Bitcoin (BTC) has fallen to near the $66,000 level, and the global cryptocurrency market has fallen markedly.

According to data provided by CoinGecko, the global cryptocurrency market capitalization has plummeted by 4.6% in the past 24 hours, reaching $2.63 trillion at the time of writing. However, daily trading volume increased by 42% to $134.77 billion, according to CoinGecko.

The market-wide decline came as the leading cryptocurrency, Bitcoin, fell from $70,000 to $66,400 in the past 24 hours. BTC's market capitalization is currently hovering around $1.3 trillion, with a 24-hour trading volume of $40 billion.

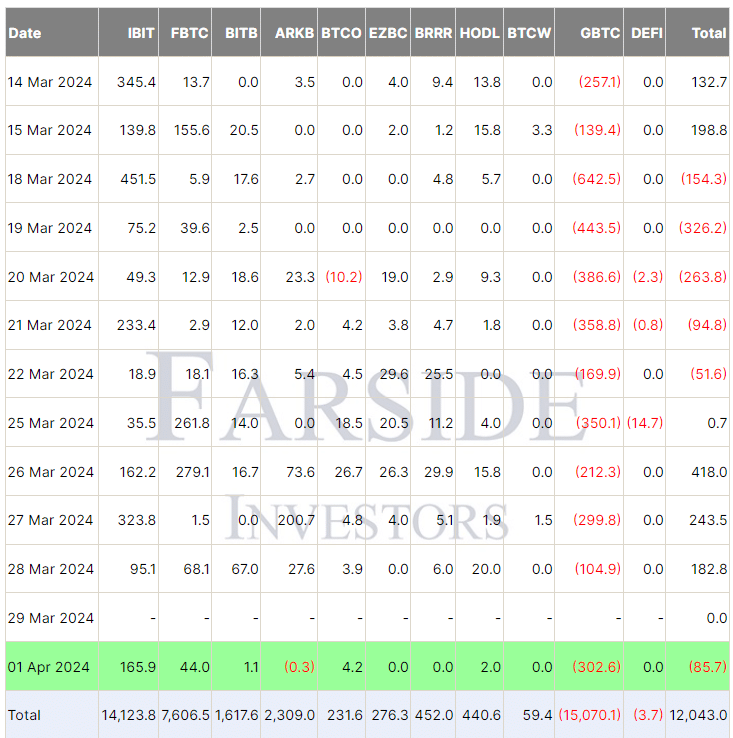

Additionally, Bitcoin ETFs recorded total net outflows of $85.7 million on April 1, according to data from Pharcyde Investors. Inflows into these investment products last week totaled $862 million, according to the data.

On March 31st, Tether, the largest stablecoin operator, purchased 8,888 Bitcoins for $618 million. The average price of each coin is $69,531. The company currently holds over 75,000 BTC at an average price of $30,305.

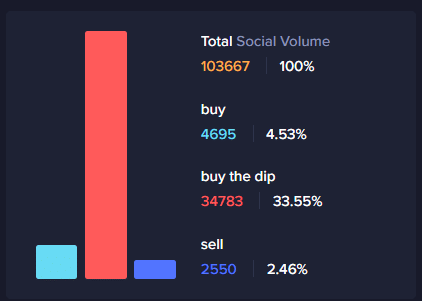

Would you like to buy dip?

Some investors and social media users are discussing the possibility of whale manipulation and even “buying on the edge.”

According to data provided by Santiment, calls for “buy on the edge” have skyrocketed in the past 24 hours, accounting for 33.55% of all social volume on crypto-related topics.

According to Santiment, the majority of social media conversations discussing potential buying opportunities come from Reddit and 4chan.

According to the data, social media conversations discussing further decline accounted for only 2.46% of total conversations and posts.