptocurrency datasets are another issue cited by quants as an obstacle to widespread implementation of systematic trading. “The biggest concern is the non-market risks in this space,” Greenig added.

The model used by Man Group is based on data starting in 2016-2017, when institutional investors became more active in the space. Bitcoin futures were launched at the end of 2017.

Academic research provides more evidence to support the claims of trend following in cryptocurrencies. A 2023 paper by researchers at Monash University found that trend-following strategies nearly outperform continuous investments in Bitcoin and Ether, and are more profitable with short lookback periods than with long ones. . A separate paper by researchers from the University of Cambridge and elsewhere found that a similar strategy yielded “consistently attractive returns” from 2011 to 2019.

Trends go mainstream

Sophisticated hedge funds aren't the only ones considering strategies. They are also becoming more mainstream as investors have access to similar strategies through exchange-traded products. The Global X Bitcoin Trend Strategy ETF (ticker: BTRN) was launched last month and tracks the CoinDesk Bitcoin Trend Indicator.

This product is dynamically allocated between Bitcoin futures and Treasury bills with maturities of 1 to 3 months. This ETF increases exposure to Bitcoin futures when prices rise and reduces its allocation when prices fall, but does not short sell.

“Bitcoin continues to be exposed to significant volatility swings and significant drawdowns,” said Adam Zee, head of product development at GlobalX ETF. “BTRN works best in environments where there is clear and stable momentum on either the upside or downside.”

While trend following has performed well in Bitcoin and Ether tests, quants remain cautious about implementing this type of systematic approach elsewhere in the crypto space. Stablecoins intended to track assets like the US dollar on a one-to-one basis are an obvious example. So are the highly speculative and often novelty tokens known as memecoins, which can be far more volatile than Bitcoin or Ether.

“You have to be very careful about applying traditional momentum models to pegged currencies, and stablecoins fall into that bucket,” said Andre Jim, partner and portfolio manager at Man AHL. “I am also cautious about so-called meme coins. Meme coins exhibit price movements that may not lend themselves to traditional momentum models.”

–With assistance from Isabel Lee.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP